A new report by SBICAPS estimates that India added a “record” 40 GW of new solar power generation capacity in calendar year 2025 (CY25). This growth was driven not only by sustained momentum in utility-scale projects but also by a sharp acceleration in rooftop solar installations under the PM Surya Ghar Muft Bijli Yojana (PM-SGMBY).

However, the capacity utilisation factor (CUF) of solar plants fell from a level of 19.2% in CY22 to just around 16.5% in the first eleven months of CY25. Overcast conditions in CY25 led to lower demand, forcing curtailment of solar power during the day-time production peak, especially in resource-rich states of western region. Besides, lower incident irradiation during the extended monsoon crippled generation. Further, significant RE capacities remain stalled due to a host of operational issues—inability to secure land, unsigned PPAs, difficulties in equipment transport (especially for wind projects), and finally, delays in transmission clearances.

Transmission infra lagging behind target

Transmission infrastructure additions are lagging behind renewable additions, creating bottlenecks for grid integration. Less than 50% of the targeted transmission capacity addition for the first eight months of FY26 has been completed. “The acquisition of land in a complicated valuation regime has created right-of-way issues. Moreover, there is a shortage of critical equipment, including transformers. Suffering the most are HVDC projects, which require highly customised equipment which cannot be stockpiled,” states the report. Compounding these challenges is the ongoing Great Indian Bustard (GIB) issue, which has led to a mandate for underground transmission lines – which are costlier and more complex.

Storage facilities to surge in medium term

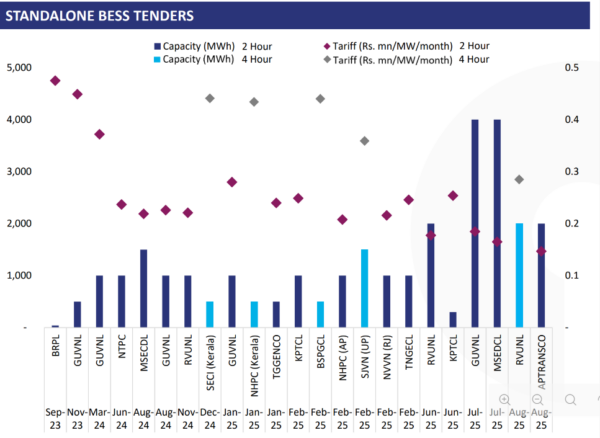

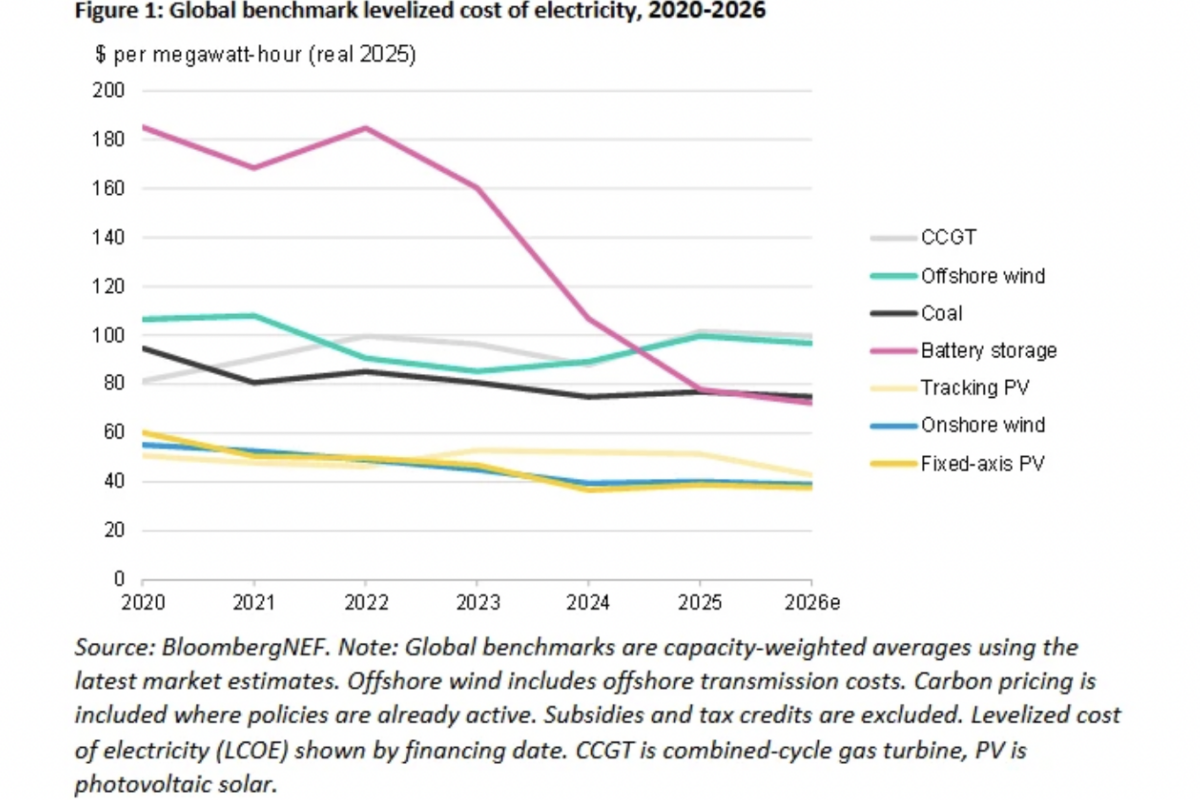

The report adds that tendering of energy storage capacities is in line with requirement, though hardly any battery energy storage system (BESS) capacities are operational at present. After stabilising for some time, tariffs for standalone BESS tenders are again on a decline, raising questions about long-term project viability. The overall descent has been aided by sharp dip in battery prices; Li-ion battery pack prices have dipped by around 8% year-on-year. This raises concerns about the signing of energy storage agreements for old awards—– 27 GWh ESS still awaits tariff approval.

Around 22% of storage capacity tendered so far has been cancelled, although much of this belongs to the CY18-CY23 period. CY25 has seen no cancellations.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.