The first half of the year 2024 has seen significant changes in weather patterns and the world is facing severe heatwaves globally. The conditions may (and will) get worse if proper measures and seriousness are not shown towards sustainability and decarbonisation, which is taking centre stage for companies, governments, and citizens. It’s no longer ‘whether’ or ‘if’ but now it’s ‘how’ to mitigate emissions, reduce environmental impact and develop future-proof business models that deliver sustainable change, address risks, and reverse the adverse impact of climate change on our lives.

To move in this direction, the landscape is evolving to embrace stricter reporting standards, pushing organisations to substantially evolve the way that they identify, manage and communicate environmental and social performance. With growing stakeholder support, momentum for strategic sustainability management has surged. Stakeholders are wielding greater influence, pushing for rigorous reporting protocols and incentivizing businesses to prioritize environmental preservation. This collective movement towards sustainability isn’t just a trend; it’s a necessity, underlining the reality that sustainable transition is now the standard, not the exception.

Here’s what to watch:

Global shift towards sustainability and net zero

Countries worldwide are collectively responding to climate and nature challenges through international consensus and agreements. More and more regulators, ministries, policies, and tax instruments in individual countries are mandating the corporate world to comply with sustainability and emission norms and provide periodical reports about emissions performance.

To achieve commitments made in COP 26 including Net Zero by 2070, India already has taken significant steps by introducing the Business Responsibility Sustainability Report, which is the first framework in India that requires eligible Indian companies to provide quantitative metrics on sustainability related factors. Further, the Indian Government has also notified Green Credit Rules, 2023 to leverage a competitive market-based approach for Green Credit and to incentivise the voluntary environmental actions by stakeholders. According to section 166(2) of the Companies Act, 2013, the directors of the company are duty bound to protect the environment. National Guidelines on Responsible Business Conduct (NGRBC) provides that businesses with sustainable policies may accrue benefits like customer loyalty, efficiency gains and risk reduction in supply chains and manufacturing, access to international capital, reduced risk from regulators, brand image, and likewise.

Additionally, under the Enhanced Transparency Framework (ETF) of the Paris Agreement, India, as well as other developing countries, are mandated to submit their inaugural Biennial Transparency Report (BTR) and, if applicable, an independent National Inventory Report (NIR) by the deadline of December 31, 2024. These submissions must adhere to the established modalities, procedures, and guidelines (MPGs).

The ETF’s mandate includes the systematic collection and reporting of greenhouse gas inventory data, monitoring of progress in relation to the Paris Agreement’s overarching objectives and India’s own Nationally Determined Contributions, as well as the provision of updates concerning financial support they are providing or receiving in the context of climate change mitigation and adaptation efforts.

Climate and sustainability disclosure requirements

Emerging standards and best practices reflect emerging climate change/sustainability disclosure, for instance, the Task Force on Climate-related Financial Disclosures (TCFD), requires companies to analyse and disclose the implications of climate change for the future performance of their organisations. This is also reflected in the IFRS’s ISSB (International Financial Reporting Standards- International Sustainability Standards Board) General Requirements for the Disclosure of Sustainability- Financial Information and Climate-related Disclosures.

In addition, new regulations are raising the bar for sustainability in international trade. For instance, the companies that are seeking to export to Europe from India, or which operate in Europe with supply chains in India, there are two recent European Directives relating to sustainability strategy, performance, and disclosure which are of significant importance:

- The first is the Corporate Sustainability Reporting Directive (CSRD), which entered into force on January 5, 2023. It requires all large and listed companies (except listed micro-enterprises) to disclose information on the risks and opportunities arising from social and environmental issues; and on the impact of their activities on people and the environment through a set of detailed disclosure requirements.

- The other European Directive of relevance to international supply chains is the Corporate Sustainability Due Diligence Directive (CSDDD), adopted by the European Commission on April 24, 2024. This establishes duties and obligations for companies (including non-EU companies) and their directors to identify, end, prevent, mitigate, and account for negative human rights and environmental impacts in the company’s own operations, their subsidiaries, and their value chains.

Moreover, companies that are subject to the abovementioned directives will be required to report on their value chain impacts and emissions. Companies in international value chains (e.g., those supplying companies) will be required to measure and disclose their environmental performance, particularly their carbon emissions.

Additionally, in pursuit of national as well as independent Net Zero pledges, companies are obligated to devise a strategic plan to align their operations with efforts to cap the global temperature rise at 1.5°C and the objectives of the Paris Agreement. By doing so, companies not only adhere to international climate objectives but also solidify sustainability as a fundamental precondition for sustained growth and long-term viability.

How to manage the transition

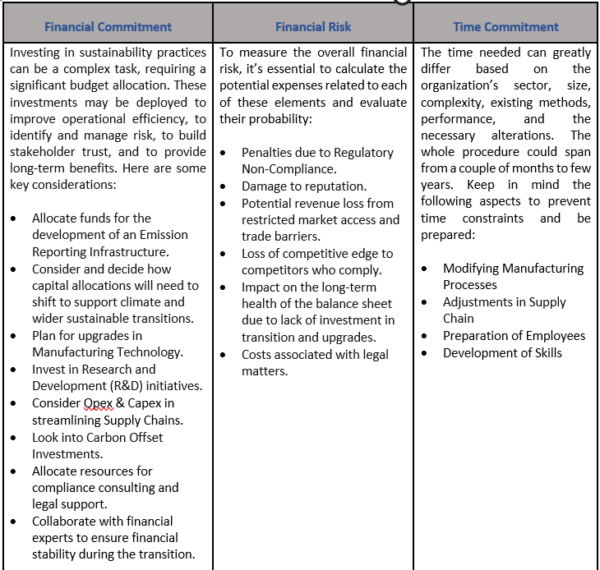

Transitioning from an unsustainable business strategy to a more sustainable one is not merely an option but a necessity that companies must embrace. This transition, however, requires a combined investment from companies in terms of time and money. Given the need to comply with increasing disclosure requirements, companies must understand their financial commitments, risks, and time commitments.

Through a comprehensive understanding of the aspects covered above, companies can better manage the transition to sustainability, thereby ensuring their long-term health while making the transition. The table below provides a breakdown of these aspects:

Sustainability is no longer a peripheral concern; the creation of new rules for reporting and sharing information highlights the need for companies to understand and integrate sustainability as a strategic concern that will shape the future of their organisations.

By proactively embracing more sustainable practices and aligning themselves with global sustainability goals, companies can ensure their continued viability and contribute to a healthier planet. The journey towards sustainability may be complex and challenging, but it is an investment that will yield significant returns in the long run. It’s clear that companies that fail to adapt will be left behind, while those that embrace this change will march the way forward.

Parveen Arora is a partner at BTG Advaya, Joss Tantram is founding partner at Terrafiniti, and Akhil Kishore is managing partner at GIA Advisors.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Why did THE PEOPLE around the world… ignore Sustaonabity for 200+ years….????

We’re they ALL STUPID or they just did not care or held accountable for their “irresponsible” behaviour to others and their home… aka EARTH…

Businesses and Others will only embrace Sustainability once they are held accountable and face immense punitive penalties and damages for the Societal Costs of their actions and behaviour. Unfortunately, the latter is dismally missing and provides no cost benefit, or (competitive) advantage. Till ALL face the “wrath” of Polluting and Unsustainable Practices & Policies, mankind will continue on its unsustainable path(s)….

Carbon Credits, for example, were created to provide a “Voluntary Path” to Sustainability, but even after 25 years has failed miserably to provide ANY tangible results or benefits to… ANY OR ALL …. !!!