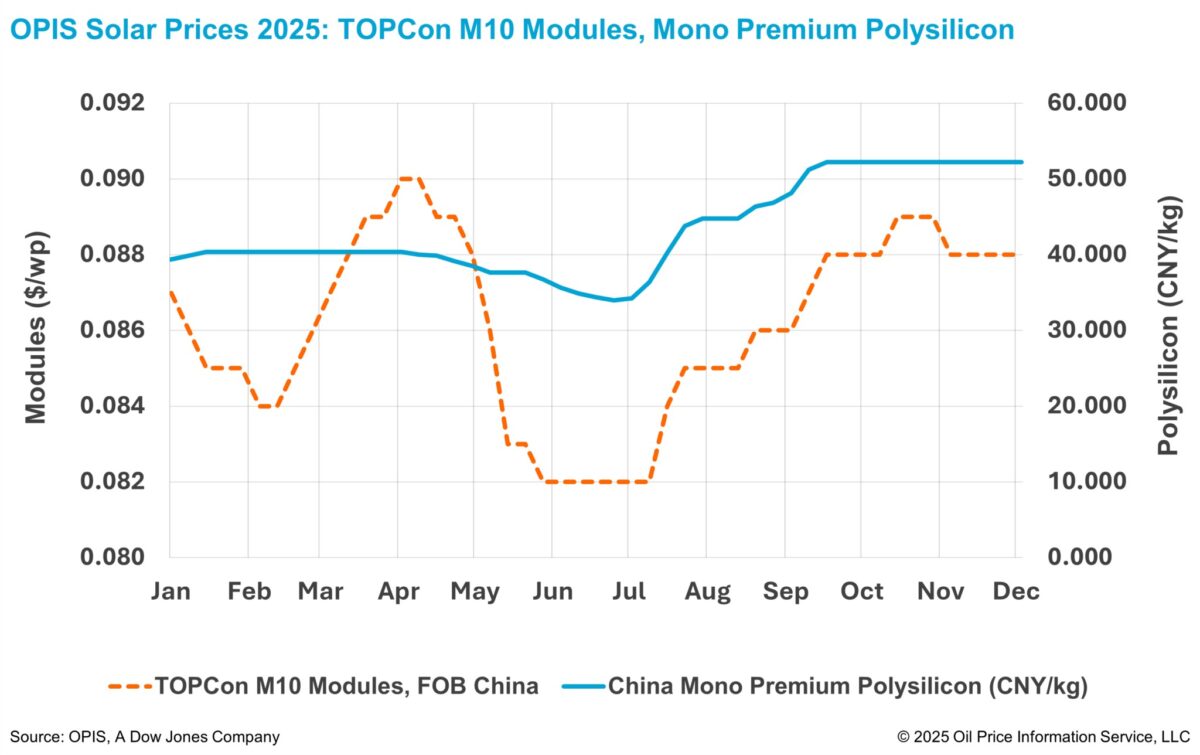

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, remained stable at $0.088/W Free-On-Board (FOB) China, with indications between $0.085-0.093/W, according to the OPIS Solar Weekly Report released on December 9.

FOB China TOPCon module forward curve indications for Q4 2026 loading cargoes weakened this week, falling 1.11% to $0.089/W. Q1 2026 loading cargoes were maintained at $0.088/W while Q2 and Q3 2026 loading cargoes were assessed stable at $0.089/W.

Fresh discussions over a potential export tax rebate reduction continued this week as the year-end approaches, with export prices stable while the market awaits clearer direction.

Several market participants surveyed by OPIS said they expect China to cut the export tax rebate for solar production by 3% to 6%, possibly taking effect at the start of 2026. China last reduced the export tax rebate from 13% to 9% in December 2024.

According to market sources, internal notices have circulated among top-tier module manufacturers, indicating that the revised rebate may apply from Jan. 1, 2026, with reductions of 3% to 4.5% for solar modules and lithium batteries. Sources said that manufacturers have encouraged customers with pending orders to make shipping arrangements soon.

Market participants said authorities would typically issue an official notice roughly two weeks ahead of implementation. On that timeline, a mid-December notice would be expected if the rebate is revised from Jan. 1, as rumored, according to a downstream producer.

Procurement activity for the remainder of the year has slowed as market participants wait for clarity on rebate policies. Trade sources noted that buyers had already advanced module purchases in Q3 2025 when the rumor first surfaced in August, leading to large inventories, with some buyers even partially stocked for 2026 demand.

Meanwhile, China’s polysilicon consolidation effort took a formal step this week with the registration of the long-anticipated platform company, Beijing Guanghe Qiancheng Technology Co., Ltd.

The entity was established in Beijing on Dec. 9 with an initial capital of CNY 3 billion ($414 million) and is widely viewed as a vehicle, backed by leading polysilicon producers, to acquire and restructure surplus capacity.

No impact on spot polysilicon prices has yet been observed. According to the same OPIS report, the China Mono Premium – OPIS’ assessment for mono-grade polysilicon used in n-type ingot production – remained unchanged week-on-week at CNY 52.200 ($7.40)/kg or CNY 0.110/W.

Market participants noted that the company’s initial registered capital of CNY 3 billion suggests the initiative remains at an early stage. Given that early discussions on the consolidation plan envisioned raising roughly CNY 50 billion to acquire about one-third of surplus polysilicon capacity—estimated at more than 1 million metric tons—significant additional funding will likely be required as the project develops.

Others noted that the establishment of the company may only represent an initial framework. Key details—including the indicative polysilicon price range and targeted acquisition volume—remain unclear and are expected to be finalized over time. Nonetheless, participants view the development as a significant milestone that has strengthened market expectations for 2026.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.