Ratings agency ICRA has assigned a stable outlook for the Indian renewable energy (RE) sector because of the continued policy support from the government of India, strong project pipeline, and superior tariff competitiveness offered by wind and solar power projects, both in the utility and the open-access segments. Tariffs in utility-scale solar and wind project auctions remained below INR 3.0/kWh (US$ 0.040/kWh) despite the upcoming customs duty on imported cells and modules from April 2022.

Commenting further, Girishkumar Kadam, senior vice president & co-group head, ICRA Ratings, said, “The investment prospects in the RE sector thus are expected to remain strong, given the policy impetus with a target to reach 450 GW by FY2030 and competitive tariffs. The capacity addition in the power sector over the medium term will be driven by the RE segment, led by a strong project pipeline of close to 40 GW as on date.”

“The key challenges constraining the growth remain on execution front, mainly associated with land and transmission infrastructure as well as the slow but improving progress in signing of power purchase agreements and power sale agreements by intermediate procurers with state distribution utilities (discoms). An improving financing environment along with the softening in the interest rate for the RE projects over the last 12-18 months period has been a positive for the sector.”

Apart from execution-related challenges, RE developers face delays in payments from the state distribution utilities and grid curtailments in some states, especially for the relatively higher tariff projects.

Vikram V, vice president and sector head-corporate ratings, ICRA, feels a recent order by the Appellate Tribunal for Electricity (APTEL) favoring developers in Tamil Nadu will act as a deterrent against grid curtailment by discoms and grid operators.

In its order, APTEL stated that the actions of the state utility of Tamil Nadu were ‘mala fide’ in issuing backdown instructions for commercial reasons and ordered compensation to the solar power producers at 75% of the PPA tariff. Further, the APTEL directed all state discoms, state electricity regulators, and grid operators that any curtailment of RE plants (for reasons other than grid security) be compensated at PPA tariff.

Further, “while the operating projects continue to face delays in payments from the state discoms in some of the key states, the presence of strong intermediate procurers like SECI and NTPC is supporting the addition of new capacities led by the presence of strong payment security mechanism in the form of a letter of credit, payment security fund and tri-partite agreement with Central government, state government and RBI.”

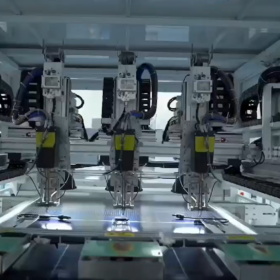

Domestic solar manufacturers

The demand outlook for the domestic solar manufacturers remains favorable, with the strong policy support through BCD imposition on imported cells and modules, the notification of the production-linked incentive (PLI) scheme, and a strong project pipeline from various schemes requiring the use of domestic modules. Also, the non-inclusion of the overseas suppliers in the Approved List of Models and Manufacturers (ALMM) so far is likely to support the demand for domestic module manufacturers in the near term.

The policy push is expected to improve the cost competitiveness of domestic manufacturers. It has led to new capacity announcements of more than 15 GW by various OEMs and the entry of new players. The timely commissioning of these new capacities remains important to meet the growing demand from the developers, given the current capacity constraints. Moreover, the ability of the OEMs to achieve backward integration and build economies of scale would be important to remain competitive against the overseas suppliers on a sustained basis, according to ICRA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.