Industry sources point to aggressive stockpiling by two major wafer manufacturers as amplifying the government-driven rally, with the companies reported to have accumulated over 100,000 metric tons (mt) and 60,000 mt of polysilicon respectively.

Polysilicon futures market activity is also supporting recent price increases. According to Guangzhou Futures Exchange (GFEX), on certain days, market participants observed the total open interest exceeding one million metric tons – representing 70-80% of China’s annual polysilicon capacity. GFEX data from July 28 also shows that futures contracts for September 2025 delivery recorded a single-day trading volume of 1,744,380 mt – the highest volume among all 2025 delivery contracts on that day. While the elevated futures market activity can temporarily reduce inventory availability and tighten market liquidity, sources caution that it cannot fundamentally address the persistent oversupply.

However, trade information indicates two major producers have begun raising their operating rates to capitalize on higher margins. Given the sustained weak end-market demand, market participants view this as a ‘dangerous signal’, with some warning that any unfavorable market development could quickly trigger another price decline.

In a separate development, Chinese authorities are reportedly planning to introduce stricter energy consumption standards for polysilicon production. The proposed revisions aim to redefine effective production capacity and accelerate the phase-out of outdated facilities by tightening energy consumption thresholds.

Some industry experts have expressed skepticism regarding the effectiveness of this measure. One expert commented that imposing stricter energy consumption thresholds may be redundant as producers who cannot meet the energy consumption threshold are those who lack the financial resources for technological advancements – already struggling to remain operational.

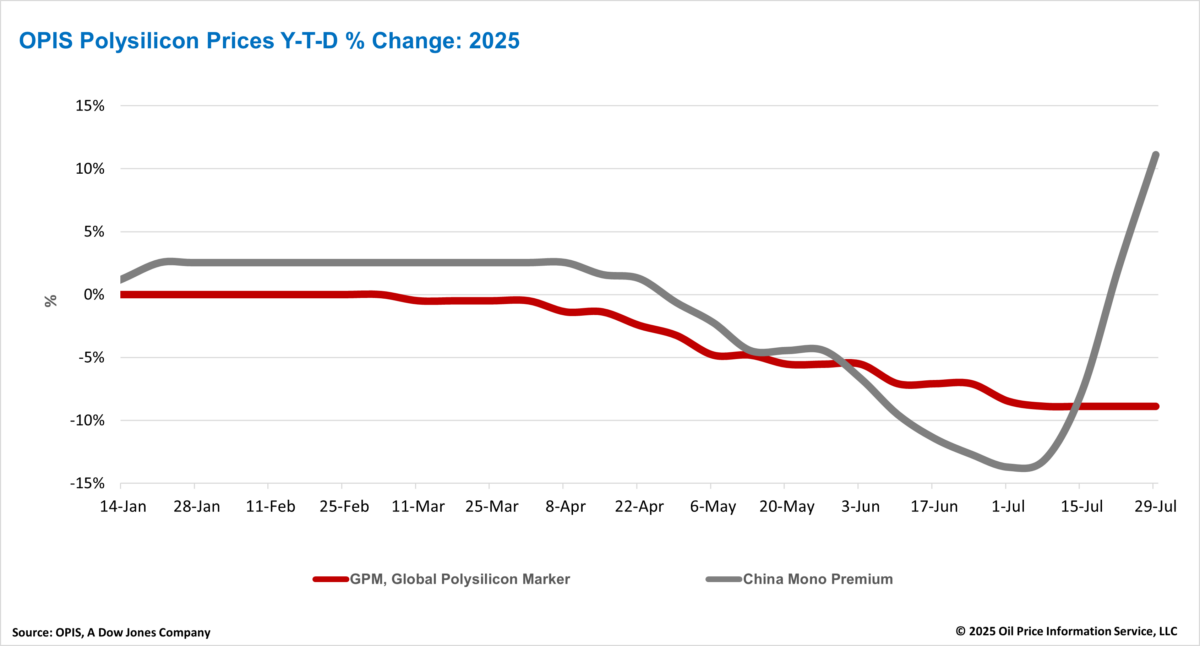

The Global Polysilicon Marker (GPM) – the OPIS benchmark for polysilicon produced outside of China – remained stable this week at $18.550/kg, or $0.039/W, based on reported buy-sell indications.

Market fundamentals remain relatively stable; however, two potential developments in U.S. trade policy may influence future polysilicon demand.

A national security investigation into polysilicon imports, launched by the U.S. Department of Commerce on July 1, could boost demand for non-Chinese polysilicon. Industry insiders anticipate that if the probe results in the classification of Chinese polysilicon as a national security threat, downstream manufacturers may pivot to alternative global suppliers.

In a separate development, a petition filed on July 16 by a coalition of solar manufacturers is expected to trigger new anti-dumping and countervailing duty investigations into solar cells and modules from Laos, Indonesia, and India.

Chinese-invested manufacturers in these regions are expected to significantly scale back production once an investigation is launched, as any resulting tariffs could apply to all shipments made from the investigation’s start date. Such a development could dampen demand for global polysilicon in the medium term.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.