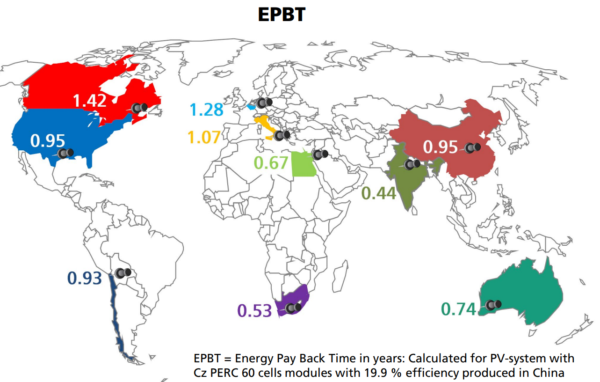

The latest version of the Photovoltaics Report produced by German research body the Fraunhofer Institute of Solar Energy Systems (ISE) shows the energy payback time of PV systems varies greatly depending on the geographical location.

The report authors considered the rooftop PV installation in different geographies used a typical, Chinese-made, 60-cell, mono-crystalline PERC, 19.9%-efficient solar module.

As per the report, such a PV system, mounted in India, would take only 0.44 year (160.6 days) to generate the amount of energy consumed during its production process, with the figure rising all the way to 1.42 years – 518.3 days – in Canada.

The energy payback time is the period required by the PV system to produce the same amount of electricity (converted into equivalent primary energy) as produced by the grid for its manufacture.

The researchers considered energy needed during different stages like poly-Si, ingot wafering, cells, modules, balance-of-systems, and transport to arrive at the total energy consumption in a PV system production.

In the examples cited by the report’s authors, the balance-of-system, non-generating components of the PV system required the most time to displace their energy footprint, accounting for about 0.46 year (167.9 days) of 1.28-year (467.2-day) energy payback period of a PV installation in Europe.

The report also provides the state of European photovoltaic manufacturing along the value chain for materials, solar cells and PV modules at the end of 2020.

The continent had 22.1 GWp of solar-grade polysilicon production capacity at that point, according to an executive summary of the latest update of the document, published yesterday. According to the report, Europe’s polysilicon capacity was held by Norwegian-based, Chinese state-controlled manufacturer Elkem, and by German businesses Wacker and Silicon Products.

By contrast, Europe had just 1.25 GW of solar wafer production capacity at the end of 2020, according to the Fraunhofer ISE report, based in Norway, at Norsun and REC Silicon-owned Norwegian Crystals; and in France, at energy company EDF‘s Photowatt operation.

The lack of European cell manufacturing capacity was even more glaring, with the study estimating just 650 MW of facilities, held by Finnish business Valoe, at its fab in Lithuania; by Italian energy business Enel in its homeland; and by Ecosolifer, in Hungary.

The market had 6.75 GW of solar module production capacity at the end of the year, however, spread across 29 companies identified by the research institute. That marked 3% of the world’s silicon solar module market last year, stated the report’s authors, with China contributing 67% as part of the 95% accounted for by the wider Asian region, and producers in the U.S. and Canada claiming 2%.

Despite the dramatic shift in module production from Europe to Asia witnessed from 2010 onwards, Germany accounted for 7.6% of all the solar capacity installed worldwide by the end of last year, with Europe as a whole hosting 23%, China 36%, North America 12%, Japan 9%, India 6% and the rest of the world 14%, including off-grid capacity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.