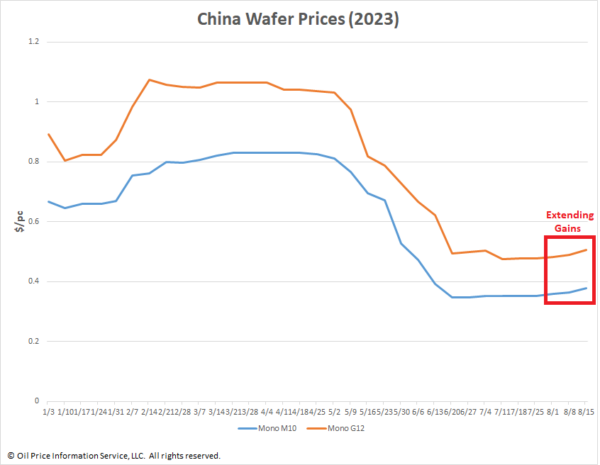

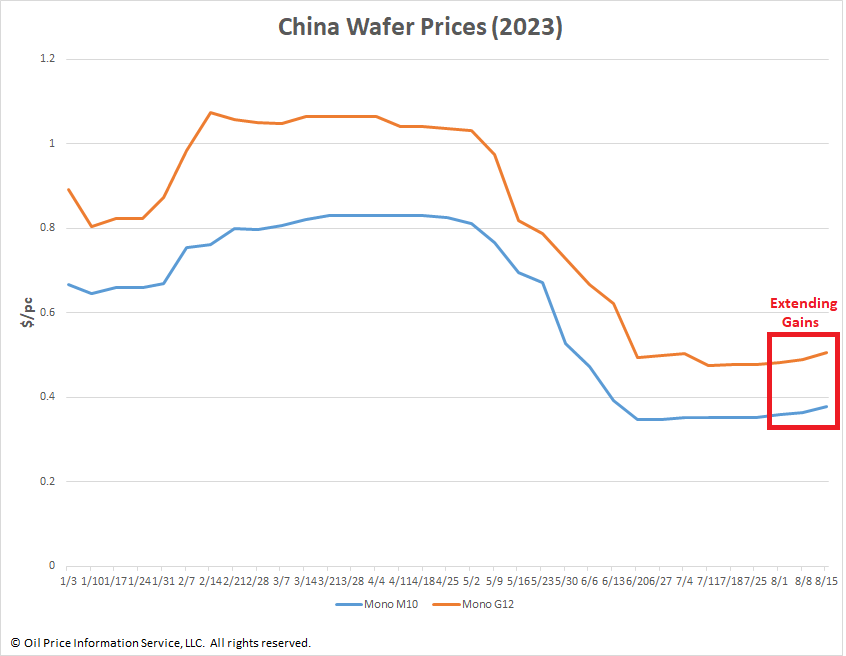

Wafer prices in China rose for a third consecutive week, buoyed by robust demand from cell makers downstream and increasing polysilicon prices upstream.

Mono M10 wafer prices climbed 3.57% to $0.377/pc and Mono G12 wafer prices rose 3.68% to $0.507/pc, OPIS assessed this week.

Leading wafer manufacturer TCL Zhonghuan raised its list prices for Mono M10 wafers to CNY3.15 ($0.43)/pc, a significant 6.78% increase on the company’s previous list prices two weeks prior. Following that, many tier-2 manufacturers raised wafer prices accordingly, prompting the market price for Mono M10 wafers to climb from CNY2.95/pc to over CNY3/pc, sources concurred.

High downstream demand has made wafer producers confident of raising prices, according to numerous sources. Cell businesses are currently procuring wafers in high volumes, making the current market tight, explained one source.

The third quarter is often a busy time for procurement and manufacturing as cell and module manufacturers increase production to prepare for China’s solar installation requirements in the second half of the year, another source added.

Upstream, China polysilicon prices rose for a sixth consecutive week to CNY71.9/kg. This 3.77% increase – comparable to the gain in wafers – takes prices past the psychologically significant figure of CNY70/kg. Polysilicon faces a “shortage of supply,” with overall market inventories estimated at 30,000-35,000 MT, one source said.

While wafer prices have been heading up, their prices could fall once the supplies required for solar installations are met, a source warned, adding demand would then decline and wafer stockpiles accumulate. “This may be seen in late October or November,” the source also said.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.