India’s Ministry of New & Renewable Energy (MNRE) has announced that renewable energy (RE) capacity of 50 GW per annum will be bid out from FY2024 to FY2028. The capacity will comprise solar, wind, hybrid, and round-the-clock (RTC) power projects with at least 10 GW of wind projects.

The MNRE move is aimed to provide a pipeline to meet the 2030 target of 500 GW non-fossil fuel capacity.

Four RE implementing agencies (REIAs), namely, Solar Energy Corp. of India (SECI), NTPC, NHPC, and SJVN, have been notified to invite these bids.

In FY 2024, a capacity of at least 15 GW will be bid out in the first and second quarters each, followed by at least 10 GW in the third and fourth quarters each.

The timely implementation of the notified bidding trajectory by the REIAs remains important to achieve the RE capacity targets.

The bidding activity in the solar segment slowed down in FY2023 amid challenges like elevated module prices, the Approved List of Models and Manufacturers (ALMM) comprising only domestic solar PV module manufacturers, and basic customs duty (BCD) on imported modules.

While bidding activity has picked up since April 2023, the timely ramp-up in tendering by the REIAs remains important to improve the project pipeline. Further, the bidding agencies must lay greater focus on hybrid plus storage tenders to ensure better integration of RE sources with the grid.

On the other hand, PV module prices have witnessed a moderation over the past nine months, with the price of mono PERC modules reducing from the peak level of 27-28 cents/watt to about 23-24 cents/watt in December 2022 and further to 20 cents/watt in May-June 2023.

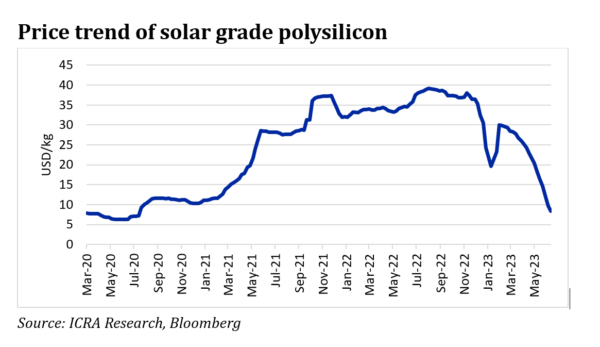

While the cell prices increased between January and March, they declined over the past three months to 10-11 cents/watt in June 2023 from 14 cents/watt in March 2023. This has been driven by improved supplies across the value chain and the decline in polysilicon prices.

Earlier, the prices were driven up by a sharp increase in the price of polysilicon, a key input for cell and module manufacturers, and disruption in operations across the value chain of solar PV module manufacturing in China.

The increase in cell and module prices between January 2021 and September 2022 impacted the viability of solar power projects. This, in turn, led to execution delays, with developers deferring projects in the hope of a reduction in module prices.

In this context, the MNRE provision for timeline extension to solar and hybrid power projects till March 31, 2024, and the moderation in cell and module prices, if sustained, would bring relief to the developers and improve the viability of the projects bid out over the past 12-18 months.

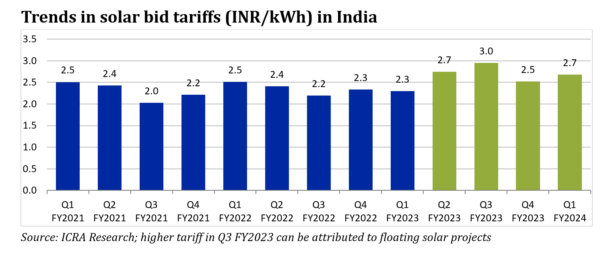

The solar bid tariffs had earlier been on a declining trend, led by reduced module costs and improved module efficiencies, and reached an all-time low of INR 1.99 ($0.024)/kWh in December 2020.

However, the bid tariffs increased thereafter to INR 2.2-2.5/kWh and further to INR 2.5-2.7/kWh following the elevated cell and module prices, imposition of basic customs duty on imported cells/modules, increase in the goods and services tax (GST) rate, and the rising interest costs.

Nonetheless, solar power tariffs continue to be highly competitive at below INR 3/kWh and lower than the marginal variable cost of generation for thermal utilities in the bottom 25% of the merit order dispatch of the discoms across key states.

Apart from the capital cost pressure, the developers face challenges like delays in land acquisition and transmission connectivity, which is leading to delays in project implementation and thus impacting the capacity addition.

The moderation in solar PV cell and module prices, along with the extension in the timeline and ALMM relaxation valid till March 31, 2024, is expected to improve the RE capacity addition in FY2024 to over 20 GW from 15 GW in FY 2023, largely driven by the solar power segment.

Apart from solar, the wind segment is also expected to see an uptick in capacity addition with the commissioning of projects awarded by the SECI under Tranche VIII, IX, and X, along with the wind component of the hybrid/RTC projects. However, this would remain lower than over 40 GW required to achieve the 500 GW non-fossil capacity target by 2030.

In this context, a timely ramp-up of tendering activity, easing of challenges associated with land and transmission connectivity, and availability of adequate financing avenues remain important.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.