AEPPL to invest Rs37.15 billion in second phase of lithium battery plant

The joint venture between Japanese majors Toshiba, Denso and Suzuki will make the investment in the Gujarat plant over the 2021-25 period, having pumped Rs12.5 billion into the first phase of development.

Gayatri Projects completes sale of power assets to Singapore-based Sembcorp

The company sold its 5.95% stake in Sembcorp Energy India—held through subsidiary Gayatri Energy Ventures—for Rs 4067.70 million.

Emissions, EVs and renewable energy: Reflections and outlook for India

India, one of the most diversified energy markets in the world, has recently become the lowest-cost producer of solar power. This reflects a steady and encouraging shift toward renewable power—a shift that’s in line with the targets set by the government. At the Climate Action Summit that was held earlier this year, Prime Minister Narendra […]

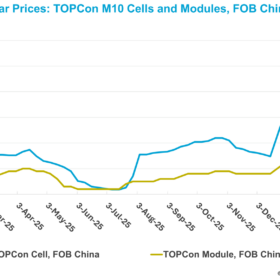

Solar set for boom after a gloomy 2019

Solar installations in year 2020 are set to exceed 10 GW after a year hit by political uncertainties, module price increases associated with safeguard duty and a fewer number of awarded tenders. The outlook for battery energy storage installations for solar projects, however, is bleak as such combinations in India can cost 3-5 times more in 2020 than standalone renewable projects.

Central Electronics Limited tenders 1.6 MWp rooftop solar in Tamil Nadu

January 4 is the last date to bid for the plants that are to be developed in capacities of 10 KWp to 50 KWp atop government buildings. Bids must be accompanied with bank guarantee of Rs 750,000.

AIIB approves US$65 million for Hero Future’s 250 MW solar project

The project—located in Jodhpur district of Rajasthan—is being developed by the Indian developer’s special purpose vehicle Clean Solar Power (Jodhpur).

The long read: Shedding some light on Indonesia’s offgrid growth

Indonesia’s Central Bureau of Statistics reported in 2018 that 2,281 villages across the nation lacked access to electricity. As a vast archipelago with more than 17,000 islands, Indonesia faces serious challenges when it comes to electrification, as inter-island connection remains prohibitively expensive. Two experts in the field, Ahmad Agus Setiawan and Chayun Budiono, share their knowledge.

Vikram Solar supplies modules for 300 solar pumps across West Bengal and Odisha

The government’s KUSUM scheme helps farmers install standalone solar pumps with a capacity of up to 7.5 hp. There is also support to make grid connected pumps of the same size solar powered. A PV capacity of up to twice the pump capacity in kW is allowed under the scheme.

A little Green Brilliance in a Virginian vineyard

The Indian installer supplied panels for a commercial client in the U.S. who had been inspired by a trip to Rajasthan with his wife in 2008.

Amp Energy installs 8.5 MWp rooftop solar plant for Skoda Auto

Touted to be one of India’s largest rooftop installations, the captive plant uses 25,770 photovoltaic panels covering 63,000 sq.m of available roof space and producing 12.2 million KWh of electricity annually.