Adani New Industries Ltd (ANIL), an arm of Adani Enterprises Ltd, announced this week it has raised a trade finance facility of $394 million (INR 3,231 crore) from Barclays and Deutsche Bank AG. The amount raised will meet the working capital requirements of its integrated solar module manufacturing facility.

ANIL, strategically located at Mundra SEZ, the integrated Green H2 hub, is building one of the largest integrated green hydrogen ecosystems, spanning supply chain products manufacturing, green hydrogen generation, and downstream products (ammonia and urea).

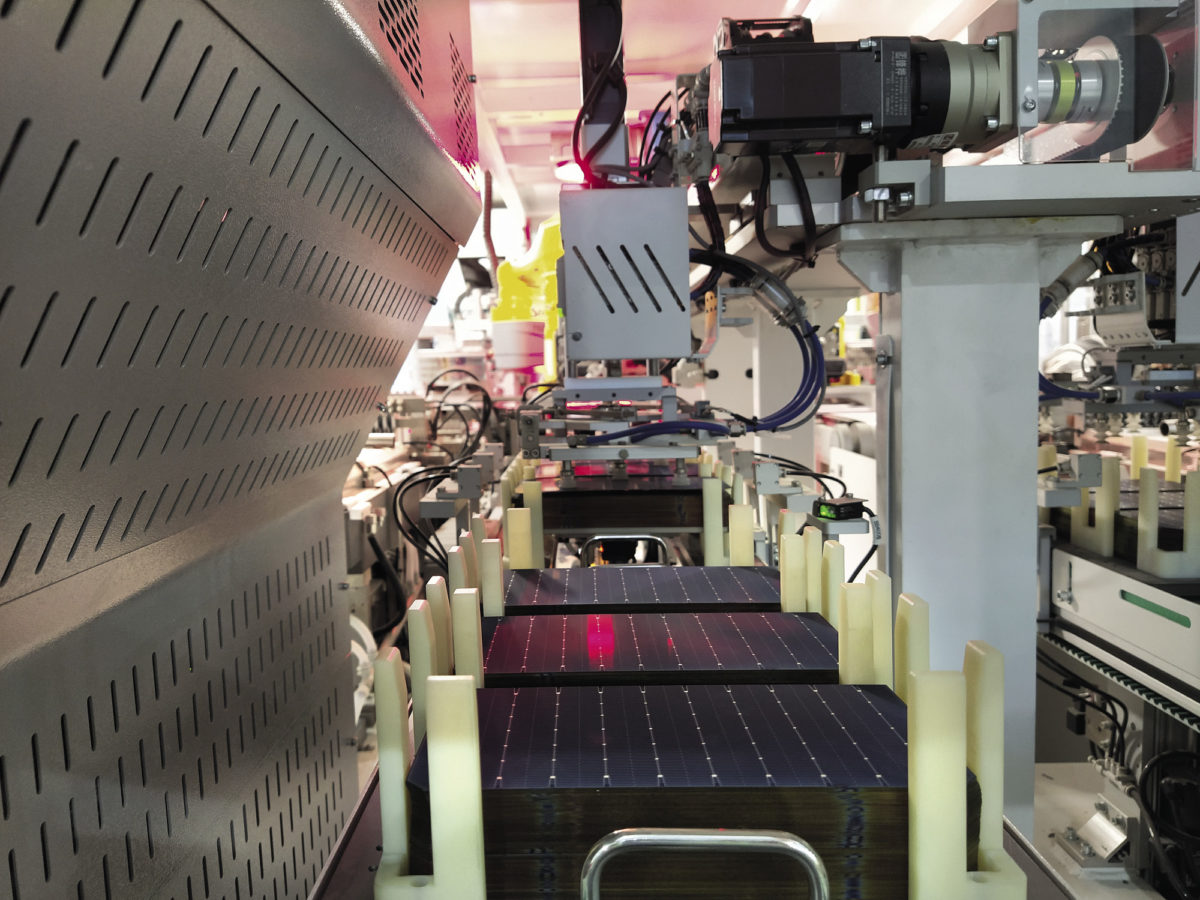

Aiming for end-to-end supply chain control, it will manufacture key components and materials for RE projects, including polysilicon, ingots, wafers, PV cells and modules, wind turbine generators, electrolyzers, and ancillary items.

In solar, ANIL plans full backward integration starting from silicon till modules. It targets MG silica capacity of 35 ktpa, polysilicon 30 ktpa, ingot/wafer 10 GW, cells 10 GW, and modules 10 GW by 2025.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.