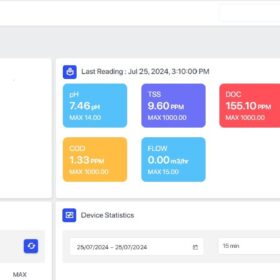

AI and Data Analytics in energy operations

Artificial intelligence (AI) and Data Analytics are transforming energy operations by introducing capabilities that were once unimaginable. These technologies provide actionable insights, automate processes, and enable real-time decision-making, making energy systems smarter and more resilient.

BPCL ropes in Volks Energie for LFP-Based solar storage plants

Bharat Petroleum Corp. Ltd (BPCL) has entrusted Volks Energie with deployment of a cumulative solar capacity of 280 kW backed with lithium ferro phosphate (LFP) battery storage of 1.6 MWh for its oil and gas pipeline network. The solar-plus-storage capacity will be equally distributed across 14 strategic locations in Andhra Pradesh and Telangana.

Hartek secures the largest rooftop solar plant in Jammu & Kashmir

Hartek Group has won the complete EPC order for an 8 MW rooftop solar plant in Jammu & Kashmir. The project has been awarded by Kandhari Beverages.

India’s installed renewable energy capacity grows 15.84% year-on-year

The nation has reached a cumulative installed renewable energy capacity of 209.44 GW as of Dec. 31, 2024, with major contributions from solar (97.86 GW) and wind resources (48.16 GW).

India installed ‘record’ 24.5 GW of solar power capacity in CY2024

India added about 24.5 GW of new solar capacity in the twelve months ending Dec. 2024, the highest recorded capacity in any previous year.

The ease of financing in the solar sector

Innovative models that provide pay-as-you-go solar systems, peer-to-peer energy trading, and crowdfunding platforms could expand access to renewable energy for underserved communities.

The shift to advanced battery technologies for a sustainable future

With the growing integration of renewable energy solutions in power grids, the demand for efficient energy storage solutions is only set to grow. Taking cognizance of the advancements in battery technology, India today stands at the cusp of a major revolution.

GEAPP joins ISA’s multi-donor trust fund initiative to mobilize $100 million solar finance

The Global Energy Alliance for People and Planet (GEAPP) has strengthened its partnership with International Solar Alliance (ISA) by signing ISA’s Multi-Donor Trust Fund, which aims to mobilize $100 million to fund high-impact solar energy projects.

Solidus Techno Power to install 110 MWp solar project for consumption by steel manufacturer

Solidus Techno Power will spearhead engineering, procurement, and construction of a 110 MWp solar project for captive consumption by Jogindra Group.

Three-phase inverters for commercial solar storage applications

Solis has introduced three-phase energy storage inverters, in a power range from 29.9 kW to 50 kW, for commercial-scale solar energy storage applications.