SunSource Energy commissions 45 MW DC of C&I solar in Uttar Pradesh

SunSource Energy has switched on three solar power plants with a combined capacity of 45 MWp in Uttar Pradesh. Power purchase agreements (PPAs) for the entire 45 MWDC capacity have been signed with clients across industry verticals.

GP Eco Solutions makes a stellar debut, lists at 299% premium

Noida-based GP Eco Solutions India Ltd has made a stellar debut on NSE Emerge as its stock was listed at INR 375 against a price band of INR 94 per share. The company will use the funds raised through the IPO to fuel its growth in the solar sector.

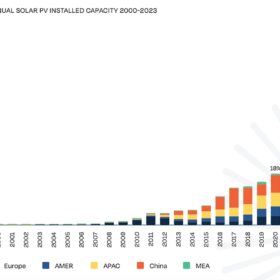

SolarPower Europe says 1 TW of solar could be annually installed by 2028

SolarPower Europe forecasts more than 1 TW of annual solar installations by 2028, but financing and energy system flexibility must be unlocked.

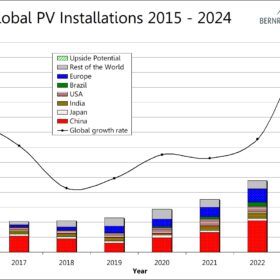

Global PV installations may hit 660 GW in 2024, says Bernreuter Research

Bernreuter Research says low module prices will drive demand in the second half of this year. The researchers note the shipment targets of the world’s six largest solar module suppliers, who are aiming for an annual growth rate of 40% on average.

India renewable growth story to continue to shine

Renewable capacity addition is expected to remain at around 15-17 GW annually, owing to significant reduction in the module prices over the past 12 months and availability of liquidity.

Financing the MSME sector to power India’s renewable energy goals

India has already seen several success stories where innovative financing has empowered MSMEs in the renewable energy sector. For instance, the Indian Renewable Energy Development Agency (IREDA) has launched schemes specifically designed for MSMEs. These schemes offer concessional loans and financial assistance, making it easier for MSMEs to undertake renewable energy projects.

$89 billion worth of investments likely to flow into the C&I RE sector in India by 2030

An additional 120 GW of C&I RE capacity is required to be set up by 2030 for India to attain its solar and wind target of 420 GW by 2030. This translates to US$89 billion worth of investments flowing into the sector between 2024 and 2030.

Spanish startup offers pre-assembled vertical rooftop PV systems equipped with reflectors

FutureVoltaics says it has developed pre-assembled, reflector-based vertical rooftop PV systems. The systems feature 175 W heterojunction bifacial solar modules and special reflectors on both sides.

BluPine Energy signs PPA with Dalmia Cement for 46.87 MWp solar plant

The solar plant will help reduce manufacturing costs and increase energy efficiency for Dalmia Cement.

Indonesia targets over 5.7 GW of rooftop solar by 2028

The Ministry of Energy and Mineral Resources in Indonesia has set a quota of 5,746 MW of rooftop solar to be deployed between 2024 and 2028. The Jakarta-based Institute for Essential Services Reform anticipates rooftop solar to be more commonly adopted by commercial and industrial consumers than residential users, following the abolishment of net-metering earlier this year.