FOB China TOPCon M10 cell prices held steady this week at $0.0378/W, with price indications between $0.0347-0.0398/W, according to the OPIS Solar Weekly Report released on August 12. TOPCon cell prices have climbed 22.3% since early July’s year-to-date-low, with last week alone posting a 12.84% increase.

Last week, export markets saw a spike in cell procurement activity for second-half 2025 deliveries amid growing expectations of a cut or removal of China’s current 9% export tax rebate. Trade sources estimate the rebate adjustment could lift cell prices between 5-9%, with costs likely to be shared between sellers and buyers.

While this policy uncertainty supported recent gains, industry sources say that cell prices will be squeezed between two trends in the coming weeks.

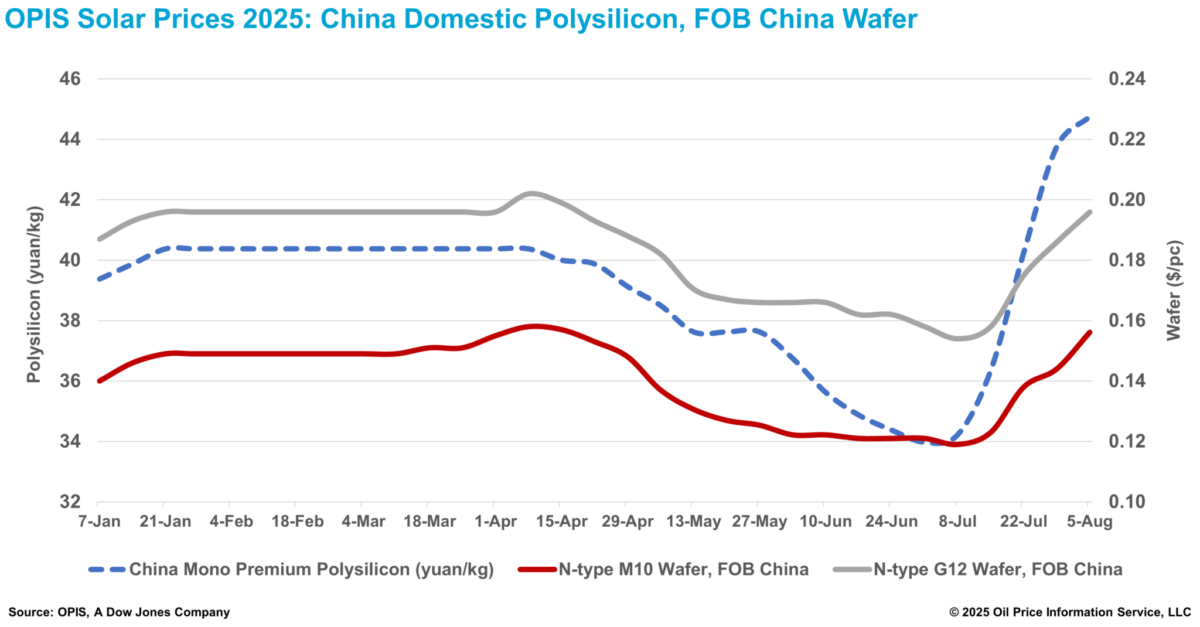

On the one hand, upstream prices are pressuring cell pricing upwards. Since July 1, China Mono Premium polysilicon and mainstream n-type M10 wafer prices have risen 31.7% and 29.0%, respectively.

Market sources said that the higher upstream costs will keep pressure on cell producers to seek further price increases. However, some noted that sustained cell price support will have to depend on whether end-users can absorb the higher costs.

On the other hand, weak end-user demand in both domestic and export markets is expected over the next few weeks, capping the cost-based upward price pressure. Compared to upstream prices which have risen more than 30%, FOB China n-type module prices have only increased 3.7%.

A Tier-1 producer said domestic demand will remain soft until September, before rebounding in the Q4 year-end installation rush.

In export markets, European procurement has slowed amid the summer holiday period.

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, was stable this week at $0.085/W Free-On-Board (FOB) China, with indications between $0.082-0.092/W.

On forward curve indications, Q4 2025 loading prices fell 1.16% to $0.085/W, with market indications ranging $0.083-0.088/W. Traded indications for this loading period were heard around $0.083-0.085/W this week.

Q1 and Q2 2026 loading cargoes were stable at $0.086/W, with prices between $0.085-0.088/W. Q3 2026 loading prices fell 1.15% to $0.086/W, with indications between $0.085-0.088/W.

Despite weaker indications across the forward curve this week, sentiment for H2 2025 loading is expected to turn bullish on growing expectations that China may fully cancel the export tax rebate by September or October, prompting module buyers and developers to front-load deliveries into August.

The rebate uncertainty is reshaping contracting practices. Contract adjustments are now common for forward deliveries. New deals include clauses specifying cost-sharing if rebates are reduced, while existing contracts are being renegotiated to add similar terms.

Yet the fundamental challenge remains cost transmission. Despite manufacturers raising offer prices, price transmission to the modules market remains limited. Market participants expect a 1-2 month lag before overseas markets fully reflect these upstream cost increases. Adding to transmission difficulties, several market sources noted that current domestic price strength is policy-driven rather than demand-led, with weak underlying buying activity expected to continue in the coming weeks.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.