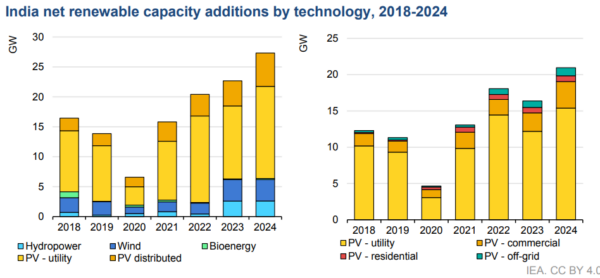

A new report by The International Energy Agency (IEA) states India’s annual utility-scale solar addition in 2023 will see an almost 20% slowdown due to supply chain challenges, lower auction volumes, and trade policies.

The report stated India’s annual utility-scale solar capacity addition (made up mainly of capacity awarded in auctions) reached a record-breaking 14 GW in 2022. On the other hand, auction volumes in 2022 dropped by one-third, with only 10 GW AC awarded—the lowest capacity since 2017.

Source: IEA

Tariffs discovered in 2022 auctions were 15% higher than in 2021, discouraging distribution companies (DISCOMs) in poor financial health from signing contracts. In addition, some states that had fulfilled their Renewable Purchase Obligations avoided further auctions, and government agencies put more emphasis on hybrid tenders.

IEA expects the lower awarded capacity in 2022 to translate into a slowdown in PV capacity addition in 2023.

Short-term supply-demand mismatches and higher prices, triggered by import tariffs, will further affect PV expansion in 2023 and 2024, IEA added.

Developers prefer high-output top-tier modules for their cost efficiency and to more easily secure low-cost financing. IEA stated the demand for high-capacity modules from large-scale top-tier manufacturers exceeds supply in the short term: “Although the list of government-approved manufacturers (ALMM) in February 2023 implied total manufacturing capacity of 22 GW, only less than 5 GW were declared by large producers offering modules with over 500 W of power.”

Along with supply-demand mismatches, introducing higher import tariffs on PV modules and cells in April 2022 led to a 30-40% increase in module prices in the second half of 2022. This reduced project bankability, forcing developers to cancel or delay projects while waiting for PV prices to fall. In response, the government postponed ALMM requirements for all projects commissioned by April 2024 and extended the commissioning deadlines.

IEA stated while government actions have mitigated some challenges, the temporary supply-demand mismatch for top-tier PV modules will prevent rapid utility-scale PV expansion in 2023 and 2024. It, however, expects PV deployment in India to boom beyond 2025, with higher auction volumes and lower prices.

The report expects India to become fully self-sufficient in solar PV supply in the next four to five years as the manufacturing capacity awarded in the two rounds of the PLI subsidy scheme comes online.

Overall, it expects India’s renewable capacity additions to increase again in 2023 and 2024, owing to faster onshore wind, hydropower and distributed solar PV deployment.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.