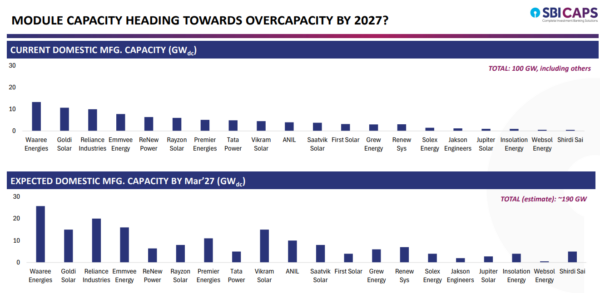

India’s solar module manufacturing capacity has reached approximately 100 GW, enough to meet annual domestic demand—assuming an effective utilization-to-nameplate capacity ratio of 55–65%—according to a new report by SBICAPS. However, with total module capacity projected to rise to 190 GW by March 2027, concerns of oversupply are emerging, particularly amid shrinking export opportunities, especially to the United States.

Solar power installations in India surged 60% year-on-year in FY25, reaching around 24 GW. This required approximately 50 GW DC of modules, based on typical DC/AC overloading ratios of 1.2 to 1.4. The report estimates annual additions will rise to 40–50 GW through FY2030 to meet the country’s solar targets, implying a steady-state requirement of around 100 GW of module manufacturing capacity.

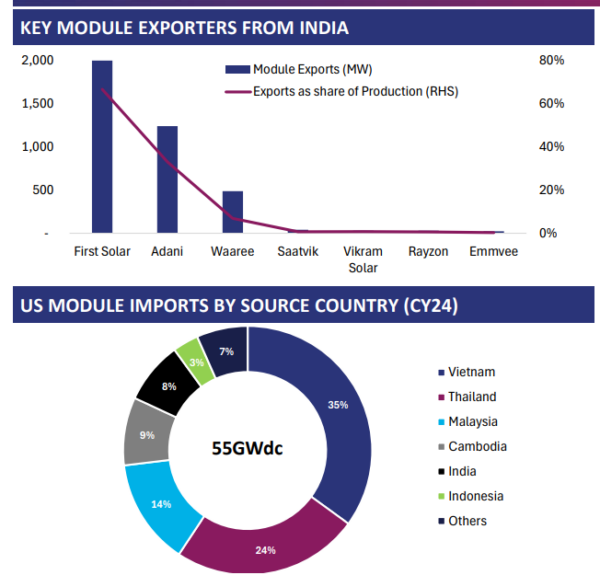

However, with cumulative capacity expected to hit 190 GW by 2027 and export prospects narrowing—particularly following recent changes in U.S. policy—an oversupply scenario appears likely. India exported just 4 GW of modules in FY25, a year-on-year decline largely attributed to regulatory changes in the U.S.

“US administration issued a directive to halt funding from the IRA. The subsequent enactment of the ‘One Big Beautiful Bill’ is expected to phase out investment tax credits and production tax credits for solar and wind projects,” the report notes. “This has reduced exports of modules from India to the US—the major export destination for Indian modules. In response, some players are setting up factories there, to adjust to the new FEOC (Foreign Entity of Concern) rules,” states the report.

Contrasting the maturity in modules, solar cell capacity in India is just 26 GW DC—less than one-third of module capacity—implying import dependence in the near term.

However, the report highlights that cell capacity is set to grow rapidly with the implementation of ALMM-II.

Under the ALMM-II order, only cells from approved manufacturers may be used for projects with bid submissions after August 31, 2025.

Additionally, only ALMM cells and modules may be used for projects benefitting from net metering or open access rules, a move which will open up the significant C&I market to domestic players.

Planned capacity additions promise to take up cell capacity to close to self-sufficiency in the medium term, with total 115 GW DC cell capacity projected by March 31, 2027. In the interim, the higher price for DCR cells could push up the cost of projects till the supply-demand dynamics re-adjust, potentially reducing bid enthusiasm.

The report also notes that Indian players enjoyed higher margins than global peers due to ALMM-I and DCR norms, besides Uighur Law helping India’s exports to US. However, in the coming quarters, given inadequate wafer integration, there could be pressure on margins for module makers. At present, only one player in India has wafer capacity in India, and thus the country relies on Chinese imports.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.