From pv magazine, September 2019

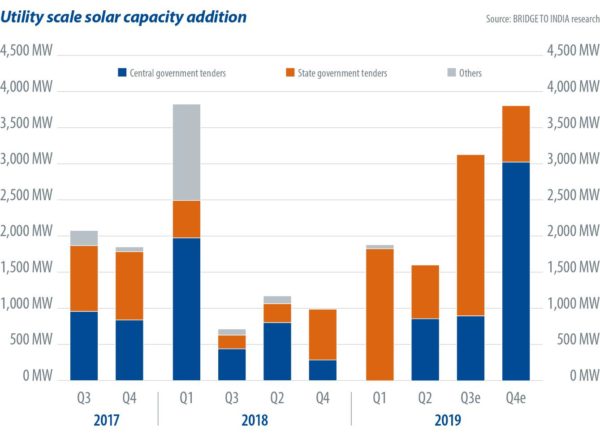

Utility-scale solar capacity additions have been slowing down in India over the past year, and the second quarter remained slow, with only 1.1 GW of capacity additions against our estimate of 1.53 GW. The slowdown is due to many reasons: land and transmission bottlenecks, tight liquidity in the financial system, and rising input costs that have affected the profitability of many projects. Distribution company (DISCOM) payment delays have also hurt the sector very badly. Rooftop solar remains a bright spot, with capacity additions of 515 MW in the second quarter.

Going forward, installation activity should pick up significantly. A total of 13.5 GW is due for completion in the next 12 months, but we expect significant slippages due to the reasons discussed earlier. The fall in safeguard duties to 15% in January 2020, and their removal by July 2020, should ease concerns for the sector. But there is rising speculation in the market that the government is mulling further duties to protect domestic manufacturers.

Tender issuance has stayed robust, with a total utility-scale capacity of 10.3 GW issued in the second quarter, although it was down 35% from the previous quarter. However, many recent tenders have been cancelled and/or under subscribed. Gujarat’s 700 MW Raghanesda tender was under subscribed by 100 MW in May 2019. Solar Energy Corp. of India’s (SECI) 1.2 GW tender in June, as well as a 2 GW tender in March and another 1.2 GW of recent hybrid tenders, were under subscribed by 50%, 53% and 25%, respectively. Recently, NTPC Ltd.’s 1.2 GW tender also failed to lure bidders, forcing a deadline extension.

The Ministry of New and Renewable Energy’s (MNRE) decision to adopt an approved list of module manufacturers – part of efforts to address quality issues in components – is also likely to create uncertainty. All installations from April 2020 will need to comply with this policy. But there are still concerns about the MNRE’s capacity to complete the necessary certification process in time, as well as the willingness of international and domestic manufacturers to hand over confidential data.

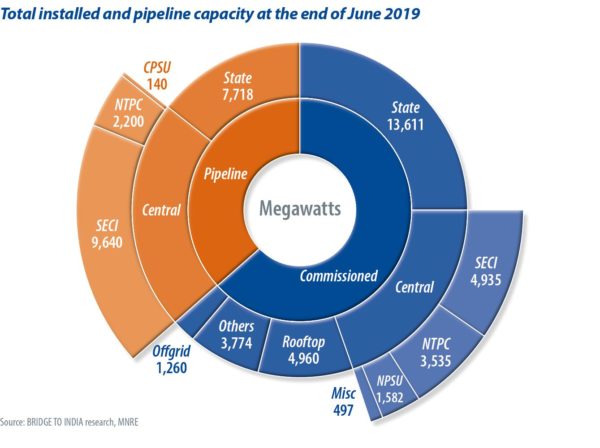

Project pipeline

India’s capacity additions have been muted for over a year now, but the nation’s project pipeline looks robust for the third and fourth quarters. It is up to the government to take decisive action to address issues related to land acquisition, transmission connectivity, and DISCOM bankability.

Incidents of tender cancellations and under subscriptions have marred investor confidence. And sentiment has been further shaken up by the state of Andhra Pradesh’s recent move to rescind PPAs. Overall, sentiment in the sector is highly stressed; everyone is now focusing on whether the government can announce measures to spur confidence.

Sai Nandamura is a consultant at Bridge to India with five years of experience in the energy sector. He has previously worked on rating the thermal power industry in India for efficiency and sustainability. Prior to joining Bridge to India, he worked with Centre for Science and Environment. Sai holds a Masters degree in Environmental Management (MESPOM) and BE (Civil Engineering) degree from Manipal University.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.