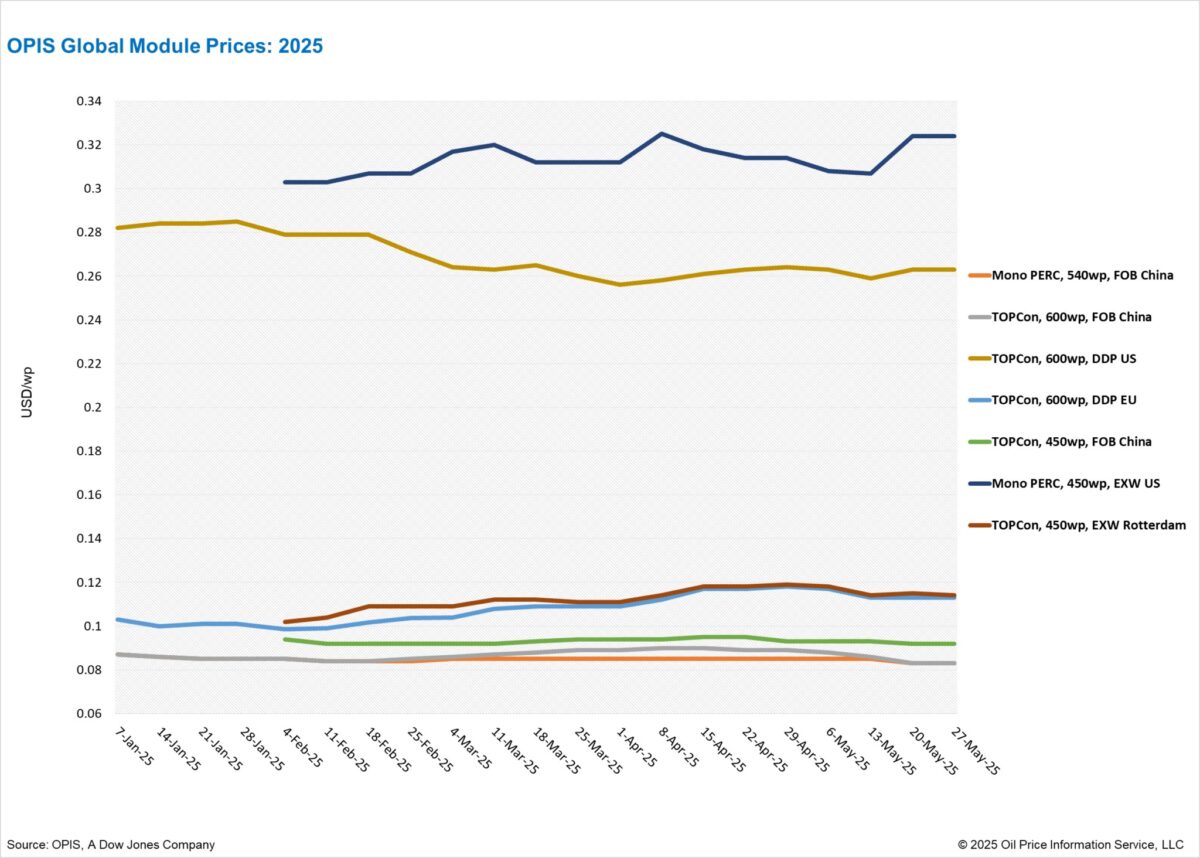

China: The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, held steady at $0.083/W Free-On-Board (FOB) China, with indications between $0.079-0.087/W. FOB China Mono PERC module prices maintained at $0.083/W with indications between $0.080- 0.088/W.

In the forward market, loading cargoes for Q3 2025 were assessed at $0.083/W, while Q4 2025 prices were slightly lower at $0.082/W. For 2026, Q1 and Q2 loading prices were assessed at $0.081/W and $0.080/W, respectively, with price ranges for both quarters falling between $0.078 and $0.084/W.

FOB China TOPCon ≤450 W modules for spot loading were stable at $0.092/W, with price indications between $0.090-0.098/W.

FOB China TOPCon module prices remained stable this week after three consecutive weeks of declines, according to OPIS data. Since the beginning of May, prices have dropped by 5.68%. The monthly average for May was assessed at $0.085/W, down from $0.087/W in April. Sentiment regarding the market outlook remains bearish, with industry participants cautioning that subdued domestic installation demand could exert further downward pressure on export prices in the coming months.

According to data released by the National Energy Administration last week, China added 104.93 GW of new solar photovoltaic capacity between January and April 2025—up 74.6% from 60.1 GW during the same period in 2024. April alone contributed 45.22 GW of new installations.

Trade sources attributed the surge to the policy-driven rush ahead of the 430 and 531 deadlines, as developers rushed installations to complete projects before the new policies took effect. Despite the strong start to the year, a top-five module manufacturer told OPIS that the market continues to grapple with oversupply and elevated inventory levels. Multiple industry sources noted that the front-loaded demand seen in the early months of 2025 could lead to a slowdown in installation activity over the remainder of the year.

U.S.: The spot price for TOPCon ≥600 W DDP U.S. was assessed this week at $0.263/W, with cargoes from Southeast Asia seeing an average price of $0.256/W and cargoes from India seeing an average price of $0.288/W. The spot price for Mono PERC modules ≤450 W EXW East Coast Warehouse (from distributors to installers) held steady at $0.324/W.

Looking ahead, OPIS maintains its assessment for the first quarter of 2026 at $0.276/W for DDP U.S. TOPCon ≥575 W modules and $0.266/W for DDP U.S. Mono PERC ≥540 W modules. The forward curve for 2026 is unchanged week on week, with sources citing hesitation around forward deals from both buyers and sellers.

The U.S. International Trade Commission (ITC) last week issued its final ruling in the anti-dumping and countervailing duties (AD/CVD) investigation into solar manufacturers in four Southeast Asian countries, solidifying tariffs that have reshaped the global supply chain over the past year.

Industry insiders expect a new probe targeting suppliers in Laos and Indonesia—recent manufacturing hubs—while attorneys for the petitioners have confirmed this as a likely next step.

A project developer noted that the potential investigation may rule out Laos and Indonesia as sourcing options for his company. Instead, the developer is turning to U.S. assemblers and actively pursuing master supply agreements with top Indian manufacturers, citing the stability of avoiding tariff exposure.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.