ITC commissions 9.45 MW offsite solar plant for self-consumption

ITC targets to meet 100% of electricity requirements from renewable sources by 2030 as a part of its ambitious Sustainability 2.0 Vision. The new Karnataka solar project will help it reduce CO2 emissions by over 12,000 tonnes every year.

Avaada Energy closes INR 597 crore refinancing for C&I solar projects

Avaada Energy has secured around INR 597 crore ($71.1 million) in refinancing for its commercial & industrial (C&I) solar projects in Karnataka and Maharashtra.

IBM acquires Prescinto for renewables asset performance management

Prescinto is a software-as-a-service (SaaS) platform to manage and optimize the end-to-end operations of renewable energy assets. Its acquisition will enhance the capabilities of IBM’s integrated solution for asset lifecycle management.

Sterling and Wilson Renewable Energy hits unexecuted order value of more than INR 10,500 crore

Sterling and Wilson Renewable Energy’s unexecuted order value has increased to its highest ever at more than INR 10,500 crore with order inflow of around INR 2,050 crore in Q2 FY25.

Gensol Engineering secures 23 MWp rooftop solar project in Dubai

Gensol Engineering has been awarded a contract for the design, construction, and long-term operation and maintenance of 23 MWp of rooftop solar PV systems for the engineering facilities of a leading aviation company in Dubai.

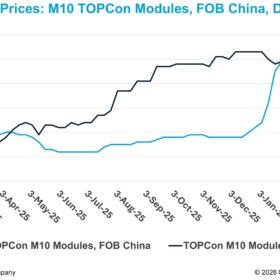

Key takeaways from Renewable Energy India Expo 2024

Solar module manufacturers are quickly ramping up to multi gigawatt-scale capacity to tap the domestic demand. At technology level, TOPCon modules based on 210 rectangular silicon wafer (G12R) cell are taking center stage.

Oriano Solar wins EPC order for 184 MWp PV projects in Madhya Pradesh

Oriano Clean Energy has secured a contract to build 184 MWp of solar PV projects on EPC basis in Agar, Malwa, Madhya Pradesh. The projects were awarded by Blueleaf Energy.

“India will be the fastest-growing renewable energy market among large economies through 2030,” says IEA

The International Energy Agency projects India’s annual renewable energy capacity additions to more than quadruple from 15 GW in 2023 to 62 GW in 2030.

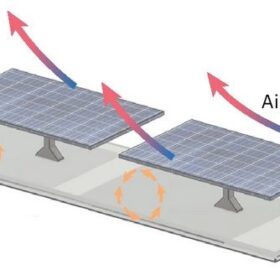

Rooftop PV installations could raise daytime temperatures in urban environments by up to 1.5 C

New research shows that rooftop PV system may have “unintended” consequences on temperartures in urban environments. Rooftop arrays, for example, may potentially lower nighttime temperatures by up to 0.6 C.

NHPC tenders 2.4 GW of solar projects

NHPC Ltd has launched a tender to select developers for setting up 1.2 GW of grid-connected solar PV projects and additional capacity up to 1.2 GW under ‘Greenshoe Option.’ Bidding closes on Nov. 4.