NTPC tenders O&M contract for 250 MW solar plant

State-run power producer NTPC has opened domestic bidding for three years of comprehensive operation and maintenance support at its 250 MWp Mandsaur solar plant. Bidding closes on May 27, while technical bids will open on May 30.

Bhago Mobility acquires stake in lithium battery supplier Pastiche

Bhago Mobility Solutions, the green energy vertical of automotive parts manufacturer Modern Automotive, will invest $16 million in a partnership with Pastiche. They plan to jointly develop solid-state and lithium-ion batteries for electric mobility and energy storage.

Borosil Renewables posts 28% net sales increase for FY 2021-22

Borosil Renewables, an Indian solar glass manufacturer, has recorded net sales of around INR 644 crore ($83 million) for fiscal 2021-22. It operated almost at full capacity throughout the year and sold out of everything it produced.

Handheld tool to clean rooftop solar panels

Mumbai-based Cleo Tech has developed a battery-powered, handheld tool for scratch-free, dry cleaning of solar panels. The tool’s cleaning brush clings end-to-end on the aluminum frames of the panels, avoiding direct contact of the moving parts with the cells, other than the soft nylon bristles.

Longi surpasses 7 GW of monocrystalline solar panel shipments to India

Chinese PV module manufacturer Longi has surpassed 7 GW of shipments to India, less than six years after launching its operations in the country.

Azure Power appoints new CEO

NYSE-listed Azure Power has appointed IndiGrid’s Harsh Shah as its new chief executive officer. Shah succeeds Ranjit Gupta, who left Azure Power after contributing to the company’s growth for three years.

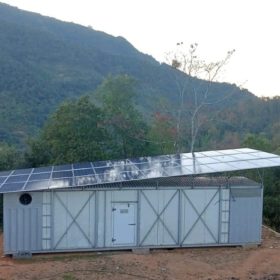

Multi-chamber solar cold storage system

Uttar Pradesh-based Inficold has developed a multi-chamber, solar-powered cold storage solution that facilitates the storage of multiple perishable commodities in different temperature-controlled chambers, all under their respective ideal storage conditions.

Saatvik launches 545 W bifacial PV modules

Indian manufacturer Saatvik has developed bifacial PV modules based on mono PERC, half-cut technology. The multi-busbar modules boast an efficiency rating of 21.12%.

New renewable capacity additions doubled in FY 2022

India installed 15.5 GW of non-hydro renewable energy capacity in fiscal 2021-22, from just 7.7 GW installed in the preceding fiscal year. About 90% of the total, or 13.9 GW, came from solar.

Webdyn India crosses 4.2 GW mark, Fimer supplies inverters for solar-plus-storage project

Webdyn’s Indian unit has supplied remote monitoring tech and hybrid power management solutions for 4.2 GW of solar plants since 2015, while Italian inverter maker Fimer has supplied its 1 MVA inverters for a new integrated solar-plus-storage project in Gujarat.