From pv magazine USA

The global shift to clean energy is happening rapidly, with decarbonization efforts no longer a future prospect, but a reality of today.

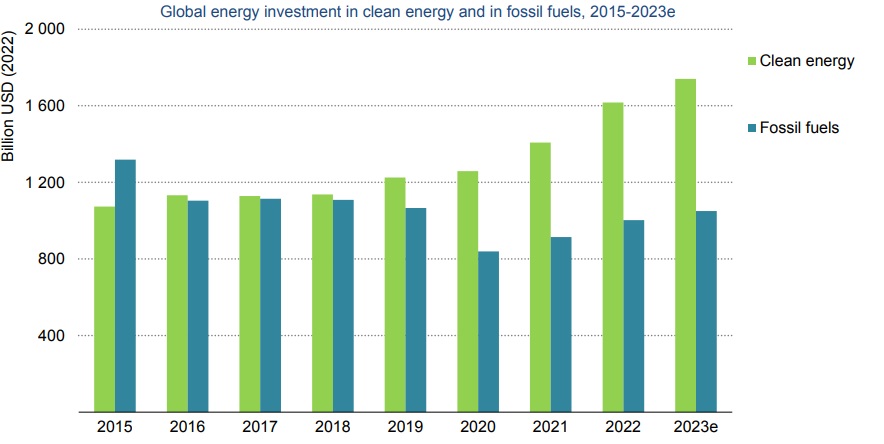

The annual World Energy Investment report from the International Energy Agency (IEA) shows that for every dollar invested in fossil fuels, $1.70 is invested in clean energy technologies. This marks a fast divergence from five years ago, when fossil fuels and clean energy investments were essentially even.

The torch is now being carried by solar, which is soon to overtake oil production said IEA. Almost 90% of new power generation investments are now tied to solar and other low-carbon technologies, said the report.

About $2.8 trillion is set to be invested in energy globally in 2023, $1.7 trillion of which will go to clean technologies, with PV leading the way as the largest contributor of energy generation. The remaining roughly $1 trillion is expected to be invested in fossil fuels. Annual clean energy investment is expected to rise by 24% between 2021 and 2023, driven by renewables and electric vehicles, compared with a 15% rise in fossil fuel investment over the same period.

Nearly $700 billion of investment is expected for renewable energy generation. Solar is the star performer with more than $1 billion per day is expected to go into solar investments in 2023. IEA expects solar investment to total $380 billion for the year as a whole, edging this spending above upstream oil for the first time.

Along with wholesale move toward clean generation is a global shift toward electrification. Global heat pump sales are growing at double-digit annual growth rates since 2021, and electric vehicles are expected to leap one-third this year after already undergoing a landmark year of growth in 2021.

China is expected to continue as the global frontrunner in clean energy investment, with increased spending of over $170 billion. The nation is followed by the European Union, with about $150 billion in increased investment, and the United States, adding about $100 billion in increased investment. Costs for clean energy edged higher in 2022, but pressures are easing in 2023, and mature clean technologies remain very cost-competitive in today’s fuel-price environment, said IEA.

China alone added over 100 GW of solar PV capacity in 2022, almost 70% higher than in 2021, and annual installations increased by 40% or more in Europe, India and Brazil, despite inflation and supply chain issues.

“While solar deployment has been increasing year-on-year, the project pipeline for some other technologies has been less reliable,” said the report. “Investment in wind power has varied year-on-year in key markets in response to changing policy circumstances. Nuclear investment is rising but hydropower, a key low-emission source of power market flexibility, has been on a downward trend.”

This investment is gaining momentum due to a powerful alignment of costs, climate, and energy security goals and industrial strategies. The recovery from the slump caused by the Covid-19 pandemic and the response to the global energy crisis have provided a significant boost to clean energy investment, said IEA.

While clean technology investments are rising worldwide, work needs to be done, especially in developing economies, said IEA. Many nations are being held back by higher interest rates, unclear policy frameworks and market designs, weak grid infrastructure, financially strained utilities, and a high cost of capital. However, IEA notes that dynamic investments in solar in India, Brazil, and the Middle East are driving forward these markets.

To help address some of the above-listed headwinds, the IEA release a new report entitled Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies on June 22.

Fossil fuel producers made record profits in 2022, though much of this cash flow has gone to dividends, share buybacks, and debt repayment, rather than reinvestment back into traditional supply. IEA said that while a shift to renewables is underway, fossil fuels are expected to continue to drive growth – with oil and gas spending expected to rise 7% this year. Coal demand still remains high in some markets, and the shift from these assets may not be occurring fast enough, as coal investment is pacing to be six times above what IEA envisions for its 2030 Net Zero Scenario.

IEA notes that clean energy among major oil and gas producers is continuing to rise, with solar and wind holding a similar share. Clean energy investment by these fossil fuels companies doubled in 2022 to about $20 billion. This investment represents about 4% of upstream capital and 0.5% of net income. European oil majors are outpacing U.S. oil majors considerably in this category, said IEA.

In the United States, demand to adopt solar is strong. In its 2023 Solar Snapshot report, Aurora Solar reported that 45% of solar professionals reported increased demand as a result of the Inflation Reduction Act, with another 40% expecting to see increased demand soon, and 70% noted their business grew in size. Nearly 77% of homeowners either have solar or are interested in purchasing it, said Aurora Solar.

In its 2021 World Energy Outlook report, IEA noted that the world is not investing enough to meet its future energy needs. This year, it said, “this picture is starting to change: global energy investment is picking up, and the rise in clean energy investment since 2021 is leading the way, outpacing the increase in fossil fuel investment by almost three to-one.”

“If [clean energy investment] continues to grow at the rate seen since 2021, then aggregate spending in 2030 on low-emission power, grids and storage, and end-use electrification would exceed the levels required to meet the world’s announced climate pledges. For some technologies, notably solar, [investment] would match the investment required to get on track for a 1.5°C stabilization in global average temperatures,” said IEA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.