From pv magazine Global

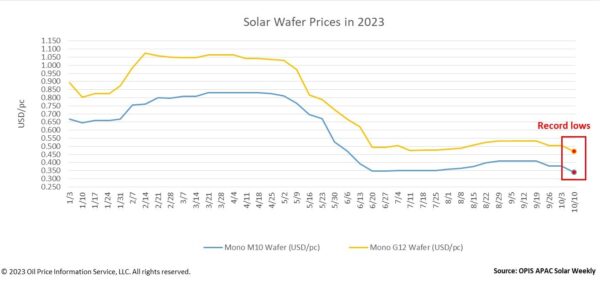

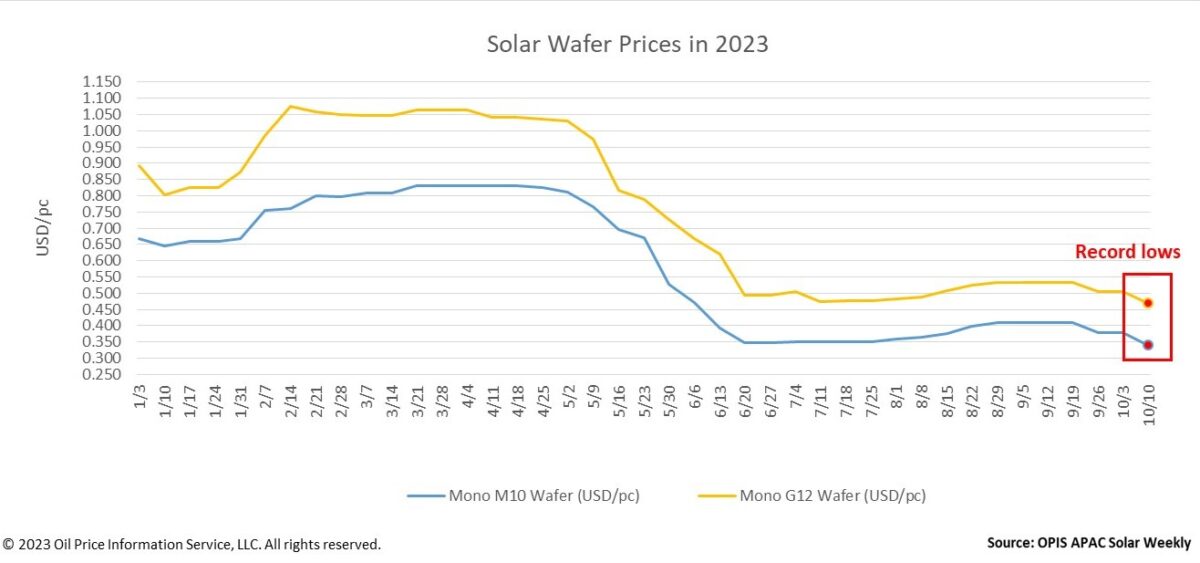

Solar wafer prices plummeted to their lowest values ever when trading resumed after China’s Golden Week, according to OPIS data. Extending their downtrend from before the holiday, Mono M10 wafers plunged a substantial 10.29% to $0.34/pc and Mono G12 wafers fell a similar 7.33% to $0.468/pc.

The main factors behind wafer price reductions are the decline in downstream demand and the accumulation of wafer inventories brought on by the high operating rate of wafer producers, concurred numerous sources.

Based on the production schedules of wafer manufacturers, a market observer estimates that China’s wafer production output would be around 65 GW in October. This would indicate an increase of around 8% in comparison to the 60–61 GW of wafers produced in September, according to data from the Silicon Industry of the China Nonferrous Metals Industry Association.

Approximately 2.4 billion pieces of wafers, or around 20 GW, are presently in stock on the wafer market, according to a source from a major vertically-integrated player. This figure will likely keep increasing soon due to the high operating rates of wafer factories, the source added.

Based on polysilicon’s current pricing, the cash cost for producing Mono M10 wafers at Tier-1 facilities is approximately CNY2.5 ($0.34)/pc, which means that there is still some room for Mono M10 wafers prices – currently average market price of approximately CNY2.78/pc – to fall further, according to a source from the polysilicon segment.

The sales of wafers has also been hampered by downstream manufacturers’ reduced production and wait-and-see attitude, OPIS learnt during its weekly market survey. This week also marks the lowest price ever for solar cells, with Mono M10 and G12 cells falling by 8.35% and 2.39%, respectively, to $0.0746/W and $0.0816/W.

According to another market watcher, cell manufacturers currently have no incentive to maintain high operating rates given their low profit margins, resulting in a decrease in wafer demand. This source therefore anticipates that wafer producers may be forced to reduce their prices on a weekly basis due to the steadily declining demand.

“Wafer producers cut production when wafer prices fall to the point when there is no more room for price reduction,” a source from a developer noted.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.