From pv magazine, October edition

Electric vehicle (EV) charging is rapidly developing across many European countries – from residential chargers to public facilities and depot fast charging. In some cases, stationary batteries are being installed alongside EV chargers to help manage capacity constraints and impacts on the grid, while in other cases, they are being used to maximize self-consumption from PV installations for EV charging. But it is still not clear how widespread the installation of batteries with EV charging infrastructure is today, or how big an opportunity it will be in the future.

In this short article, we will draw on some of the research focusing on the segmentation of the EV charging infrastructure market, as well as new applications and Delta-EE’s future outlook for the market.

Charging infrastructure

There are many forecasts calling for growth in the number of plug-in EVs that will be on the road over the next decade or so. Whatever you believe, it’s certain that there will be a lot more in 10 years’ time than there are today. To support this EV uptake, it will be necessary to develop nationwide infrastructure for EV charging at different locations, including at home, on the motorway and in the workplace.

Delta-EE sees three main segments of EV charging infrastructure for cars and vans, as well as one for buses:

- Charge points in the home, often 322 kW, with charging periods typically in the evening

- Fleets and company cars in the workplace, often 722 kW, with charging periods during the day

- Destination and transit at public locations, at roughly 22,450 kW, with charging periods throughout the day and evening

- Electric buses are emerging in Europe as cities act to improve air quality. These installations require significant connection capacity due to the 100,450 kW fast charging requirement.

Emerging applications

New loads from this EV charging infrastructure will place additional strains on electricity networks. In particular, rapid charging will require higher connection capacity. We therefore see segments #3 (public) and #4 (electric buses) being the most attractive use cases for batteries co-located with EV charging in the near term.

Delta-EE’s research shows that the market for co-locating storage and EV charging infrastructure is emerging across Europe through pilots and early commercial activity. It estimated that some 50,100 kWh of battery storage has been installed for such applications to date, with the United Kingdom, Germany, the Netherlands, Austria, Switzerland and Sweden all having notable project activity.

Perhaps unsurprisingly, the most active application is the co-location of batteries with fast charging infrastructure. Battery vendors and chargepoint operators have been the main actors to date and – while business models are still being explored – PPA and revenue sharing approaches are currently most common. The current low utilization of the chargers (due to low numbers of EVs on the road) means that using the batteries to provide network support services will be an important part of the business model.

The electric bus segment requires very rapid charging during the day (more than 400 kW in some cases) because the costs of drivers sitting around idle during the day are critical for the bus service operators. At night, lower power charging (around 100 kW) would normally be sufficient. These requirements are a major challenge for local electricity grids, which may already be stressed in many urban centers. While batteries can clearly help to mitigate these problems, one difficult constraint may be the physical space required by storage systems at bus depots in city centers.

While workplace and fleet charging do not usually require fast charging, we have identified some interesting propositions driven by the need to avoid grid re-enforcement, or to enable end users to avoid peak charges. This segment is less developed, but two strategies that seem to be emerging are providing a battery alongside a charger, or providing an integrated product comprised of a battery with an EV charger in a single unit.

Outlook and opportunities

Delta-EE expects that the use case for energy storage co-located with EV charging infrastructure will grow rapidly, and we expect it to become a significant part of the storage market. Up to 1 GWh of batteries could be installed in Europe for this application over the next few years, potentially representing around 10% of the total European energy storage market.

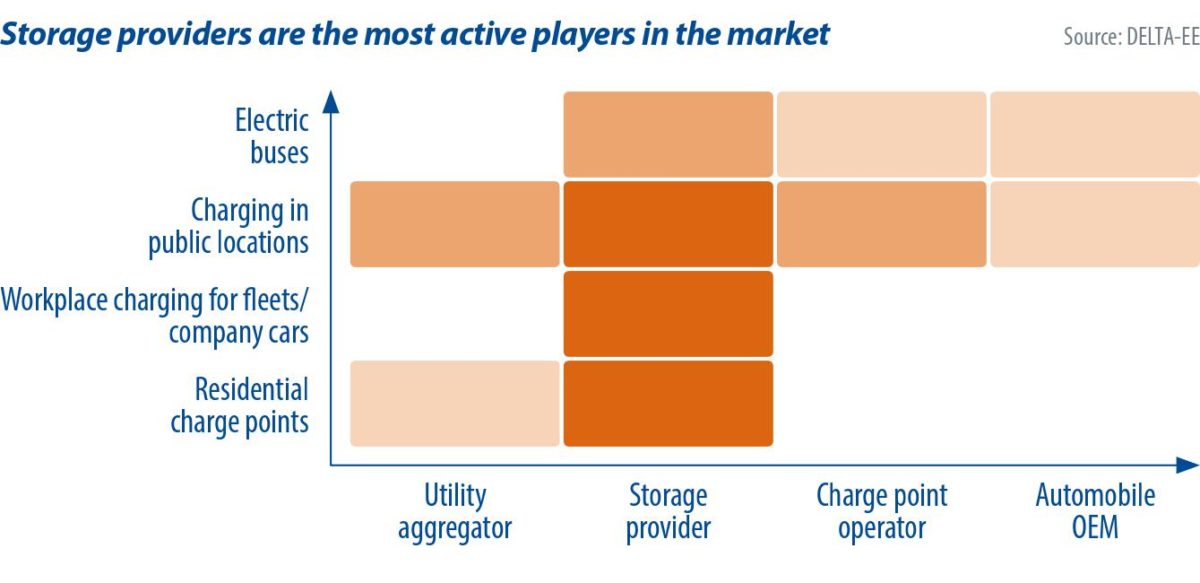

While co-located storage with EV charging remains a relatively small application today, we see a range of different companies are already active or are becoming active in the market: utilities, aggregators, storage vendors, charge point operators and automotive OEMs. It’s likely we will see the emergence of some leading partnerships as the market develops.

Public fast charging offers the greatest potential for energy storage, with perhaps 50% of fast charging infrastructure projects including storage by 2022. Electric buses also represent an important opportunity, as storage is particularly interesting for smaller fleets, where the cost of a grid connection upgrade can be prohibitive.

About the author

Robin Adey-Jones joined Delta-EE in 2019 to support the energy storage team, delivering research around the impact of storage technologies and business models on European energy markets. He works in close partnership with the flexibility service.

He will soon graduate with an Engineering Doctorate in Micro- and Nanomaterials and Technologies from the University of Surrey’s MiNMaT CDT. In his research project, he used advanced imaging and modeling techniques to characterize multiphase flow in porous media. He holds an MEng in Mechanical Engineering from the University of Edinburgh, during which time he worked with one of the UK’s leading demand-response aggregators.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.