India will fall short of its much-hyped 2022 target of reaching 175 GW of renewable energy generation capacity by as much as 42%, according to Mumbai ratings agency CRISIL’s REturn to Uncertainty report.

Blaming policy failures, trade tariffs, power purchase agreement uncertainty and waning developer interest, CRISIL predicted India’s installed renewables capacity could rise by just 40 GW to 104 GW by 2021-22, from 64.4 GW in the last fiscal year.

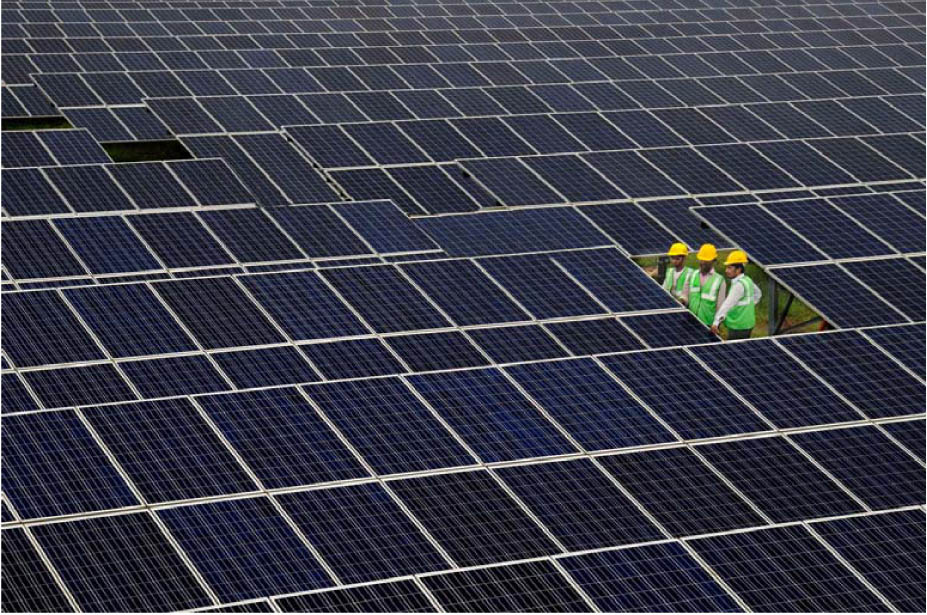

The projected 104 GW figure includes 59 GW of solar capacity which will rise to 81 GW in 2023-24 with the balance supplied by wind capacity as India reaches an expected 130 GW of renewables in four years’ time.

CRISIL pointed to waning interest from developers which saw 26% of the 64 GW of renewables projects tendered by public bodies in the last fiscal year receive either no bids or a lukewarm response. A further 31% of such projects were delayed after being tendered. That added up to only 34% of tendered renewables capacity being allocated, down from a cumulative 77% in 2015-16 and 2016-17.

Tender failures

“Despite the increase in tendering volume, not only has allocation of projects slowed down but both under-subscriptions and cancellations of awarded tenders have also increased,” the report stated.

Citing “growing incoherence between the policy thrust on RE [renewable energy] on the one hand, and the actual action by implementation agencies like the Solar Corporation of India (SECI) and state distribution companies on the other”, the report said an unstable policy environment posed a big risk to the country’s clean energy targets.

The ratings agency study also mentioned tariff re-negotiations in Andhra Pradesh. At the end of July, the state’s electricity distribution companies (discoms) owed around Rs2,600 crore to renewable energy producers, partly because the state government had delayed payments over a tariff dispute. Such prolonged delays and disputes not only set a negative precedent but also endangered investment, according to the CRISIL report.

Similarly, the Rajasthan government’s recent draft solar and solar-wind hybrid project policy proposed an additional annual levy of Rs2.5-5 lakh per megawatt of generation capacity for all projects selling power to entities outside the state. If implemented, the move could be highly detrimental as Rajasthan is one of the most prized states for PV plant developers.

Remedies

In the last fiscal year, federal government entities cancelled 4.4 GW of renewables capacity after deciding the resulting electricity tariffs were too high with state distribution companies cancelling a further 100 MW. For instance, SECI terminated its 2.4 GW interstate-transmission system Tranche II solar scheme as the resulting Rs2.64/kWh solar power tariff was higher than expected.

“Developers are also increasingly losing interest as central and state power discoms are increasingly lowering tariff caps, which is constraining project viability and resulting in renegotiation of tenders, where counter-parties disagree on pricing,” stated the CRISIL report. “The Bhadla Solar Park in Rajasthan, which saw tariff bids of Rs2.44 per unit in May 2017, has become a benchmark of discom expectations on tariff bids today, resulting in a solar tariff cap of around Rs2.5-2.6 per unit.”

The ratings agency report stated confidence global investors will continue to supply the estimated Rs2.6 lakh crore India’s renewables industry will need over the next five years, provided governmental clean energy policy is consistent.

To restore developer confidence, CRISIL recommended relaxing tariff caps; enhancing cooperation between federal and state authorities; and the formalization of policies such as renewable purchase obligations and penalties for delays in payments by including them in the Electricity Act.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.