From pv magazine 05/2021

The reasons behind the move to larger cells and modules appears obvious: larger cells allow manufacturers to achieve higher throughputs, although fewer pieces, on their lines. On the module front, the higher power output reduces material costs on a per-watt basis. And for project developers, as module suppliers have been clamoring to demonstrate, it shows how longer strings can deliver significant balance of system (BOS) savings at the system level.

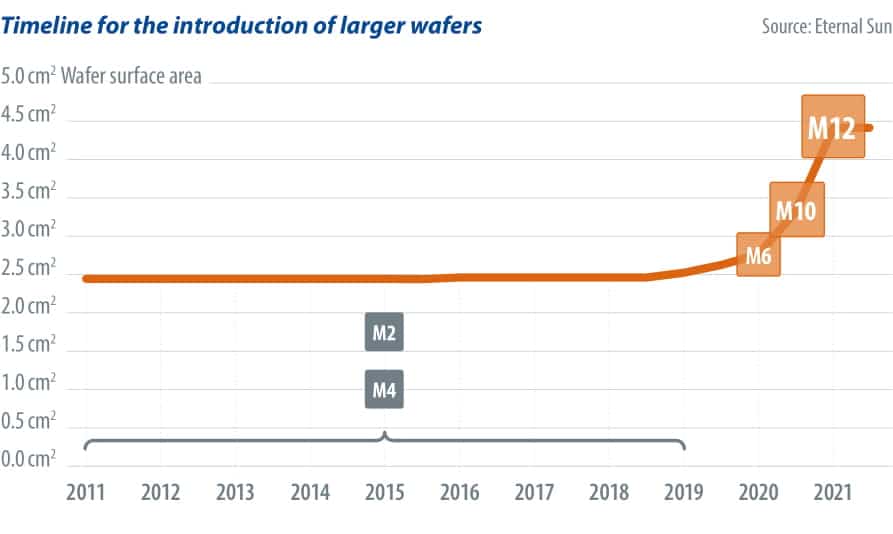

Combined, cost savings and increased productivity result in a reduced LCOE, but the introduction of larger cell and module formats hasn’t come without pain. The entire supply chain has had to absorb the fast-paced upsizing and vastly increased power outputs. This includes production equipment and material suppliers, BOS players, including mounting structures and power electronics, and logistics providers and installation contractors.

Why now?

Beyond the advantages set out above, there may also be a strategic dimension to the trend to larger formats. The cell and module incumbents that have led the charge have wrong footed rivals, argues Alex Barrows, the newly minted director of analysis at U.K.-based consultancy Exawatt.

“It [the move to larger formats] makes sense because it costs the manufacturers less and they can sell it for more, because it delivers BOS savings,” says Barrows. “Some of the big players have liked that it bullies anyone who doesn’t have money to expand and buy new lines – and it’s a way to kill off lower-tier manufacturers, who can’t afford to buy new lines. ‘Do we upgrade?’ Can be an existential question.”

The shifter to bigger formats is also a logical step, Barrows notes, as “next generation” high efficiency technologies do not appear “ready,” from a cost standpoint, for the transition to tens-of-gigawatt scale. Exawatt believes that technologies such as heterojunction (HJT) and TOPCon will likely be adopted at the 10 GW+ scale in the timeframe of 2023-25. And until then, bigger if not better is an alternative path to continuing progress.

“Manufacturers always have to be doing something new,” says Barrows. “And manufacturers will always do the next easiest or cheaper thing.”

In this fashion, Barrows argues, the shift to larger formats is similar to the deployment of high-density modules and cell interconnection layouts, including shingling, paving, or tiling.

Size limits

The Netherlands-based testing equipment and service provider Eternalsun Spire has observed the first of the large-format modules arriving in the European solar marketplace, at its testing site in the Port of Rotterdam. Alex Goscomb, the company’s technical customer support manager, describes the shift to the larger sizes as having been a step change.

“You can’t take a step change without pausing and optimizing to that change,” Goscomb observes. “There are so many factors you have to take into consideration in the industry. If it was only one of them impacted, I would say that it [the move to bigger formats] wouldn’t stop. But it will for now at least, because all of the different players in the industry are trying to figure out how to do this size safely and effectively.”

Transportation alone appears to be a hard stop against which a further expansion in size will run up against. Module dimensions, Goscomb notes, appear to be maxing out at 2.6 m x 1.31 m. Beyond this, he says, shipping becomes near impossible.

“The logistics part of it is the other big part that people sort of forgot about, says Goscomb. “They kind of forgot how to move these items about. The solar industry is big, but the shipping industry is a lot bigger.”

| Module dimensions using M10 wafers |

||

| No. of cells | Width (m) | Length (m) |

| 66 | 1.13 | 2.05 |

| 72 | 1.13 | 2.25 |

| 78 | 1.13 | 2.45 |

| Module dimensions using M12 wafers |

||

| No. of cells | Width (m) | Length (m) |

| 50 | 1.1 | 2.2 |

| 55 | 1.1 | 2.4 |

| 60 | 1.31 | 2.2 |

| 66 | 1.31 | 2.4 |

| 72 | 1.31 | 2.6 |

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.