Solar cell and solar wafer exports from China increased significantly during the first half of the year, according to analysis by London-based think tank Ember Energy.

Figures from the company’s online data tool shows solar cell exports increased 76% over the first six months of 2025, equivalent to 19 GW of capacity, while solar wafer exports were up 26%, equivalent to 8.6 GW.

The increase means that China’s combined solar product capacity was 11% higher in the first half than during the same period in 2024, despite a decline in solar panel exports.

Ember Energy also said that solar cells and wafers now make up over 40% of China’s solar product exports. Solar cells made up 22% of exports alone in the January-June period – their highest share reported to date.

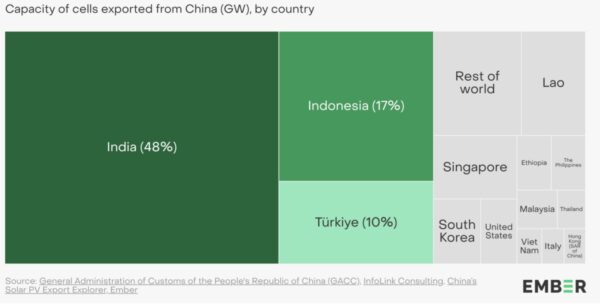

The drive in solar cell exports is led by India, Indonesia and Turkey, which together account for 75% of cell exports from China in the first six months of this year.

India alone contributed to 52% of the year-on-year increase in cell exports. Ember Energy noted that India is rapidly building up its domestic panel and cell manufacturing industry. With its panel manufacturing capacity outpacing cell capacity, the country currently relies heavily on cell imports to feed its panel factories.

India’s solar cell imports almost doubled in the first half of 2025 compared with the same period last year, rising from 11 GW to 21 GW. Ember said wafer imports from China are also accelerating to support cell production.

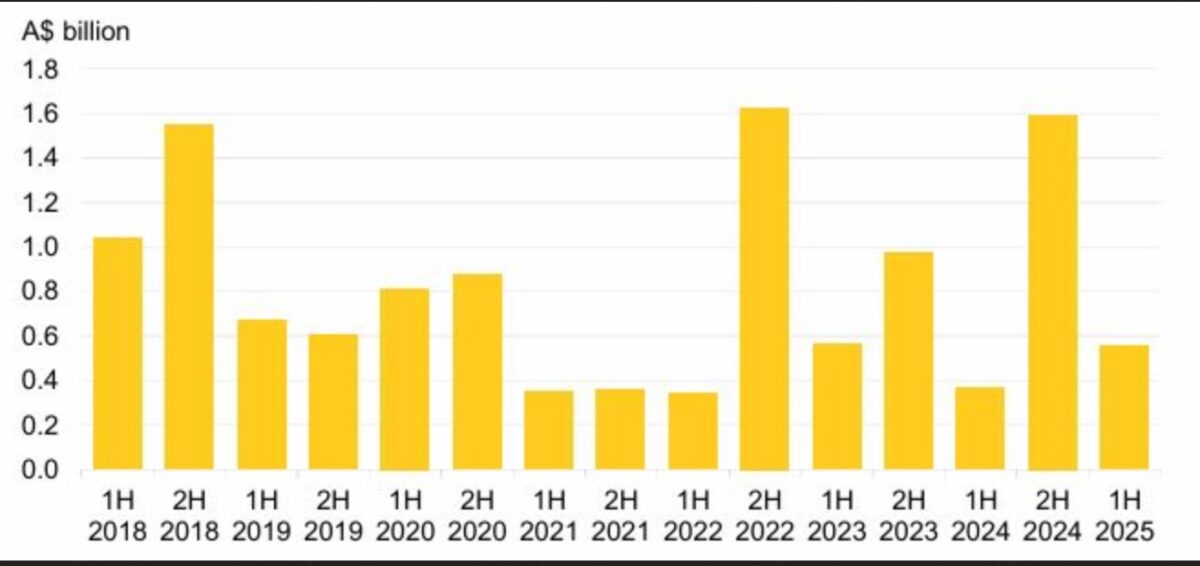

Solar panel exports from China are stagnating for the first time since the General Administration of Customs of the People’s Republic of China began reporting panel and cell exports separately in 2022.

Ember Energy said cumulative panel exports fell 5.2% in the first six months of 2025, equal to 6.7 GW less capacity. The think tank attributed the decline to stockpile drawdowns and slowing installations in Europe and Brazil.

Matt Ewan, energy systems analyst for Ember Energy, said cell and wafer exports are “more than making up for the stagnation” in Chinese panel exports. “To understand the growing global solar supply chain, it’s now crucial to track products upstream of panels,” Ewan added. “India is driving growth in cell exports, whilst panels must now find new markets to go to.”

The think tank’s latest analysis adds that since August 2022, the price of solar cells exported from China has fallen by $0.16/W, from $0.19/W to $0.03/W. Over the same time period, the price of solar panels exported from China has fallen by $0.20/W, from $0.29/W to $0.09/W.

“More than 50% of the raw cost of Chinese solar panels is now contributed by components other than solar cells, such as glass facing and the aluminum border,” said Ember Energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.