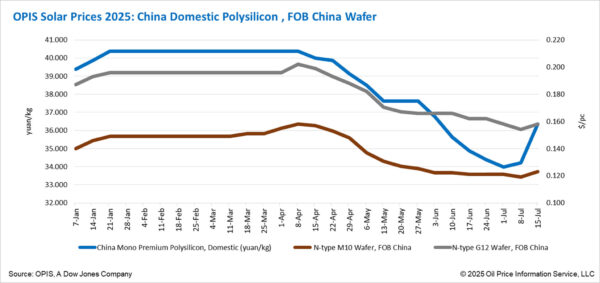

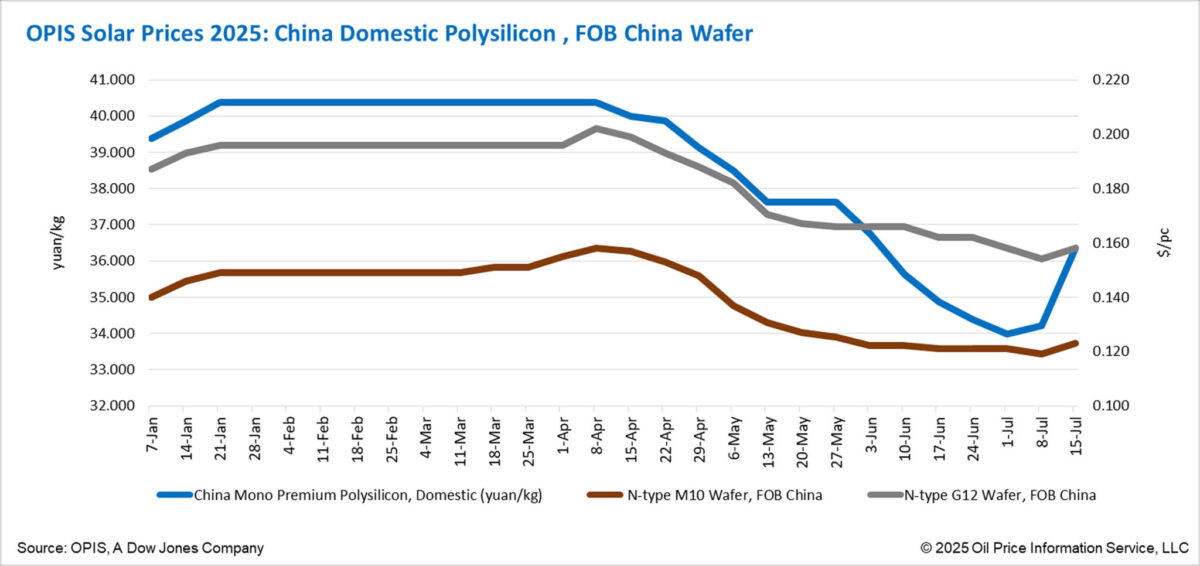

According to the OPIS Solar Weekly Report released on July 15, the China Mono Premium—OPIS’s benchmark price assessment for mono-grade polysilicon used specifically in n-type ingot production for the domestic Chinese market—rose by 6.21% week-on-week, reaching CNY 36.350 ($5.06)/kg, or CNY 0.076/W.

In tandem with the movement, FOB China prices for n-type M10 and G12 wafers also saw notable increases. As of July 15, prices reached $0.123/pc and $0.158/pc, representing week-on-week gains of 3.36% and 2.60%, respectively.

These price increases come at a time when structural overcapacity in China’s photovoltaic sector remains unresolved. Industry sources attribute the recent upward momentum largely to renewed government guidance and oversight, particularly directives aimed at keeping sales prices above manufacturers’ production costs.

Polysilicon producers have demonstrated strong intent to push prices upward during the current market correction. The OPIS report notes that prices have now risen for a second consecutive week. Sources indicate that after bundled sales of n-type and p-type polysilicon from certain suppliers reached the CNY 36–37/kg range, these sellers began refusing deals at those levels and are now actively seeking further increases.

Additional trade sources revealed that some polysilicon manufacturers are attempting to capitalize on improved sentiment—fueled by administrative interventions—to push prices rapidly toward CNY 45/kg. While certain producers have already issued n-type polysilicon quotes above CNY 45/kg, no wafer buyers have reportedly accepted transactions at that level so far.

As polysilicon prices climbed, wafer producers also began adjusting their offers in response, aiming to pass cost increases downstream. According to OPIS assessments, transaction prices in the domestic Chinese market for n-type M10 and G12 wafers stood at CNY 0.913/pc and CNY 1.228/pc, respectively. However, industry participants reported that current quotations have exceeded CNY 1.00/pc for n-type M10 wafers and CNY 1.35/pc for G12 wafers. Despite these elevated offer prices, actual transaction volumes at these levels reportedly remain limited, reflecting buyer resistance and cautious procurement strategies.

The bullish sentiment in the spot market has also extended into the futures market. As of July 14, 2025, settlement prices for polysilicon futures traded on the Guangzhou Futures Exchange for deliveries scheduled between July and December 2025 ranged from CNY 35.320/kg to CNY 41.945/kg. For contracts maturing in the first half of 2026, settlement prices ranged between CNY 41.795/kg and CNY 42.575/kg, with the highest price recorded for June 2026 delivery. According to industry sources, these values are nearing the cash cost line for certain producers, suggesting growing confidence that current policies are influencing market expectations.

The upward movement in both spot and futures prices is widely seen as a response to the latest round of government intervention, which has shifted from encouraging voluntary production cuts and industry self-regulation earlier in the year to enforcing minimum price levels more assertively since July.

A market observer commented that while these recent policy measures have contributed to stabilizing prices, their long-term effectiveness remains uncertain. “Polysilicon inventories are still high, and downstream demand in the second half of the year appears limited. Ultimately, the sustainability of any price rebound will depend on the underlying balance between supply and demand,” the observer concluded.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.