New study provides state-wise renewables addition plan for India

A new study by government thinktank NITI Aayog provides state-wise renewable energy potential that can be harnessed by states to meet their renewable purchase obligations, RE capacity that needs to be procured by the deficit states from other RE-rich states, and storage requirement to meet the required grid balancing. The study was carried out with the support of the Central Electricity Authority and the Ministry of New and Renewable Energy.

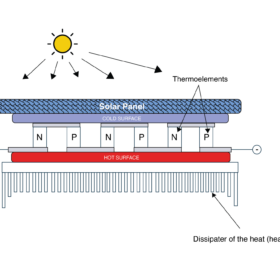

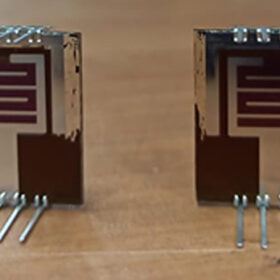

Scientists claim PV systems combined with thermoelectric cooling may achieve 6-year payback time

Scientists in South Africa have modeled a photovoltaic system connected to a thermoelectric cooling device and have found it may produce around 9.2% more electricity than conventional PV system without cooling. The research team claims the proposed system guarantees a minimum cost saving of 10.56%.

Another bidding extension for 25 MW AC solar plant with 20 MW/50 MWh battery storage in Leh

Solar Energy Corp. of India (SECI) has extended bidding for the installation and commissioning of the 25 MW AC (50 MWp DC) solar PV plant with 20 MW/50 MWh battery storage in Leh by another two weeks.

Solar panels in orbit

Space-based solar power generation has the potential to address many of the challenges that terrestrial systems face.

SECI launches 1.2 GW solar tender

Solar Energy Corp. of India (SECI) has invited bids to set up 1.2 GW of solar PV power projects on a build-own-operate basis in India. Bidding closes on July 12.

High import duties affecting solar deployment in Bangladesh

Analysts at a recent event in Dhaka called for the removal of high import duties on solar products in Bangladesh, as it could reduce PV system prices by up to 11%.

Avaada Energy secures $38 million for captive solar project in Karnataka

Avaada Energy has secured financing for its solar PV power project being developed under a long-term captive power purchase agreement with Karnataka Cooperative Milk Producers’ Federation Ltd.

Jakson Green secures INR 600 million to advance renewable energy projects

Jakson Green has secured a sustainable trade facility of INR 600 million ($7.2 million) from HSBC India. This funding will support the company’s working capital requirements for its renewable energy business, both in India and internationally.

The role of renewable energy in achieving India’s net zero goals

The road to net-zero emissions in India doesn’t require herculean efforts. We can get there by wholeheartedly adopting renewables, investing in innovation and technology, and promoting public-private partnerships to build a better, cleaner, and more sustainable India for generations to come.

Gensol Engineering profit 129% up in FY 2024

Gensol Engineering recorded consolidated revenue of INR 996 crore and net profit of INR 53 crore for fiscal 2023-24.