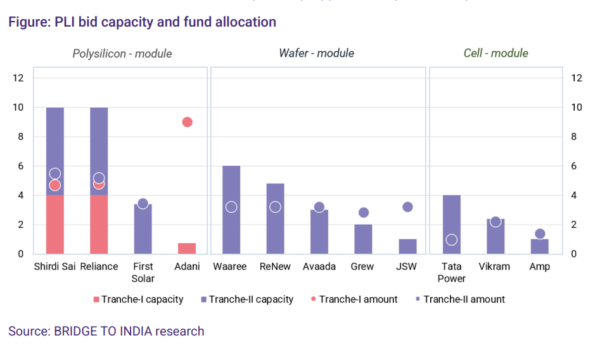

SECI has announced winners of tranche-II of the solar manufacturing Production-Linked Incentive (PLI) scheme. 11 companies have been awarded total PLI of INR 139 billion (USD 1.7 billion) to set up combined manufacturing capacity of 39.6 GW. Reliance and Shirdi Sai have each been awarded PLI for another 6 GW fully integrated capacity taking their total awarded capacity to 10 GW each, maximum permissible under the scheme. First Solar is the only other winner in the fully integrated category with a capacity of 3.4 GW. There are five winners including Waaree, ReNew, Avaada, Grew and JSW in the wafer-module category with a combined capacity of 16.8 GW; and three winners including Tata Power, Vikram and Amp in the cell-module category with a combined capacity of 7.4 GW.

Average PLI amount per GW of awarded capacity for the three categories works out to INR 5 billion, INR 3 billion and INR 2 billion respectively, approximately 25% of capital cost.

In total, PLI will be available for 48 GW manufacturing capacity. The second tranche was 4.3x bigger than the first tranche and yet the total response was 32% lesser in comparison. Overall, it was undersubscribed to the extent of 28% but the biggest shortfall of 37% was seen in the fully integrated category. Many bidders from the first round chose not to participate, most prominently Adani. Having earlier set ambitious plans, the group chose to sat out this round focusing instead on capital discipline in the aftermath of Hindenburg allegations.

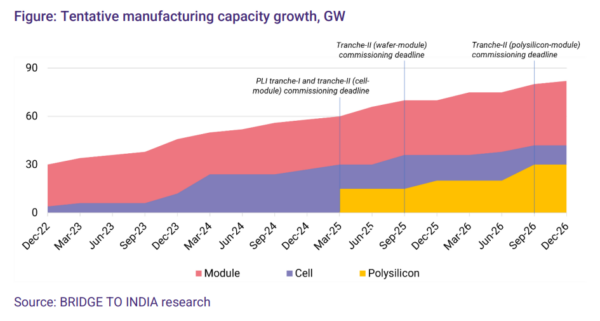

The muted response is mainly down to the overly generous US Inflation Reduction Act (IRA) and massive overcapacity in China. Both countries are seeing a spate of investments leading to concerns about competitiveness of India-made modules in the international market. China’s polysilicon capacity is expected to double this year to an equivalent of about 800 GW of modules, while its total cell and module capacity is expected to jump to a whopping 1,000 GW, as against estimated global demand of about 300 GW. Meanwhile, the US module production capacity is also expected to grow multi-fold to about 70 GW by 2026.

It is worth noting that almost 50% of the PLI bid capacity has come from project developers (Reliance, Tata Power, ReNew, JSW, Avaada and Amp), who, alarmed by market disruption over last two years and stiff import barriers, are seeking mainly to meet their captive demand.

Commenting on the scheme, Vinay Rustagi, Managing Director, BRIDGE TO INDIA said: “The bid result shows immense competitive disadvantage facing domestic manufacturers. Despite strong trade barriers and offering a plethora of incentives, we expect domestic polysilicon and cell capacity to reach only 30 GW and 42 GW respectively by December 2026, barely enough to meet domestic demand. Unfortunately, market uncertainty seems set to continue for both manufacturers and project developers.”

BRIDGE TO INDIA is a renewables-focused consulting and research services company. Its clients include project developers, investors and financiers, policy makers, equipment manufacturers, contractors as well as power consumers.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.