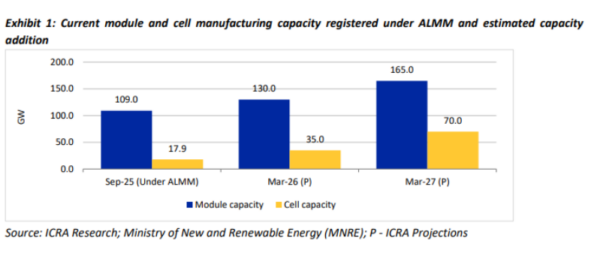

ICRA expects the solar PV module manufacturing capacity in India to increase to over 165 GW by March 2027 from 109 GW at present, led by policy initiatives such as the Approved List of Models and Manufacturers (ALMM), the imposition of basic customs duty on imported cells & modules, and the production-linked incentive (PLI) scheme. Further, the implementation of ALMM List-II for solar PV cells from June 2026 has spurred the ongoing expansion of cell manufacturing capacity by module original equipment manufacturers (OEMs) in India, which is likely to increase to about 100 GW by December 2027 from 17.9 GW currently under ALMM.

ICRA says the industry is likely to face an overcapacity scenario with annual solar capacity additions expected at 45–50 GW (DC) against an annual solar module production capacity of 60–65 GW. Further, the recent imposition of US tariffs has adversely impacted the export volumes, posing new challenges for the industry as the modules have been redirected from the export market to the domestic market.

The overcapacity in module production is likely to result in a consolidation of the smaller/pureplay module players. However, ICRA anticipates the vertically integrated manufacturers to benefit over the long term due to greater control over the supply chain.

“The operating profitability for ICRA’s sample set of domestic solar OEMs, which remained elevated at 25% in FY2025, is likely to moderate due to competitive pressures and overcapacity build-up,” said Ankit Jain, Vice President & Co-Group Head – Corporate Ratings, ICRA. “The recent imposition of tariffs by USA and the growing regulatory uncertainty in the USA are likely to dampen export volumes, potentially exerting pricing pressures on domestic OEMs.”

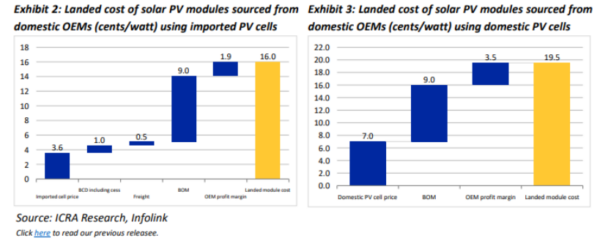

Jain said that a significant scale-up in the cell manufacturing capacity along with its stabilisation in a timely manner remains critical in the near term as the ALMM requirement for solar cells comes into effect from June 2026. He estimates that modules made with domestic cells will cost 3–4 cents per watt more than domestic modules made with imported cells.

All projects wherein the last date of bid submission is prior to September 1, 2025, translating into a solar project pipeline of 45-50 GW, will be exempted from the requirement of using solar PV cells under ALMM List-II even if their date of commissioning is after June 1, 2026. “This will support the order book of OEMs without cell manufacturing capacity in the near term. Nevertheless, the bidding activity has slowed down in the last few months, which remains a key monitorable,” stated ICRA.

The solar PV manufacturing supply chain is dominated by China, with over 90% share in the global manufacturing capacity across polysilicon and wafer, over 85% share in cells and around 80% share in modules. Given the dependence on China for the sourcing of wafers and ingots, any potential geopolitical restrictions on the supply of technology/machinery in setting up backward integration facilities for domestic OEMs over the medium term remains a key monitorable. Moreover, each successive stage in the value chain demands higher technological complexity, which not only requires substantial capital investment but also heightens the risks associated with project stabilisation and implementation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.