From pv magazine Global

This week sees the publication of the annual ITRPV report, compiled by German engineering association VDMA. Now in its 14th edition, the report takes an in-depth at technology trends across the supply chain for silicon PV products. VDMA calculates PV module shipments in 2022 at 295 GW, with 258 GW installed and the remainder still in transit or warehoused.

The ITRPV finds that, at the end of 2022, the weighted average spot price for silicon PV modules fell by 7% compared to the previous year, reaching $0.228/W. The report also notes a growing market share for n-type technologies, and that the price premium for these is now marginal – just two tenths of a cent above the average at $0.230/W.

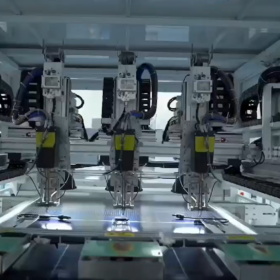

In terms of manufacturing capacity, VDMA finds that around 600 GW was online at the end of last year, with crystalline silicon technologies representing 95% of the market. New factories coming online today usually have at least 2 GW of capacity, and this is expected to increase to 5 GW in the longer term.

Technology trends

Large wafer formats (182mm and 210mm) now represent more than 60% of the market, with formats 166mm and smaller expected to disappear from the market entirely by 2027. VDMA also expects formats larger than 210mm to appear after 2025, representing only a small market share over the next decade. The split between these two large formats is still not clear, but all new production lines will be able to process both.

Monocrystalline silicon now accounts for 97% of production, and the report expects older multicrystalline technologies to disappear entirely in the near future. Gallium doping has also now become mainstream, with the boron doping it replaces also expected to disappear by the end of this year.

PERC (passivated emitter rear contact) remains the leading cell technology for now, amounting to around 70% of the market, but VDMA notes that its replacement with TOPCon (tunnel oxide passivated contact) is now well underway. TOPCon is expected to reach a market share of 60%, heterojunction of 19% and back contact technologies of 5% in 2033, according to the report.

Silver

VDMA’s research found that efforts to reduce silver consumption have proceeded faster than predicted in the 2022 ITRPV, and have now reached an average of 10mg/W. This should fall to 6.5mg over the next decade, despite the growth of n-type technologies that require more silver than PERC. “TOPCon in mass production by Tier 1 manufacturers in China is reported to be, end of 2022, on lower consumption levels 2 to 5 years ahead of our prediction,” states VDMA.

The ITRPV remains conservative about replacing silver entirely, however. It expects copper plating to be introduced in mass production during the next decade, but says this will represent only 7.5% of the market in 2033. “Technical issues related to reliability and adhesion must be resolved before alternative metallization techniques can be introduced,” VDMA states. “Appropriate equipment and processes also need to be made ready for mass production. Silver is expected to remain the most widely used front metallization material for crystalline silicon cells in the years to come.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Reaching a manufacturing capacity of 600 GW in 2022 is a significant milestone for the photovoltaic (PV) industry. It demonstrates the remarkable progress and growing demand for solar energy worldwide. This increased capacity signifies the increasing affordability and accessibility of solar power, paving the way for greater adoption and a more sustainable future. It is an encouraging sign that the global community is taking significant strides toward achieving renewable energy targets and combating climate change.