A new report from the International Renewable Energy Agency (IRENA) says the energy consumption across all solar manufacturing stages will fall over the next five years.

The “Solar PV Supply Chain Cost Tool” report details the materials, processing and assembly costs at each stage of solar PV module manufacturing. It features assumptions data, country-specific data and cost projections through to 2030 to calculate total module cost.

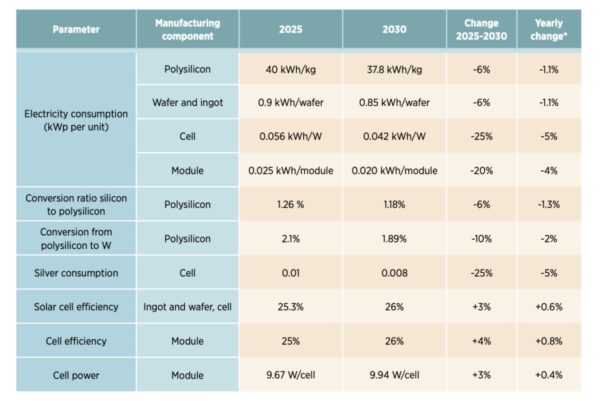

The report says the electricity consumption of polysilicon is expected to decrease by 6% between 2025 and 2030, the same percentage drop anticipated for solar wafer and ingots. The electricity consumption of solar cells is expected to drop 25% by the end of the decade, while the electricity consumption of solar modules is expected to fall 20%, from 0.025 kWh/module in 2025 to 0.020 kWh/module in 2030.

Image: IRENA

IRENA expects advances in areas such as kerf loss reduction to bring improvement in polysilicon-to-wafer conversion yield. It also predicts a decrease in specific polysilicon consumption will result in thinner wafers and higher yields.

Silver consumption in solar cells is also expected to decline, by 5% annually to 25% by the end of the decade.

The report also predicts solar cell conversion efficiency will increase 3% by 2030, while solar module efficiency will increase by 4%, to both stand at 26% by the end of the decade. IRENA says this improvement will lead to solar cells that produce more ouput.

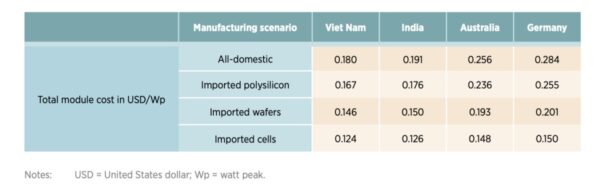

IRENA’s report also provides an overview of total module cost in Vietnam, India, Australia and Germany under different manufacturing scenarios.

Image: IRENA

IRENA says total module costs remain relatively high when all components are domestically manufactured due to accumulated manufacturing expenses and possibly higher input costs. The most notable decreases in total module costs arise when more advanced components are imported, the report adds, particularly considering current market prices.

In the report’s conclusion, IRENA says Vietnam sees manufacturing costs comparable with China due to its lower-cost labour and electricity tariffs. India is less competitive than Vietnam due to is higher average electricity prices despite its also-low labour costs.

Australia’s higher manufacturing costs is driven by its higher electricity, labour, and building and facilities costs, IRENA’s report says, while Germany’s is attributed to high electricity rates, elevated labour and construction costs, and smaller economies of scale.

IRENA goes on to say that its tool highlights the “problematic relationship between short-term market dynamics and long-term industry sustainability.” It explains that while enabling rapid solar deployment, low-cost imports from China are significantly lower than what is required to maintain sustainable production levels, leading to financial strain across the value chain.

“There is a need for a balanced approach: maintaining affordability to support solar adoption, but also ensuring fair market conditions for manufacturers – both domestic and international,” the report concludes. “Without some corrective action, there is a risk of deepening market distortions within the solar industry.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.