From pv magazine USA

With much uncertainty around the final tariffs on solar and energy storage components coming into the United States, one thing that is certain, according to a recent report from Wood Mackenzie titled “All aboard the tariff coaster: implications for the US power industry,” is that the cost of power and energy storage will rise.

The United States is already one of the most expensive markets for utility-scale solar, and the costs will escalate with the projected tariffs, according to the analyst firm. However, Wood Mac said that energy storage will be hardest hit.

Another slowdown is expected in project development activity, according to the report.

“In a business with five- to 10-year planning cycles, not knowing what a project will cost next year or the year after is disruptive and causes massive uncertainty for US power industry participants,” said Chris Seiple, vice chairman, Power and Renewables at Wood Mackenzie. “As a result, we could see potential delays in project development and rising power purchase agreement (PPA) prices. We will definitely see impacts on power sector capital projects. The severity depends on what scenarios play out.”

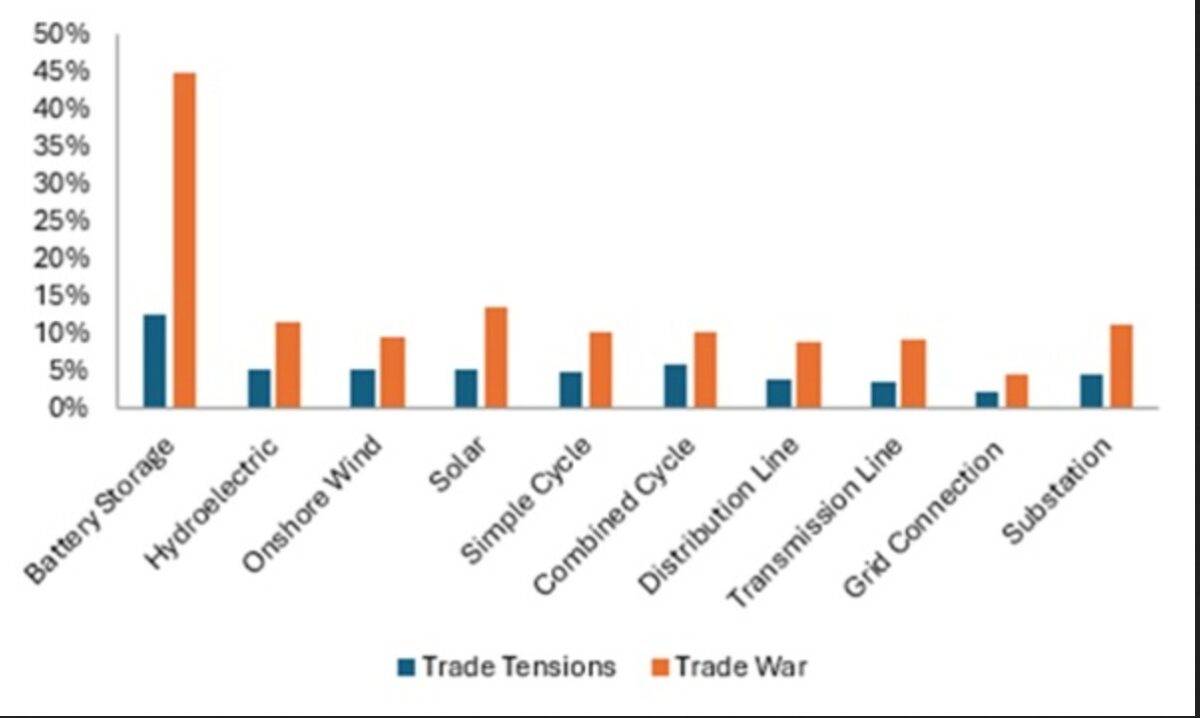

Wood Mackenzie used its Power & Renewables Supply Chain Cost Hub tariff calculator to estimate the impact tariffs would have on the cost of power sector capital projects. Tariff impacts are assessed using various inputs, including project and equipment cost breakdowns, as well as US import data.

The analysis looked at two scenarios:

- Trade tension scenario assumes that by the end of 2026 the effective tariff rate settles at 10%, 34% tariff on China.

- Trade war scenario sees the United States maintaining an aggressive tariff policy and implementing reciprocal tariffs that result in an overall effective tariff rate of 30% through 2030.

Based on these scenarios, Wood Mackenzie estimated most types of technologies will experience cost increases of 6% to 11%, with utility-scale storage the exception.

Energy storage

Tariffs on imports from China are expected to greatly affect energy storage costs, and a 90-day pause in mid-May gave the industry a temporary reprieve.

The Wood Mackenzie report notes that the United States is heavily dependent on battery cells to serve the burgeoning market for utility-scale battery energy storage Systems. That dependence coupled with potentially high tariffs could increase costs of these projects from 12% to more than 50%, according to estimates by Wood Mac.

“While US battery cell manufacturing capacity is expanding, it is not expanding at a pace nearly fast enough to meet even a small fraction of battery projects in the US,” said Seiple. “In 2025 we estimate there is sufficient domestic manufacturing capacity to only meet about 6% of demand and by 2030 domestic manufacturing could potentially meet 40% of demand.”

In the trade tensions scenario, Wood Mac estimated that the cost of a utility-scale solar facility in the US will be 54% more expensive than in Europe and 85% more expensive than a new solar plant built in China. The analyst firm notes that US utility-scale solar is already among the highest cost in the world.

“The tariffs that have been in place on solar modules along with an inefficient transmission policy that exacerbates interconnection costs have made construction costs for solar higher in the US than in most other markets,” said Seiple. “An increase in tariff levels will only worsen this premium US energy consumers need to pay to access renewable energy.”

Seiple said current trade policies are creating major challenges for the US power industry, with participants likely to face higher costs and possible supply chain disruptions, even as the full impact remains unclear.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.