From pv magazine Global

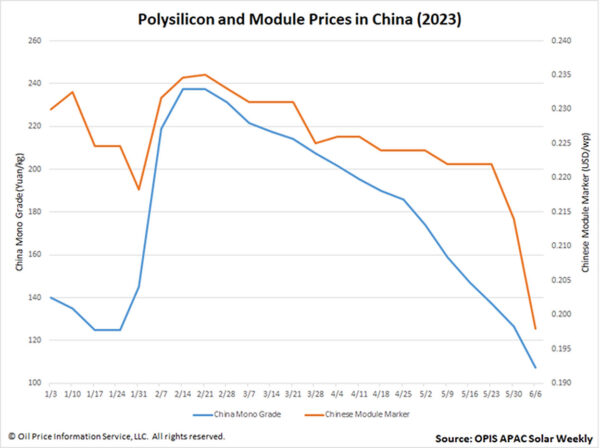

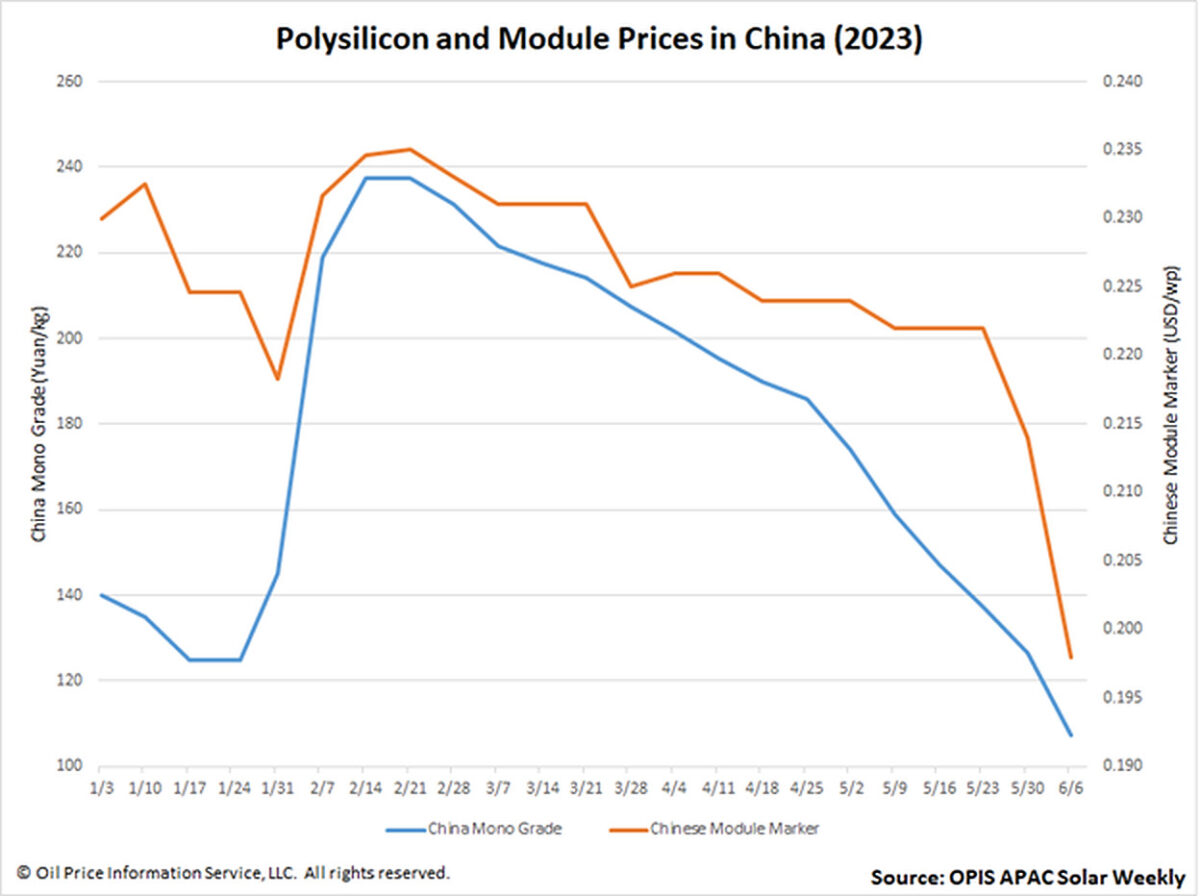

The Chinese Module Marker (CMM), OPIS’ benchmark assessment for modules from China, declined for a second week running to $0.198 per W as dramatic downslides in the country’s upstream segments pushed module prices to their lowest level in almost three years, according to OPIS data.

This 7.48% plummet – the largest percentage drop so far this year – takes CMM below the psychologically significant level of $0.2/W.

Multiple market players pinned the slump on growing polysilicon capacity in China and how China-made polysilicon is essentially back at what one source calls a “reasonable price.” The latter, which OPIS assesses as China Mono Grade, continued its inexorable march downwards to 107.5 CNY ($15.10)/kg.

China module prices are dropping rapidly, with opening bids for some recent domestic projects all lower than CNY1.5/W, noted multiple sources. Downstream demand is huge, with 48.31 GW installed in the first four months of this year. Yet module shipments are still lower than expected as prospective buyers, expecting further price drops, delay their purchases, sources also concurred. Buyers will wait as long as their project allows them to do so, explained one veteran market observer, adding that he did not expect falling module prices to level off.

OPIS expects significant price volatility ahead as buyers and sellers alike adopt a wait-and-see approach to the China module market’s direction. Pent-up demand from what one source calls “all-time high” procurement, with China’s National Energy Administration approving a third batch of Gigawatt-base power projects, means falling prices could find a floor.

According to the China Photovoltaic Industry Association, the country is set to install up to 120 GW of solar power in 2023. But manufacturers should have big module inventories accumulating, noted another source, which if unleashed on the market may suggest more downslides on the horizon.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Is this “Price Collapse” REAL or just ANOTHER SOLAR WAR PERPETRATED BY CHINA TO SHUTDOWN THE COMPETITION.. ???

These INVERIFIED Reprts on China are Useless.. Worthless and need to be treated as such, as they are based on ANYTHING THAT THE COMMUNIST PARTY OF CHINA WANTS TO PROMOTE & PROPAGATE.. AS PART OF ITS OFFICIAL AGENDA .. TO CONQUER THE WORLD AND ENSLAVE MANKINDS 8 BILLION PEOPLE (including and like those in China too..) ..!!!. BEWARE OF THE DRAGON..!!!