Elusive longevity

The expected lifetime of PV inverters is significantly shorter than that of modules. In many projects, inverter replacement is included in financial calculations from the start, despite the high costs. Research is being conducted into the causes of faults to develop more durable inverters and components. But plant design can already improve the lifespan of inverters in use today, reports pv magazine Germany’s Marian Willuhn.

Hydrogen to play limited role in building energy supply

How much hydrogen is actually needed? Several German research institutes have examined 40 energy scenarios for hydrogen ramp-up and found that 15 million GWh of hydrogen will be needed worldwide by 2050.

Electrolyzer tech to produce hydrogen from seawater

With a new start-up and a consortium in the Netherlands, German automotive supplier Schaeffler wants to significantly reduce the costs of green hydrogen.

Puffer fish inspired floating PV structure

With a new system for floating photovoltaic power plants, engineers from Germany want to make the application cheaper, higher-yielding, and safer. The result is somewhat reminiscent of a pufferfish, which also gave the system its name.

CATL claims to have made sodium-ion batteries a commercial reality

The manufacturer has launched sodium-ion products online. Production has begun and will be easily scalable, according to the CATL chairman. Researchers have been keen to make the technology work as it offers a cheaper, more environmentally friendly alternative to lithium-ion products.

German start-up offers 5.2 kWh AC battery that works without inverter

Sax Power has developed a new residential battery which it describes as a game-changer in the battery technology.

New residential lithium-ion battery from Germany

The battery system, which is aimed at increased self-consumption, can handle a maximum DC input power of 18 kW and 1000 V.

Sonnen battery still running after 28,000 full charge cycles

Sonnen has published test results indicating the longevity of its storage systems after extended use.

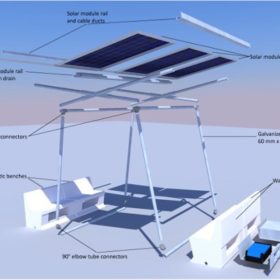

A solar pavilion for India’s rooftops

India’s energy transition will not succeed without rooftop PV and roll-out is hindered not only by a lack of household finance, but by the fact many of the nation’s flat roofs are enjoyed by residents. Germany’s international development agency has proposed a solution.

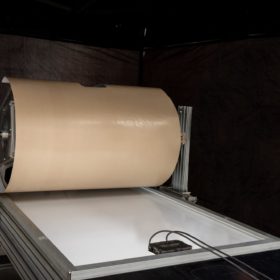

A repair tape for cracked backsheets

Backsheet failures have plagued the industry, causing hefty financial burdens to many asset owners. DuPont has launched a product it says allows for easy repair of modules.