A consortium of ReNew Energy Global promoters has made a non-binding proposal to buy out the company’s publicly listed shares.

Masdar, Canada Pension Plan Investment Board (CPP Investments), Platinum Hawk (an arm of the Abu Dhabi Investment Authority, ADIA) and Sumant Sinha (the founder, chairman and CEO of ReNew) have offered to acquire the entire issued and to be issued share capital of the Indian renewable energy developer not already owned by members of the Consortium, for cash consideration of $7.07 per share.

The offer price is at 11.5% premium over ReNew’s stock closing price of $6.34 on Dec. 10.

The ReNew Board of Directors have formed a Special Committee led by Manoj Singh, the lead independent director, consisting of the six independent non-executive ReNew directors to consider the non-binding proposal.

“The role of the Special Committee is to constructively explore and evaluate all strategic capitalization/financing opportunities available to the Company, including the proposal received from the Consortium, and act in the interests of all investors,” stated the company.

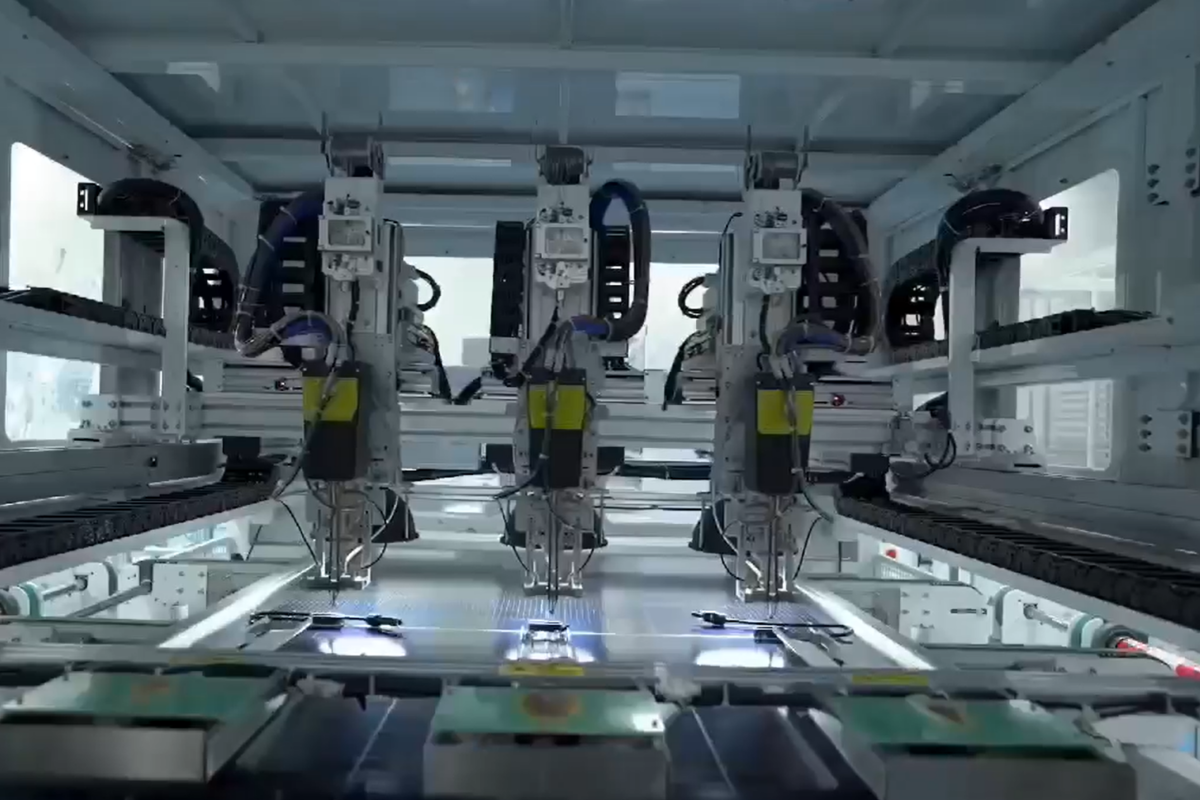

NASDAQ-listed ReNew has a clean energy contracted portfolio of 16.3 GW on a gross basis as of Nov. 19, 2024. This includes 10.4 GW operating assets (wind: 4.8 GW, solar: 5.5 GW, hydro: 99 MW) and 5.9 GW committed (solar: 3.6 GW, wind: 2.3 GW).

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.