Solar installations in India have been steadily rising since March 2023. As per official numbers, India installed 9 GW (AC) of solar capacity from January to August 2023, which is around 12 GW of DC capacity, according to estimates. These installation numbers reflect many projects that were originally supposed to be built in 2021 and 2022 but were hindered by high equipment prices.

A government-approved relaxation of restrictions imposed by the approved list of models and manufacturers (ALMM) – which indicates which products can be included in government-backed projects – has accelerated Indian PV installations, helped also by falling module prices.

The start of 2023 looked a bit gloomy for India, compared with the usual pattern of a strong first quarter each calendar year. Module price and availability prevented many projects from being completed. In May, after the SNEC solar trade show in China, the market turned around. Module prices, excluding import duties, quickly dropped below $0.18 per watt (W) and continued to fall, reaching less than $0.15/W in the July to September period. Installers took the chance to complete pending projects, driving the current installation boom, which is likely to continue through the first three months of next year.

Rising imports

Local developers have grabbed the opportunity offered by module price declines to order in bulk. We believe that will lead to a strong upswing in module imports in the final three months of this year and the first three months of 2024. These modules will go into projects in the first part of next year and possibly even further out, depending on how legislation evolves.

Current regulation allows for government-tendered projects to include modules not named on the ALMM list, until March 31, 2024. Modules imported before that deadline but not installed will not be eligible for installation on government-aided projects. Developers are trying to persuade the government to extend that deadline by another three months, to give them more flexibility in terms of orders and imports.

Expanding production

Module manufacturers have ramped up India’s solar panel output, with annual production capacity expansions driven by national local-content policies. Annual module manufacturing capacity in India has already crossed the 20 GW mark but the factory utilization rate remains below 50% to date. That means, with local manufacturers having brought their prices closer to the cost of imported modules (plus basic customs duty), they will not be able to meet demand.

The fall in imported solar cell prices has resulted in a strong spike of cell imports over the past few months, which is likely to boost solar module-assembly factory utilization rates. The share of Indian-manufactured modules in new installations is expected to increase accordingly, especially after March 2024.

Projects corresponding to more than two thirds of this capacity are unlikely to obtain modules before March 31, 2024. Hence, most developers of government-backed projects will need to procure modules included on the ALMM list. Such constraints on module procurement put the solar project pipeline at risk of delays.

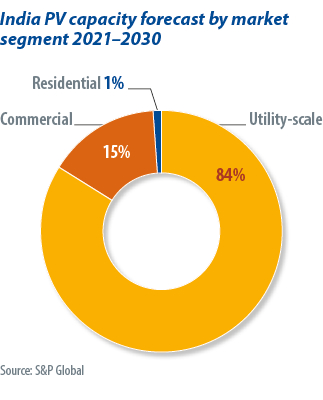

In parallel with the government-backed PV project pipeline that dominates the Indian solar market, there is also growing interest among commercial and industrial electricity consumers seeking to procure solar power via on-site systems or private power purchase agreements. As these are not limited by ALMM list requirements, these segments of the solar industry are in position to benefit from possible module inventories in 2024. India’s PV deployment is, hence, set to diversify further across different market segments.

Given the high number of PV projects waiting to be commissioned and the level of module imports expected for the rest of the year, S&P Global Commodity Insights forecasts India will have installed 20 GW of solar this year. Solar installations in 2024 could be even higher than our forecast, depending upon government policy and possible further ALMM relaxations. Deadline extensions are possible, as we have seen previously in India’s solar power market.

About the author: Josefin Berg is an associate director for solar research at S&P Global Commodity Insights, leading a team that covers forecasts, trends, and company strategy in the downstream solar market. Her focus areas include developers and engineering, procurement and construction business strategies, demand for PV in emerging markets, and the role of solar in the power mix. With more than 12 years of industry experience, she writes reports on PV markets and trends and regularly speaks at industry events.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.