The Hydrogen Stream: Germany to use hydrogen ‘in all sectors’

The German authorities have announced plans to double domestic electrolysis capacity to 10 GW by 2030, BloombergNEF has reported that green hydrogen became competitive with gray hydrogen earlier than expected, and Chinese researchers have presented new research on microbial hydrogen production.

The hydrogen motives: understanding the ‘why’ of the hydrogen push in Asia and beyond

Various industry interests are at play behind clean energy drive

Hero Future Energies signs $756 million MoUs with REC, PFC

Power Finance Corp. (PFC) and Rural Electrification Corp. (REC) will extend INR 3,100 crore (($378 million) each to support Hero Future Energies’ upcoming renewable energy projects.

PFC signs MoUs for clean energy lending worth around $29 billion

Adani, Greenco, ReNew, Continuum, Avaada, JBM Auto, Megha Engineering & Infrastructure Ltd, and Rajasthan Renewable Energy are amongst companies that signed the MoUs to raise funds for their clean energy projects.

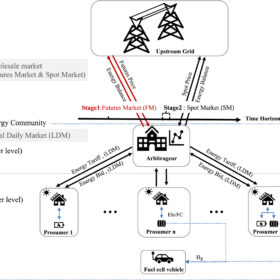

Energy communities operating on hydrogen, batteries

Researchers in Spain have studied the impact of hydrogen production and storage technologies in risk management for energy communities with internal price-tariff systems. They found that the optimal involvement in futures markets and spot markets will depend on a community’s risk aversion and self-sufficiency.

Acme secures $488 million REC loan for green hydrogen, ammonia project in Oman

REC has also agreed to lend INR 21,000 crore for Acme’s 380 MW round-the-clock renewables plant, the first phase of Odisha and Tamil Nadu green ammonia projects, and 600 MWh of pumped hydro project.

HPCL building 370 tpa green hydrogen plant in Andhra Pradesh

Hindustan Petroleum Corp. Ltd (HPCL) is setting up a 370 tpa (tonnes per annum) green hydrogen plant at its Visakhapatnam Refinery in Andhra Pradesh.

Reliance Industries, BharatBenz unveil intercity luxury bus powered by hydrogen fuel cell

The intercity luxury coach, engineered by BharatBenz, runs on Reliance Industries’ hydrogen fuel cell technology.

The Hydrogen Stream: EU, Argentina, Chile, Uruguay to partner on hydrogen

The European Commission and the European Investment Bank have agreed to collaborate with Argentina, Chile and Uruguay on hydrogen, while Masdar, Mitsubishi and Inpex have said that they will use green hydrogen to produce e-methane and polypropylene.

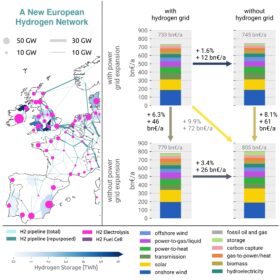

The Hydrogen Stream: Hydrogen grid could cut Europe’s energy costs by 3.4%

German researchers say gas-grid retrofits for hydrogen transport, combined with power grid expansion, could decarbonize Europe’s economy, while S&P says the global ammonia trade could expand by nearly 10 times by 2050.