pv magazine: Azure Power’s mission is to be the lowest-cost power producer in the world. How would you define it as you have to earn revenues too?

Ranjit Gupta: Our mission is to be the lowest-cost power producer in the world. This is not the same as having the lowest selling price of power in the world. At our core, we are a shareholder return focused management and the relationship with investors is of paramount importance to us.

It is very clear to us that only when returns meet minimum threshold, will we invest in projects for future growth. That threshold must be above our capital cost and must be accretive on a cash flow per share basis.

What has been the impact of Covid-19 for Azure?

Ranjit Gupta: Despite the significant impact Covid-19 has had on the economy, financial markets and even electricity demand, we have been one of the few companies that has not seen any material adverse impact.

Azure’s business has remained very stable during the Covid-19 pandemic and as of date, we do not foresee any increase in our project costs related to Covid-19. As an essential service, we have been operating our plants to their maximum capacity and paid by our counter-parties on time. We continue to benefit from economies of scale of our platform and are driving operating costs lower.

Do you feel that Discoms will be reluctant to sign new power purchase agreements (PPAs) under the present circumstances when electricity demand is low?

Ranjit Gupta: In India, the need for new, clean electricity capacity remains. This September peak electricity demand touched a new high of 174.33 GW, surpassing 173.15 GW in September last year. Looking further, many of our countrymen lack ready access to reliable power and the long-term drivers of economic growth remain favourable for the country, even during these difficult times.

Given the deteriorating air quality generally and the need to increase clean sustainable supply of electricity, Discoms are increasingly looking to renewable energy as the answer. India is blessed with abundant sunshine, a significant natural resource, which makes solar power the lowest-cost source for current and future demand.

Of course, during these uncertain times, deciding on purchasing power for 25 years is more difficult, but it is clear that they need the power for their customers and there will continue to be a strong demand for solar power over the long run.

We have to be cognizant of the fact that when a PPA is signed, power from that project flows only 18-24 months later. So when Discoms are making buying decisions today, they are doing it for the post-pandemic period.

With the current push for Atmanirbhar Bharat (Self-reliant India) and now with the extended safeguard duty and proposed custom duty on solar imports, how do you see the RE industry panning out?

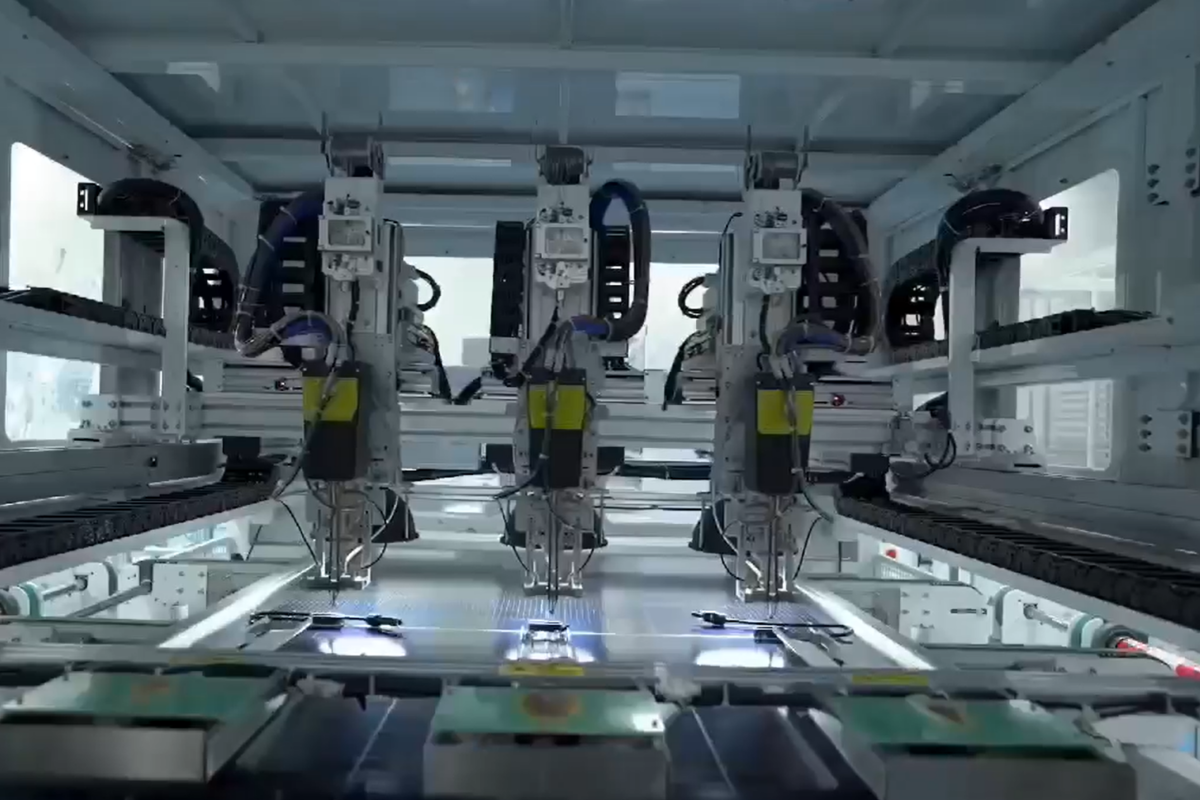

Ranjit Gupta: As India is inching closer to its stated mission of 100 GW installed solar capacity by 2022, it is an opportune time and, in fact, imperative to become atmanirbhar (self-reliant) in solar PV manufacturing. The Prime Minister has set for India an even more challenging and laudable goal of installing 450 GW of renewable energy capacity by 2030. This implies that some 30 GW of new renewable energy—most of it likely to be solar given its cost advantage—will be installed every year.

The Indian developers are fully supportive of the government’s push towards local manufacturing. We realize that this is a strategic imperative for the country. Even though the cost of local manufacturing is currently around 10-20% higher than imported panels, we realize that the eventual tariff increase for the final consumer will be in the range of few paise per unit of electricity, and that too for a short period till local manufacturers innovate to become as competitive as China.

Unfortunately, at the moment, only about 3 GW of solar modules and cells is manufactured in India. There is a mismatch between supply and demand.

The focus has been on a competitive and reliable energy source, and the Indian RE industry has successfully achieved record low tariffs in recent years. This has meant that the industry sourced low-cost competitive materials for their projects from across the world, mainly from China.

Now that the country is moving towards a new paradigm of ‘Atmanirbhar Bharat’ and Make in India, we expect to see new policies and regulations to help domestic manufacturers and eventually do away with imports sooner than later. The central government should consider ways of supporting local manufacturing through direct subsidies and grants.

Simultaneously, the transition must be made smooth by providing clear processes to ensure that the industry is protected from the risk of higher capital expenditure required to deliver the committed low-tariff capacity. Import barriers such as basic customs duty should be implemented in a phased manner, considering the balance between demand for solar modules to fulfil signed PPAs and the shortage of local solar module supply.

The current pipeline mustn’t be affected by the change in tax regimes. It would be prudent to notify new taxes immediately but make them applicable only after a year from notification to eliminate risk to current pipeline investments.

Today, there are 30-35 GW of solar projects in various stages of development and construction. These projects and this investment of US$15-20 billion must be supported and protected.

Do you feel India can compete on the solar module and cell costs globally?

Ranjit Gupta: Absolutely! India has several advantages that most countries do not. With significant domestic demand, there is a local advantage. Besides, India has a highly talented, extremely hard-working, innovative labour pool that is low cost.

To make India a solar manufacturing hub, the government needs to introduce favourable policies to ensure long-term offtake at sustainable prices, drive innovation through R&D support in the sector, and focus on skill development.

Going ahead, how do you see the Indian solar market develop? What trends are going to define the market?

Ranjit Gupta: Not long ago, solar power was considered a high-cost, marginal source of power. However, increased technological innovations and falling levelized cost of electricity have made solar the cheapest energy source in India.

With solar now costing less to generate in India than competing fossil fuel, India is expected to see a significant demand for renewable energy in the coming years. While previously, the need for solar power in India was primarily driven by Renewable Power Obligations, the market is now more driven due to solar’s economic advantage.

The demand for solar energy will undoubtedly pick up with proposed amendments to the Electricity Act, such as improving enforcement of contracts, creating a payment security mechanism for scheduling electricity, introducing distribution sub-licensees and franchisees, and increasing focus on open access.

We believe that as the penetration of renewable energy in the grid increases, Discoms will want dispatchable power from RE, which has traditionally been an intermittent power source. As a result of this shift, we are seeing more auctions focused on supply with higher capacity factors, such as wind/solar hybrid, hybrid with storage, and dispatchable such as peaking power and round-the-clock power (renewable energy complemented by thermal energy).

In the longer term, we believe that technologies such as hybrid and storage will be the norm, given the focus on a 24×7 supply of electricity. With competition and the low cost of technology and operations, there is an opportunity for us to participate in growth, earning returns above our cost of capital for the foreseeable future.

Azure recently won a significant capacity in SECI’s manufacturing linked tender. What is the progress of the project? Is the tariff of INR 2.92 discovered in this tender viable?

Ranjit Gupta: The project’s combined capacity is 4 GW, which can be developed anywhere in India and is expected to be commissioned in staggered annual phases of 1 GW with the first commissioning expected by 2022 and full commissioning by 2025.

In terms of manufacturing, the combined project comes with a 1,000 MW cell and module manufacturing capacity requirement, for which we intend to partner with a domestic manufacturer.

We have already received the letter of awards for these projects and are in the process of signing PPAs. We expect to spend around INR 18,000 crore on building the projects, which will drive about 15,000 direct and indirect jobs and avoid approximately 200 million tonnes of carbon emissions. Partnering on such a large project with predictable visibility over five years is unique, even on a global scale.

As far as the cost is concerned, one has to consider that the plain vanilla tariff was around INR 2.75 when the tariff of INR 2.92 was discovered. The delta between the extant tariff and INR 2.92 given the risk of manufacturing, makes this tariff very competitive for the country.

The Solar Energy Corporation of India (SECI) and the Ministry of New and Renewable Energy (MNRE) are aware that a small delta in tariff does not materially impact the end consumer. SECI is working on getting the PPAs signed, and we expect to sign them soon. We have to consider that the 4 GW capacity comes with an ISTS waiver that is expected to expire for others in June 2023. As the ISTS waiver expires, the power generated from these projects will be at a lower delivered cost than the lows being seen in recent auctions.

With the focus on Make in India and solar manufacturing being a low hanging fruit, the government realizes that in the short term, certain support will need to be provided until the manufacturing industry finds its feet. Ultimately, whether subsidies are provided or taxes are imposed, the impact will be on tariff.

Bundling manufacturing with PPA is a unique concept developed by the MNRE. In our opinion, it has the greatest chance of success at the least cost to the consumer.

Tell us about the investor part.

Ranjit Gupta: Azure Power is the only publicly traded pure-play Indian solar independent power producer on the New York Stock Exchange. It is backed by several marquée investors such as CanaCaisse de dépôt et placement du Québec/CDPQ (the second-largest pension fund in Canada), International Finance Corporation (part of the World Bank), Helion Venture Partners, Morgan Stanley Asset Management, Jefferies, Handelsbanken, Franklin Templeton, Société de Promotion et de Participation pour la Coopération Économique (PROPARCO), and Netherlands Development Finance Company (FMO) among others.

Earlier this year, CDPQ acquired a majority stake in our company. This new investment by CDPQ is a recognition of Azure Power’s leading solar development platform in India and by having a majority shareholder with a long-term approach and a AAA credit rating, we will have better access to external capital, further improving our future growth and return prospects.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.