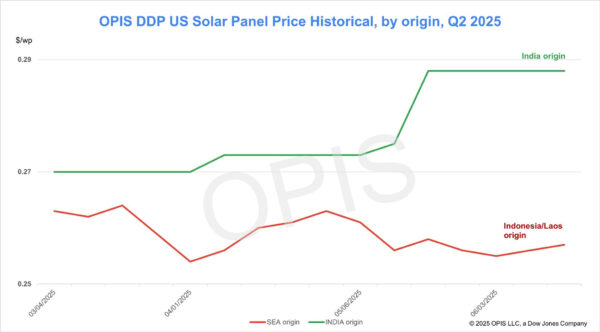

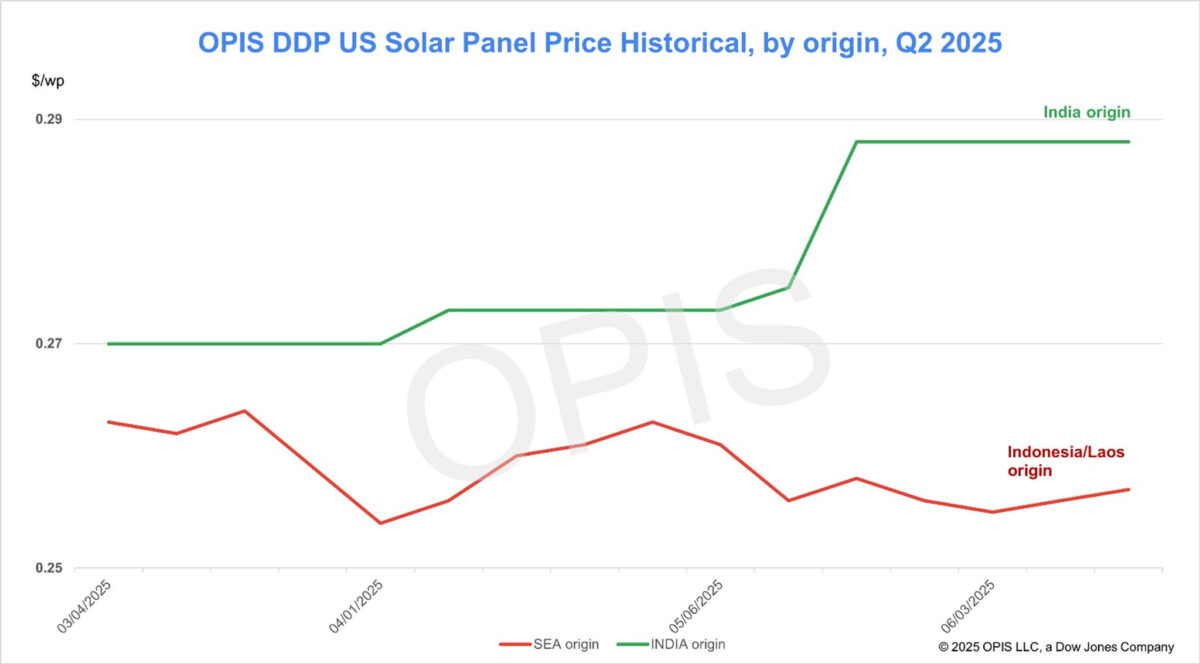

The spread between panel prices from Indonesia/Laos and from India compared with the average OPIS DDP US price has widened from 2.65% point in early April 2025 to 11.74% point this week. The market is increasingly nervous about the threat of a new anti-dumping and countervailing duties investigation opening into suppliers operating out of Laos and Indonesia which had recently become an important source of panel supply to the US market.

The spot price for TOPCon over 600 W modules DDP US rose 0.76% this week to $0.264/W, with quotes for cargoes from Southeast Asia rising 0.39% to $0.257/W and quotes for cargoes from India stable week-over-week at $0.288/W. The spot price for Mono PERC modules of less than 450 W EXW East Coast Warehouse (from distributors to installers) also stood stable at $0.325/W.

Quotes for US-assembled modules with imported cells continue to be heard between $0.26/W and $0.33/W, while modules with domestic content – which are still limited to just a handful of producers – are generally quoted between $0.4/W and $0.5/W.

The U.S. Senate Finance Committee on Monday released an updated budget draft proposal that softens some of the stricter changes to clean energy incentives included in the House version.

In perhaps the most newsworthy modification, the draft provides some breathing room for solar developers hoping to secure eligibility for the Investment Tax Credit (ITC or 48E, worth up to 30% of eligible costs) and the Production Tax Credit (PTC or 45Y, worth $0.60 per kWh produced), both of which were established by 2022’s Inflation Reduction Act and have driven a record boom in new solar power on the U.S. grid.

For solar and wind, 48E and 45Y would drop to 60% of their value for projects that start construction in 2026, and to 20% for projects that break ground in 2027, before phasing out entirely by 2028. The previous version of the bill would have denied the credits to any project not under construction within 60 days of the bill’s enactment and in service before 2029.

Generally, the industry has viewed this update as relatively good news in light of the worse alternatives. Trade groups, like the Solar Energy Industries Association (SEIA), say they are pushing for additional changes.

The bill fleshes out ‘Foreign entity of concern’ (FEOC) restrictions with cost ratio thresholds to determine ‘material assistance,’ which scale up from 40% next year to 60% after 2029.

In a statement, Mike Carr, Executive Director of the Solar Energy Manufacturers for America (SEMA) Coalition, applauded the Senate for restricting Chinese firms’ access to the Advanced Clean Energy Manufacturing Credit (or 45X) and “making the domestic content bonus more effective.”

But he said the phaseout of the ITC (which originally kept its full value into the early 2030s) makes these changes “functionally irrelevant.” Senate Republicans have said they are aiming to get a bill to President Trump by July 4.

The budget proposal that passed through the House last month would have blocked ITC and PTC eligibility for any project not under construction within 60 days of the budget becoming law, a window that would have likely closed sometime in the fall.

Though Monday evening’s updated budget bill provides two years of breathing room, a U.S. developer source said the threat of the 60-day window was enough to start a rush for modules. Had the 60-day window stuck, he said, the rush would have been exaggerated.

That source said this anticipation – of disruptions to both domestic and trade policy – has applied the “little bit of upward pressure” that imports from Southeast Asia have seen recently.

A developer said he is mostly focused on the threat of a new anti-dumping/countervailing duties investigation opening into suppliers operating out of Laos and Indonesia.

“I think whatever (the situation) is, whether the reciprocal tariffs stay as is, or there’s an AD/CVD case, the clock is ticking on Laos and Indonesia supply,” he said. “If you significantly choke off that (cell) supply, there’s not much else out there right now.”

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.