From pv magazine Global

Swiss renewables research firm Pexapark has released a white paper documenting the evolving role of independent power producers (IPPs).

Titled “The Next-Gen IPP playbook,” the publication features insights from interviews with senior leaders and executives at eight of Europe’s leading IPPs: Eurowind Energy, Mirova, Nadara, Nuveen Infrastructure, OX2, Sonnedix, Taaleri Energia and Zelestra.

The white paper says a recurring theme quickly emerged from the interviews of IPPs evolving into “customer-centric platforms” with the aim of shaping, shifting and firming renewable output, rather than just generating it.

Each of the IPPs featured said they are working towards multi-GW-sized, multi-technology, multi-market portfolios. Pexapark says that from the asset investment side, this translates into a focus on adding battery energy storage systems (BESS) to the portfolio, allowing for enhanced flexibility and the capture value beyond generation.

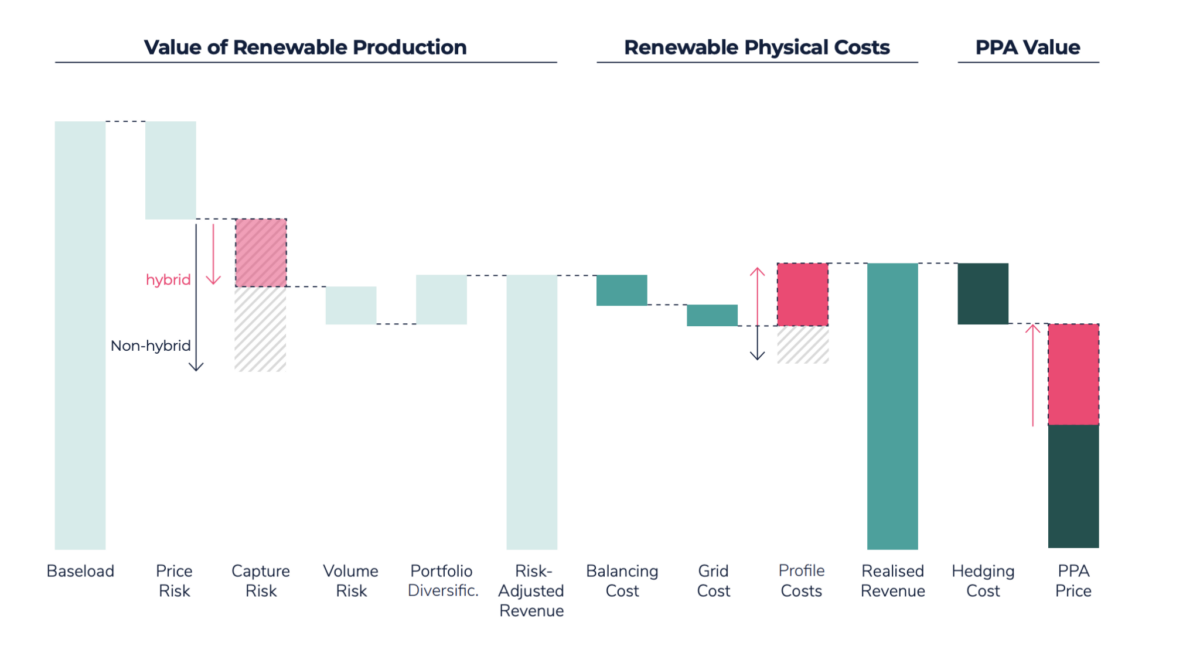

The interviewees shared that they are adding more structuring and pricing capabilities to prepare for the next wave of deals, expected to focus on BESS and co-located projects. Pexapark says that as deals are becoming more structured due to increased value in the middle of the revenue stack, more emphasis on flexibility purchase agreements (FPA), hybrid power purchase agreements (PPAs) and shorter and/or more complex PPAs, including agreements with negative price clauses, is expected.

The white paper adds that many of the interviewees said that at the heart of the evolving IPP is a “revenue brain”, which is described as a set of people, processes and systems fully dedicated to maximizing revenues and managing risks across a portfolio. This evolution has seen some IPPs create dedicated portfolio management teams responsible for managing, optimizing and trading with a focus on short-term operations. Pexapark adds this movement is particularly pertinent within the growing role of BESS, adding that while old IPPs were “light on operations”, the new IPP “actively dispatches, bids and structures.”

Pexapark adds that a further driver of the shift is the structural break between baseload prices and capture prices in renewable-heavy markets. The analysts explain that as IPPs must now compete with standard power markets, they need to develop products that can be valued and traded with conventional market instruments. “This requires a new commercial mindset, where structuring, short-term positioning and portfolio hedging are treated as essential disciplines, not add-ons,” the white paper emphasizes.

“In short, the next generation of IPPs are no longer passive asset holders,” Pexapark says. “They are becoming active energy managers, equipped with the data, teams and structure needed to extract more value, manage volatility and deliver tailored solutions to offtakers.”

The white paper ends with a call to build the next generation of IPPs, where Pexapark says that although the transformation is already emerging, momentum must continue before utilities, trading houses and BESS optimizers “capture the optimization margin, leaving IPPs as low-value generators squeezed by more aggressive intermediaries.”

The paper recommends that IPPs work as revenue managers and not just asset managers, build their commercial stack early, invest in structuring, pricing and portfolio management and operate with MWh, not MW, as their currency.

“At Pexapark, we expect this shift to materialize first in a new wave of deals,” the analysts conclude. “Whereas revenue once centered on PPAs, the focus is now on structured offtake arrangements and the integration of new asset classes such as BESS.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.