From pv magazine Global

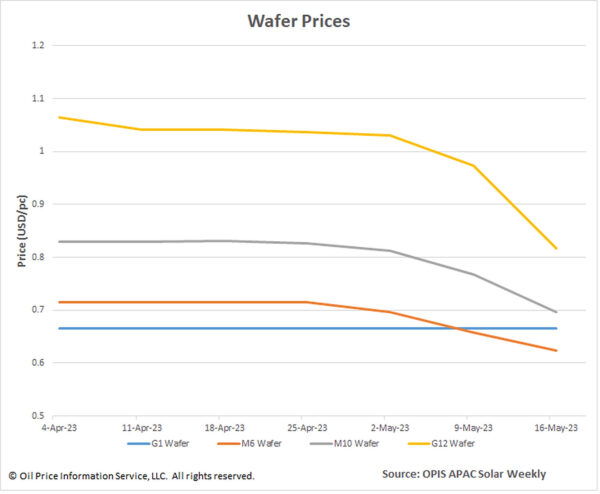

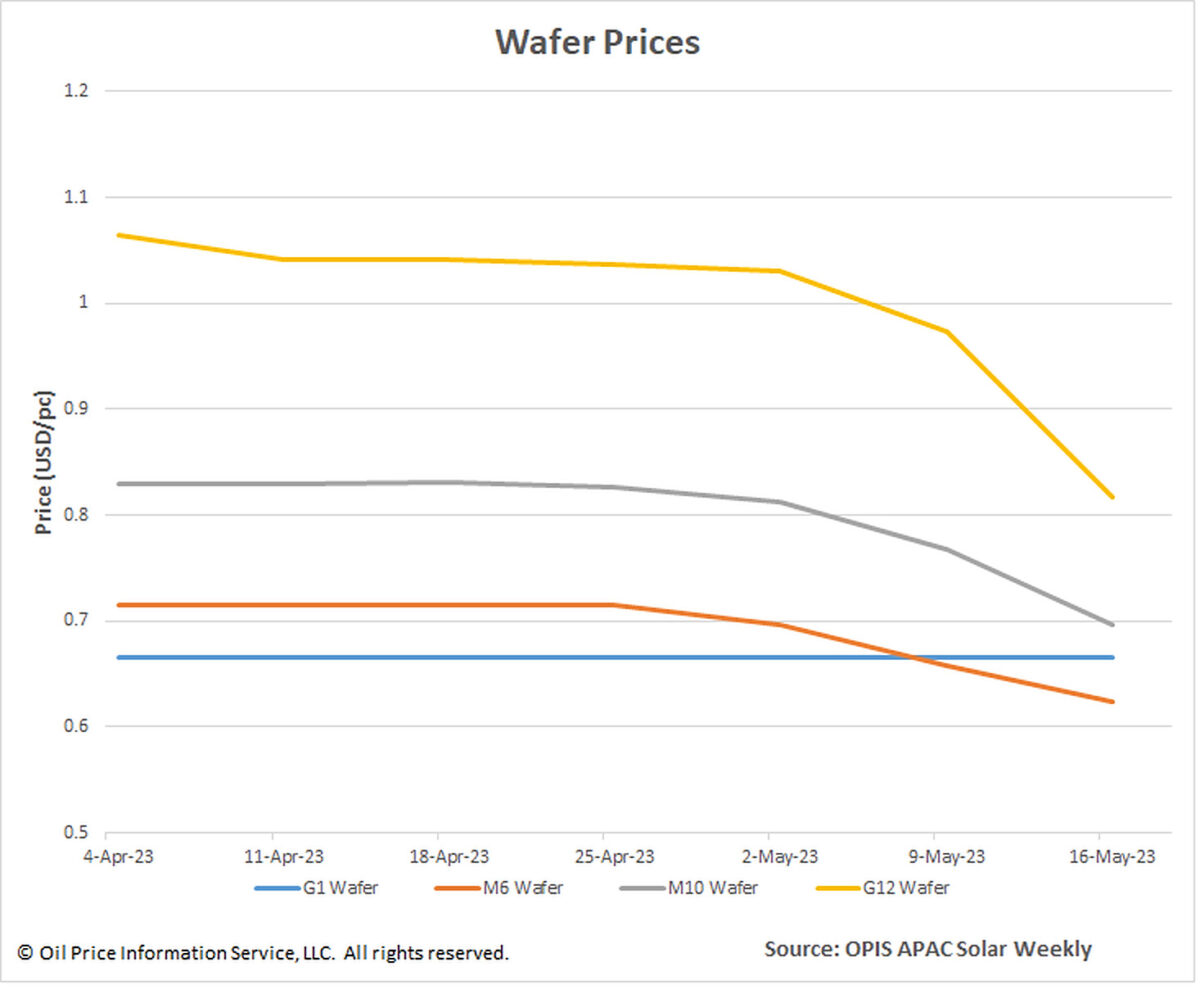

In its latest price assessment on May 16, OPIS saw wafer prices decline for another week as leading wafer maker TCL Zhonghuan slashed its prices for a second time in as many weeks. Prices for Mono M10 and G12 wafers, the mainstream sizes, plunged this week, with M10 wafers falling 9.26% to $0.696 per piece (pc) and G12 wafers diving an even more pronounced 16.02% to $0.818/pc.

Not immune to this weakness, the less-traded M6 wafers also dropped 5.17% to $0.624/pc. Mono G1 wafer prices remain unchanged at $0.666/pc while its trading remains restrained in the face of declining market share.

Chatter about the motivation behind and consequences of Zhonghuan’s latest move – a momentous price cut of approximately 15% across wafer types – dominated this week’s market survey. In the perspective of multiple sources, Zhonghuan is trying to increase its market share by undercutting its main rival, LONGi. By dropping G12 prices more heavily than M10 prices, Zhonghuan appears to be paving the way to for G12 wafers to expand its share in the overall wafer market, a source added.

Although other smaller wafer makers were surprised by the speed at which the market leader had slashed prices, it is “reasonable” according to a market participant who believes the price cuts are equivalent to the cumulative trickle-down effect of domestic China polysilicon’s price declines in the preceding months.

Given the persistent softening of polysilicon prices as production output of the raw material grows, OPIS expects wafer prices to slip further in the near term and pave the way for declining prices downstream.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.