From pv magazine Global

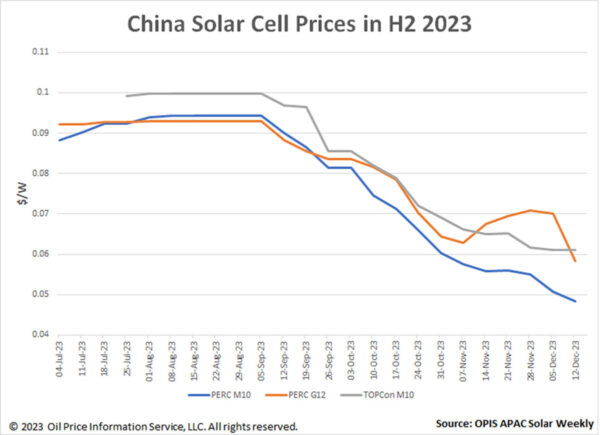

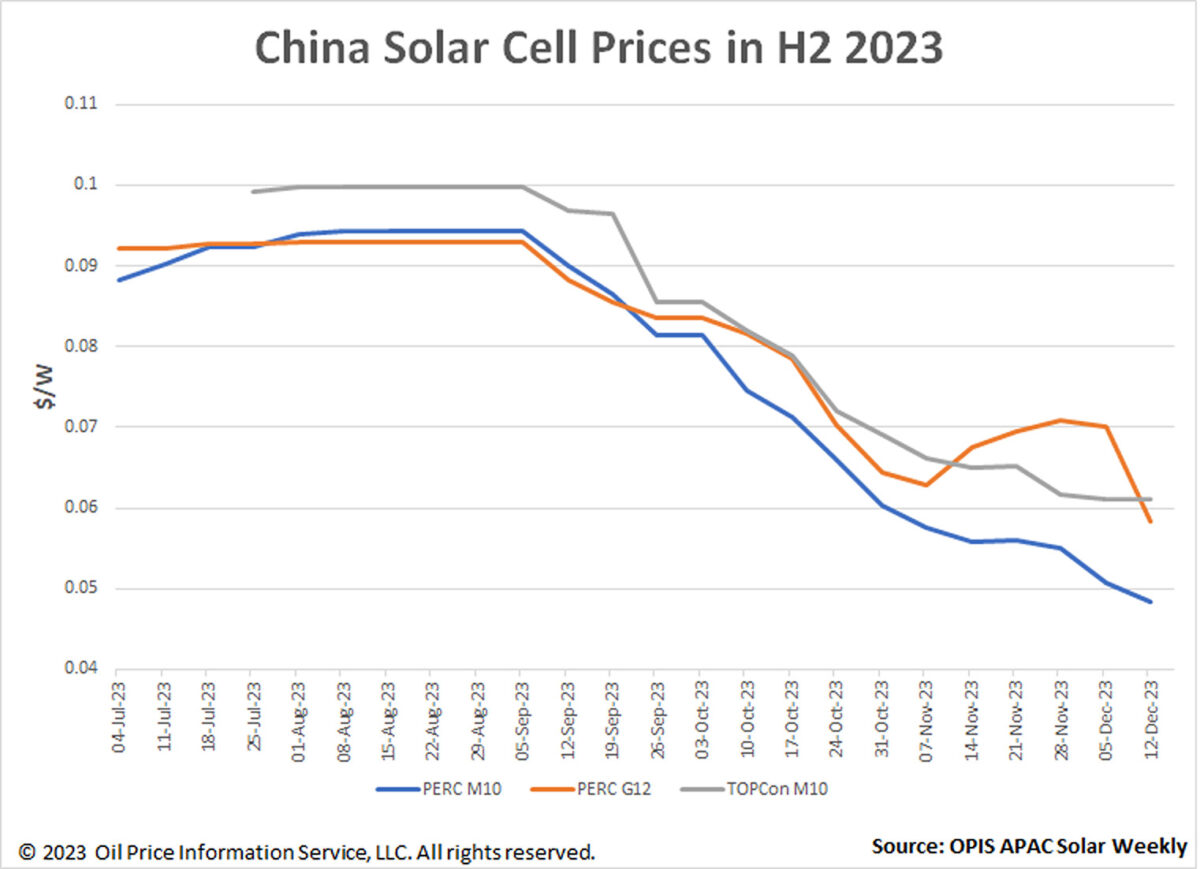

China’s monocrystalline PERC M10 and G12 cell prices extended losses this week, falling 4.54% and 16.69% to $0.0484/W and $0.0584/W respectively, while TOPCon M10 cells held steady at $0.0610/W.

The price spread for PERC M10 cells has widened this week. As M10 cells fall to an average price of around CNY0.389 ($0.055)/W, a major cell manufacturer continues to offer them at about CNY0.41/W, saying that “production will cease if the price drops any further.”

In contrast, an integrated player said cell buyers are unwilling to pay for PERC M10 cells at CNY0.4/W. The market has even reported transaction prices of CNY0.35/W, a project developer said.

PERC M10 cells have an “excessively high production capacity” and “there are quite a lot of irrational prices on the market at the moment,” according to a cell producer.

PERC G12 cells meanwhile plummeted 16.69% this week as demand dropped, more than shedding recent gains from November’s demand spike, a market watcher said. This suggests that the peak demand season for this year’s installations has passed, he added.

TOPCon M10 cells hold steady as sources concur that the market faces a scarcity of high-efficiency N-type cells. However, an increase in n-type cell prices is unlikely, according to a large integrated manufacturer. The next two months are an “off-season” because of the Christmas and Chinese New Year holidays, he said. “Depending on how low demand and shortages interact, n-type cell prices may remain steady in the near future,” he continued.

A significant amount of PERC cell production capacity is reportedly closing, with a faster than expected shift towards n-type cell production taking place, according to a major solar manufacturer. According to the manufacturer, half of PERC cell capacity is predicted to shut, leaving only 200-300 GW of PERC capacity available in 2024.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.