From pv magazine, October edition

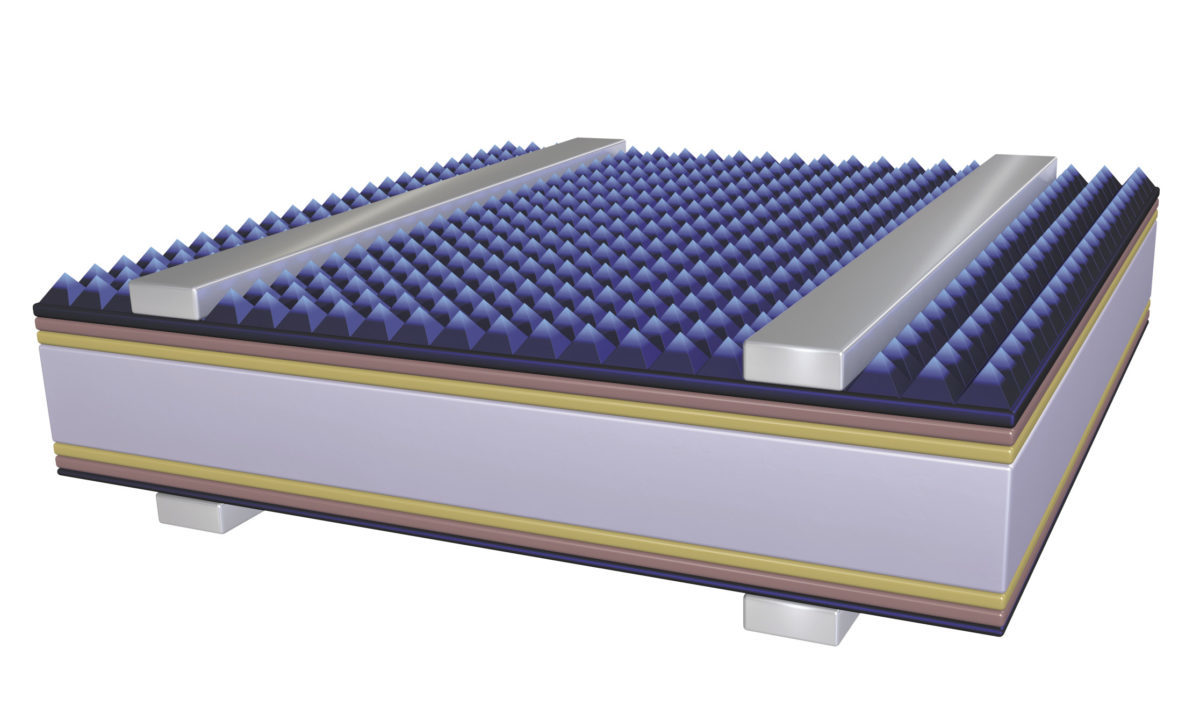

This month the first modules will roll off REC Group’s production lines in Singapore, and it marks a significant milestone for the PV manufacturing sector. The modules will be from REC’s Alpha Series, and they deploy Meyer Burger’s heterojunction (HJT) technology. And while HJT is nothing new, having been pioneered, manufactured and sold first by Sanyo and then Panasonic, it may be a sign of things to come for high-efficiency solar production.

REC is set to produce 600 MW of its Alpha HJT modules a year, once its new lines are fully ramped. The production lines are said to be highly automated, with an autonomous robotic transport system moving batches between some process steps. Highly automated means lower labor costs through fewer operators, and given REC’s production location in relatively high-wage Singapore, it’s a must for its production.

High levels of automation and integrated automated optical inspection (AOI), which REC is known to have been a pioneer in utilizing on its earlier PERC lines, can also allow for efficiency feedback loops. This allows optimizations to be integrated into production relatively quickly. And it’s this, when combined with REC’s many years of high-throughput manufacturing, that is giving many proponents of HJT hope that the technology may achieve the efficiency improvements and cost reductions that will take it to the pinnacle of PV manufacturing.

REC’s Alpha modules will come in at a power output of 380 W for a 60-cell configuration. In terms of efficiency, its standard Alpha will hit an efficiency of 21.7%, with an aesthetically pleasing all-black module for the high-end rooftop segment expected to hit 21.4%. And with cell efficiencies potentially going beyond 24% over time, power outputs could soon push beyond the 400 MW barrier. If, that is, improvements in scale production are achieved.

High efficiency

The Alpha will go into competition with other high-efficiency concepts, primarily but not exclusively for the residential rooftop segment. One competitor product is the LG NeON 2 series, which deploys n-type monocrystalline cells – which it brands as CELLO technology. Produced in South Korea, the NeOn 2 achieves a power output of 350 W for a standard module and 345 W for all black. The module uses busbarless cell interconnection, similar to the REC Alpha, which deploys Meyer Burger’s Smartwire.

LG’s place in the higher end of the market, along with the NeON – which picked up an Intersolar Award in its first iteration back in 2015 – is well established.

Another fast-moving competitor is Longi Solar, which is supplying its Hi-MO 4 and Hi-MO X series modules – both on a mono PERC technology platform. Longi reports that the Hi-Mo4, in a 60-cell configuration, achieves 370 W peak power output. The Hi MO X deploys shingled technology, achieving 360 W at its peak.

“We believe it [Hi-MO X] is going to be the hottest product for rooftop applications,” says Richard Qian, a Longi Solar product engineer. “The Hi-MO 4 is a 435 W mono product or bifacial panel. Both of these two panels are two of the most powerful on the market.”

Shingled technology is also one of the keys to U.S.-based high-efficiency supplier SunPower’s latest offering. The company’s A-Series is well established in the market, deploying IBC technology to go past the 400 W threshold. SunPower announced that its powerful A-Series exceeded the 400 W threshold in March. It utilizes the third generation of its Maxeon IBC cell technology.

SunPower’s strategy is to develop and produce its P-Series using shingling, plus a new Chinese production site, to achieve high efficiencies without the significant cost premium at which IBC is known to come. And that is particularly notable from a strategic standpoint. Using mono PERC cells purchased from third-party suppliers, SunPower deploys the shingling technology it acquired in 2015 from Cogenra to produce its P-Series modules in Mexico and China.

SunPower’s capacity plans for its P-Series stood at 5 GW, when it announced a venture with DZS in early 2017. Currently it is producing 2.2 GW per year of the P-Series. In its latest iteration, the SunPower P-Series comes in at 350 W. And while well-suited to the rooftop segment, the P-Series was selected by Innogy and Belectric in Australia for the 349 MW Limondale solar power plant in October 2017, indicating that it is not only on the roof that the P-Series is being deployed.

Other high-efficiency rivals to REC’s new HJT offering exist, and it is clear the company is not moving into an uncontested field. But it is also apparent that its Alpha HJT tech does offer considerable differentiation and performs strongly, from a power output and conversion efficiency standpoint.

Shingled concerns

There is another advantage the Alpha may have over some rivals. The module uses a half-cell, dual-module configuration – along with Smartwire cell interconnection, as previously noted. REC has a long track record in both half cell and dual/split module production, having pioneered both approaches at a large scale in its award-winning TwinPeak series. So, while REC’s learning curve for HJT might be sharp, it is familiar with the processes.

By not going down the shingled path, REC may also be avoiding a potential legal pitfall in the future. Legal conflicts over PV manufacturing technology are nothing new to the market in 2019, but the Hanwha Q Cells case in Germany, the United States and Australia over PERC technology has sharpened minds as to the implications of potential patent infringements. And it is thought that similar challenges may arise when it comes to shingling.

In August, SunPower was awarded a Chinese patent for its shingled module technology. The patent covering shingling joins similar granted patents or applications in Australia, South Korea, Europe and Japan. It is unclear what impact the patent will have on the shingled technology deployed by Longi and others, but there are likely to be questions asked at some point in the future.

Cost reduction

Few would dispute that REC’s success with its Alpha will depend on it being able to achieve cost reductions in production. The capex premium commanded by HJT is thought to around three times that required for a standard mono PERC line. But equipment suppliers are attempting to close that gap by producing equipment in China – even though Meyer Burger dropped similar plans to do so earlier this year.

For the tooling currently being ramped in Singapore by REC, solar consultant Götz Fischbeck understands that the company was able to buy them at a big discount from the Swiss-based production equipment supplier, and that the collaboration goes even as far as profit sharing.

“I believe this bet is the last chance for Meyer Burger to survive as an equipment supplier to the solar industry,” says Fischbeck of Smart Solar Consulting. “They [Meyer Burger] had to grant REC a limited exclusivity on this technology in order to secure the order for 600 MW and the prospects to expand beyond this scope.

“If by time the HJT modules from REC become available in quantities in the market the price decline has further advanced, it could very well mean that there is no meaningful profit to be shared between Meyer Burger and REC,” Fischbeck notes.

In terms of other HJT expansions, there is considerable movement in China itself, with both Risen Energy and Chinese HJT technology developer GS Solar expanding operations. But there is another European collaboration that presents an intriguing HJT possibility.

Along with REC, Meyer Burger is also currently supplying a 200 MW HJT line for perovskite developer Oxford PV, to be established at a former CIGS factory in Brandenburg, Germany – only an hour or so from the national capital. As a part of the supply deal, Meyer Burger also took an 18.8% stake in Oxford PV.

The British perovskite developer is looking to produce HJT-perovskite tandems, and given its experience in setting records on perovskites in the laboratory, the approach is showing promise. Oxford PV recently presented the potential to take solar LCOE to “unprecedented” levels by using 28% HJT-perovskite tandem technology.

It is undoubtedly positive to see HJT modules beyond those which Panasonic has long supplied coming onto the market.

And there could very well be a place on the market for HJT, given the current competitive landscape among high-efficiency cell and module concepts. The story now is to be written by execution, both in terms of cost and performance in mass production.

“Cost must be aligned with the actual efficiency gain,” observes IHS Markit Research Director Edurne Zoco, when considering the future of HJT. “That is the only way to achieve scale and mainstream adoption of a new technology in the market, as it has happened with PERC technology in the last few years.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.