India’s solar module manufacturing capacity is expected to reach 215–220 GWp by FY28, driven by strong policy support, growing domestic demand, and export opportunities, according to a new report by CareEdge Ratings. The country’s solar cell manufacturing capacity is also projected to rise sharply to around 100 GWp by FY28.

India’s module manufacturing capacity has expanded rapidly — from about 72 GWp in March 2024 to nearly 118 GWp by July 2025. In contrast, solar cell capacity has grown more modestly from 8 GWp to around 27 GWp over the same period.

While India’s operational wafer manufacturing capacity currently stands at only 2 GWp, several domestic players have announced expansion plans for capacities exceeding 30 GWp, expected to become operational in the medium term. These projects represent a capital outlay of over INR 20,000 crore.

According to CareEdge, the ongoing capacity buildup has been supported by rising solar installations, government incentives, and improved access to financing. Analysts estimate India’s current annual production capacity at 50–60 GWp for modules and 8–10 GWp for cells, leading to a cell import dependency of 40–45 GWp. Consequently, many module manufacturers remain dependent on imports—primarily from China—to sustain output levels.

To reduce this reliance and promote domestic self-sufficiency, the government has introduced several regulatory measures, including the Approved List of Models and Manufacturers (ALMM) that mandates the use of domestic modules for certain projects, and upcoming ALCM/ALMM rules for cells to encourage greater use of locally made solar cells.

“Planned module capacity of over 215-220 GWp by FY28 is expected to entail investments of more than INR 14,000 crore, with an estimated 25–30% of panels likely to be exported,” says Tanvi Shah, Senior Director, Care Analytics and Advisory.

“The domestic cell manufacturing capacity is expected to reach around 100 GWp, supported by cumulative capex exceeding INR 55,000 crore,” ” says Nitu Singh, Associate Director, Care Analytics and Advisory.

Exports to drive sector growth

CareEdge states that in the coming years, India’s module and cell output will exceed domestic requirements, positioning exports as the key growth driver for the sector.

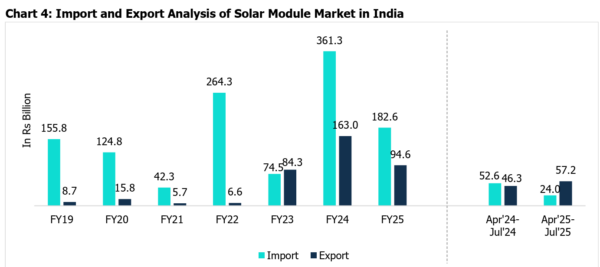

As a result of the rise in backward Integration, India’s exports have grown sharply from INR 8.7 billion in FY19 to INR 94.6 billion in FY25, with momentum peaking in FY23–FY24 when shipments briefly surpassed imports. The surge was also largely driven by U.S. developers diversifying away from China, though exports to markets outside the U.S. have remained relatively stable.

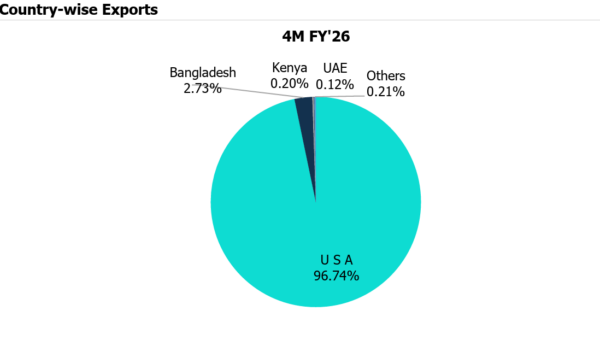

In FY25, exports fell mainly due to a steep drop in U.S.-bound shipments, which had accounted for over 95% of India’s module exports. The decline was due to scrutiny of US imports under the Uyghur Forced Labour Prevention Act. Notably, exports to the U.S. rebounded in the first four months of FY26, as developers accelerated shipments ahead of tariff deadlines, even as domestic demand absorbed most locally produced cells. Meanwhile, imports fell by 54% in this period, underscoring India’s progress toward solar self-sufficiency.

In value terms, the increase in exports during 4M-FY26 was primarily driven by shipments to the USA, which rose by INR 1,104.09 crore. However, the most significant growth was recorded in exports to Kenya, which expanded by 55.5 times year on year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.