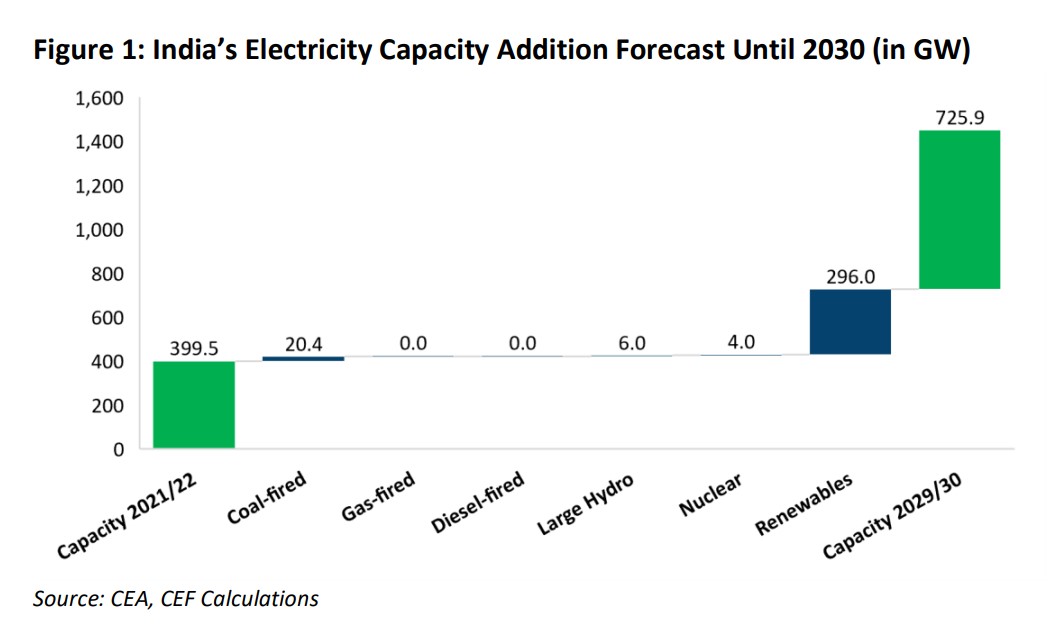

India’s renewable energy installations will surge rapidly with 35-40 GW added annually through to the fiscal year (FY) 2029-30, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and Climate Energy Finance (CEF).

With this, India will reach a renewable energy capacity of 405 GW in FY 2029-30–on track to surpass its target of 50% of its energy from non-fossil fuel sources by 2030.

Thermal power, on the other hand, is set to progressively lose market share, with the expanding use of domestically produced thermal energy in response to recent global events likely to be a “short-term hiccup”, the report says.

“India has been one of the champions globally in adopting renewable energy as part of its energy transition. While recent headwinds faced by the renewable energy sector and rapidly rising power demand has forced the government to re-look at thermal power as a short-term fix, the government’s clean energy capacity addition targets, as well as commitments by various corporations, remain ambitious,” says the report’s co-author Vibhuti Garg, director, South Asia, IEEFA.

In the utility-scale segment, the top 16 players are expected to deploy a cumulative RE capacity of 231 GW in the eight years ending in 2030. The estimation is based on these players’ current capacities and commitments. Leading the list is state-owned NTPC, which targets 60 GW of cumulative RE capacity by 2030 from the current 5.7 GW. Adani Green Energy targets 45 GW and Tata Power, ReNew Power, and Acme Solar 25 GW each.

“The Indian government seems unbending in ensuring the renewable energy targets are met through facilitating growth across the sector’s spectrum. Financially strong investors, such as the Indian government, domestic conglomerates, and some of the biggest global investors, back most industry players, lending them the firepower needed to fulfil their capacity addition targets,” says Garg.

Beyond utility-scale capacity additions, rooftop solar, solar pumps, and renewable energy capacity addition by non-power public sector companies will supplement power generation from non-fossil fuel sources.

“On the decentralized renewable energy side, several segments have the potential to grow multifold as policy-side reforms streamline current bottlenecks and demand-side drivers provide lucrative returns,” says co-author Shantanu Shrivastava, energy finance analyst, IEEFA.

“On the demand side, green hydrogen is a major force that promises to massively drive India’s clean energy ambitions. Corporates, such as the Adani Group and Reliance Industries, have wholeheartedly supported the country’s green hydrogen policy, announced in June 2022, and its 5 million tonnes per annum (MTPA) target, with several major commitments.”

The report finds that India’s green hydrogen target of 5 MTPA by 2030 will require an additional renewable energy capacity of 118 GW.

To put the ambitions of Indian corporates into context, the report also undertakes a study of similar clean energy commitments by four global majors – NextEra Energy (U.S.), RWE (Germany), Ørsted (Denmark), and Enel (Italy).

“Understanding the clean energy commitments of domestic players compared with global counterparts also provides perspective on where India’s renewable energy plans stand relative to international developments and what Indian utility players can leverage from the experience of global leaders,” says co-author Tim Buckley, Director, CEF.

“We find that the ambitious decarbonization targets of the four global companies, which do not rely on carbon offsets or carbon capture and storage, have helped their share prices outperform broader equity markets. It has also helped the companies tap a rapidly growing global green bond market.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.