From pv magazine Global

The global FPV fleet is expected to grow at a steady rate as land scarcity and increasing land cost for ground-mounted PV projects continues to drive demand. By 2031, the annual FPV capacity additions are expected to top the 6 GW threshold, according to research firm Wood Mackenzie.

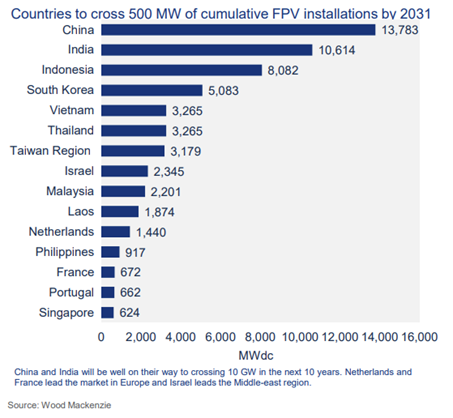

Fifteen countries are forecasted to exceed 500 MW of cumulative FPV installations by 2031. China, India, and Indonesia, which made up almost 70% of the total FPV demand in 2022, are forecast to stay in the lead.

WoodMac expects FPV to have a steady market share compared to overall global solar demand, with the compounded annual growth rate (CAGR) for FPV expected to rise 15% in the 2022-31 period.

“Despite development costs of FPVs ranging between 20-50% higher than comparable ground-mount projects, increased competitiveness in the developer and EPC landscape is helping to drive down costs in the sector,” Ting Yu, a consultant at Wood Mackenzie, said at the SNEC PV Power Expo in Shanghai this week.

The Asia-Pacific market will continue to lead demand. The region had approximately 3 GW of floating solar projects in 2022, capturing over 90% of the global FPV market. In China, cumulative FPV capacity is projected to cross 13 GW by 2031 at a 12% CAGR over the next 10 years.

“China will continue to lead in floating solar installations. The country has been able to utilize flooded coal mines that have been decommissioned to develop floating solar,” said Yu.

With almost 150 MW, Europe is the second largest region for FPV demand. The Netherlands, representing 32% of Europe’s FPV market in 2022, is the top developer of FPV projects in Europe, followed by France.

The Netherlands is home to the largest FPV project outside the Asia-Pacific region – the 41.4 MW Sellingen floating solar park, which came online in 2021. However, WoodMac predicts slow growth for the Dutch market after 2025 “as the main spots would have already been developed by this point.”

For the US, floating solar CAGR is estimated at roughly 13% by 2031, where development is being driven in regions with high demand for solar but expensive land costs, including California, Florida, and New Jersey.

“Overall, the floating solar industry has seen high costs across all market segments, due to component costs and other soft cost increases, as a result of supply chain constraints in 2022,” Yu said.

For instance, the rise in price for high-density polyethylene (HDPE) was the main driver of high structural balance of system (SBOS) costs for FPV. However, WoodMac expects the cost to fall as the supply chain expands.

According to S&P Global, 3.4 GW of floating PV capacity was installed across the world by the end of 2021. The market intelligence firm predicts that global floating PV demand will reach up to 14 GW by 2026. About 92% of those installations will likely be built in the Asia-Pacific region, driven by favorable policies and installation targets, says S&P Global.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.