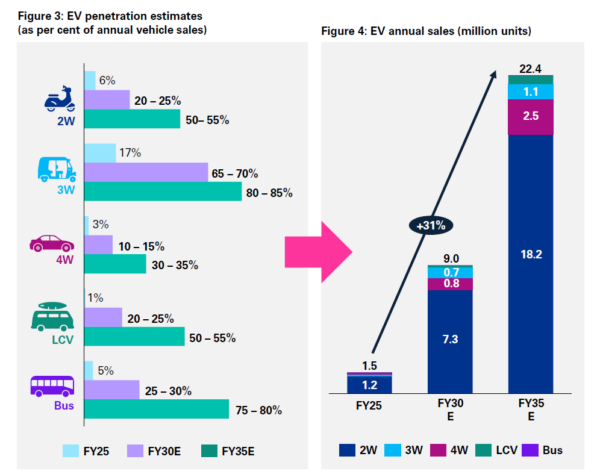

A new report by KPMG projects annual electric vehicle (EV) sales in India to reach 22.4 million units by FY2035, with EV penetration crossing 50% across most vehicle segments. EV penetration in India has risen sharply from just 0.5% in FY2020 to nearly 6% in FY2025, with sales reaching around 1.5 million units. This growth is being driven by strong government support, favourable economics, rapid infrastructure development, technological advancements, and evolving consumer preferences.

However, the report notes that India’s EV transition is heavily dependent on the availability of critical raw materials required for battery and motor production.

Global reserves of key battery minerals and rare earth elements are highly geographically concentrated, with a handful of countries dominating extraction and refining. Lithium is largely sourced from Australia, Chile, and Argentina, while cobalt and nickel are primarily sourced from the Democratic Republic of Congo and Indonesia, respectively. China, meanwhile, controls over 80% of global refining capacity and rare earth magnet production. This concentration makes the EV value chain highly vulnerable to supply shocks and price volatility.

The KPMG report, titled “Securing the Supply Chain: Preparing for the Electric Vehicle Raw Material Challenge,” highlights how India can convert potential supply chain risks into opportunities for leadership in sustainable mobility. With demand for critical raw materials such as lithium, nickel, cobalt, and rare earth elements expected to rise sharply, the report outlines strategies to build resilience and competitiveness in India’s EV ecosystem.

Key insights from the report include:

- Exponential demand growth: EVs require up to six times more minerals than conventional vehicles, driving surging demand for lithium, nickel, cobalt, and rare earth elements as global EV adoption accelerates.

- Supply chain concentration: More than 70% of global refining capacity for critical minerals is concentrated in a few geographies, creating geopolitical and trade risks.

- India’s strategic gap: India lacks proven reserves of many critical minerals and remains heavily import-dependent, exposing the sector to price volatility and supply disruptions.

- Domestic opportunities: Exploration of reserves in states such as Jammu & Kashmir, along with domestic processing and recycling initiatives, could significantly reduce import dependence.

- Policy imperatives: Incentivising domestic refining, securing long-term supply contracts, and investing in R&D for alternative battery chemistries are critical next steps.

“India’s EV ambitions hinge not just on manufacturing capacity but on securing the raw material backbone. Without resilient supply chains, the transition risks being delayed or derailed,” said Rohan Rao, Partner, Automotive and Lead–Electric Mobility, KPMG in India.

“Strategic investments in exploration, refining, and recycling will be pivotal. India must act now to build partnerships and capabilities that ensure long-term competitiveness in the global EV ecosystem,” added Raghavan Viswanathan, Partner, Deal Advisory, KPMG in India.

The report concludes that by combining domestic initiatives with global collaborations, India can secure its supply chain, reduce vulnerabilities, and position itself as a leader in sustainable mobility.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.