ReNew trims net loss to $61 million in FY 2023

ReNew Energy Global posted a net loss of $61 million for FY 2022-23, compared to $196 million for FY 2021-22.

Torrent signs MoU for 5.7 GW of pumped hydro storage in Maharashtra

Torrent Power has signed a Memorandum of Understanding (MoU) with the Government of Maharashtra to develop a cumulative 5.7 GW of pumped hydro storage capacity in Maharashtra.

Saltwater redox flow battery with integrated ultracapacitor

US-based Salgenx says it has successfully integrated ultracapacitors with its saltwater redox flow batteries, resulting in significantly better power response and system performance.

NHPC exploring pumped storage development

The state-owned hydropower producer is exploring pumped storage development in Andhra Pradesh, Jharkhand, Karnataka, Madhya Pradesh, Maharashtra, and Odisha.

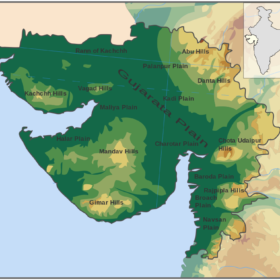

Tata Group to set up 20 GWh lithium-ion cell plant in Gujarat

Tata Group will set up a 20 GWh lithium-ion cell manufacturing plant in Gujarat with an estimated investment of INR 13,000 crore in the first phase.

ONGC, Assam discom sign JV agreement for 250 MW battery storage project

The joint venture will build, own and operate a 250 MW/500 MWh battery energy storage system in Assam, enabling the effective integration of large-scale solar power capacity coming up in the state.

L&T advances renewables infrastructure for world’s largest green hydrogen plant

Larsen & Toubro (L&T) is set to begin constructing the renewable energy generation, storage, and grid infrastructure for the green hydrogen production facility in Saudi Arabia, as it has made significant progress from design to procurement.

NLC, WAPCOS sign MoU on pumped storage

State-owned thermal energy giant NLC has signed an agreement with WAPCOS Ltd, a public-sector engineering consultancy services provider, to carry out collaborative technical services and advisories for developing pumped storage projects in India.

L&T forms Green Energy Council

The council will identify technology trends in green energy, analyze the evolving global policy developments, evaluate emerging business models, and advise on collaborations.

NTPC confirms over 20 GW of renewables portfolio

NTPC, India’s largest power producer, has 3.3 GW of renewable energy capacity already commissioned, 4.6 GW under construction, and a balance of 12.6 GW under planning and implementation.