From pv magazine, July edition

The past two years have shifted the landscape for suppliers of solar cell manufacturing equipment. In June, pv magazine reported on a new generation of atomic layer deposition (ALD) tools that are taking the Chinese PV industry by storm. Its pioneers claim that their early success signals an unstoppable market trend in PERC manufacturing, driven by higher cell efficiencies and better production-line economics. The competition begs to differ.

“There is no indication that ALD performs better,” said Gunter Erfurt, CTO of Meyer Burger, a key supplier of plasma-enhanced chemical vapor deposition (PECVD) equipment. Erfurt adds that PECVD is still used by top-efficiency PERC manufacturers and continues to dominate 70% of the PERC cell equipment market. “What we know from our customers is that the total cost of ownership of an ALD-fitted PERC line is higher than for a plasma-based solution,” he explained.

Cost figures are highly confidential and production line outputs can be difficult to compare, but cell manufacturers, equipment suppliers and academics have shared their insight on the business case for aluminum oxide passivation layers for PERC cells deposited by batch-ALD.

Efficiency race

Since 2018, Leadmicro — the current market leader for ALD equipment — has carved out a multimillion-dollar market share with tools that it claims deposit better passivation layers than their PECVD counterparts, at significantly lower manufacturing costs.

“ALD was originally invented to make the best films on the market,” said Leadmicro CTO Wei-Min Li, adding that feedback from several production sites now reveals that, “ALD-enabled PERC cells have energy conversion efficiencies about 0.05% higher as directly compared to those deposited using PECVD.”

Few experts would dispute the quality of ALD-deposited layers. “If you compare material properties one on one, the density and purity of aluminum oxide passivation layers are better with ALD than PECVD,” said Erwin Kessels, a professor at Eindhoven University of Technology in the Netherlands. His research group was an early pioneer of ALD and works on a range of vacuum deposition processes, including PECVD.

The physical properties of passivation layers in turn contribute to the overall performance of PERC photovoltaics. But their benefits can be overshadowed by technical limitations elsewhere in the cell. In the early days of PERC production, Kessels says that any advantages bestowed by ALD were not noticeable at the cell level. “The quality of passivation layers deposited by PECVD were not a showstopper,” he said. “In terms of material properties: good enough was good enough.” This view is still held by some of the world’s leading cell manufacturers today.

“The passivation quality of aluminum oxide deposited by ALD and PECVD layers is comparable,” said Axel Schwabedissen, Process Technologist at Hanwha Q Cells in Bitterfeld-Wolfen, Germany. His company has mass-produced PERC cells since 2012 and runs tests on ALD and PECVD equipment alike.

Downtime down

Another factor often quoted as driving the adoption of ALD is the technology’s low downtime. Schwabedissen says that the inline PECVD tools Hanwha Q Cells works with require several hours of preventive maintenance every five to seven days because of parasitic deposition on microwave tubes and chamber walls. “ALD tools require less maintenance to deposit aluminum oxide and therefore spend more time in operation,” he said.

Kessels explains that low maintenance is an intrinsic perk of ALD deposition. Given how thin passivation layers can be grown within ALD tools, the technology wastes less material on the sidewalls of the reactor and coats them uniformly, causing no pile up or flaking that would require weekly removal, as is the case with PECVD. Leadmicro claims that their ALD tools operate more than 99% of the time.

Costs in context

Shubham Duttagupta at the Solar Energy Research Institute of Singapore (SERIS) generally agrees with these figures, but stresses the importance of putting them into context. Last year, he crunched numbers provided by cell manufacturers running various kinds of ALD and PECVD equipment to determine the overall cost and efficiency benefits of each technique. According to his calculations, the crucial factor was not the downtime of individual pieces of equipment, but how well they were integrated with each other.

“People generally think from a tool perspective,” said Duttagupta. “But if you want to compare apples with apples, you have to consider the entire manufacturing line under a realistic scenario.”

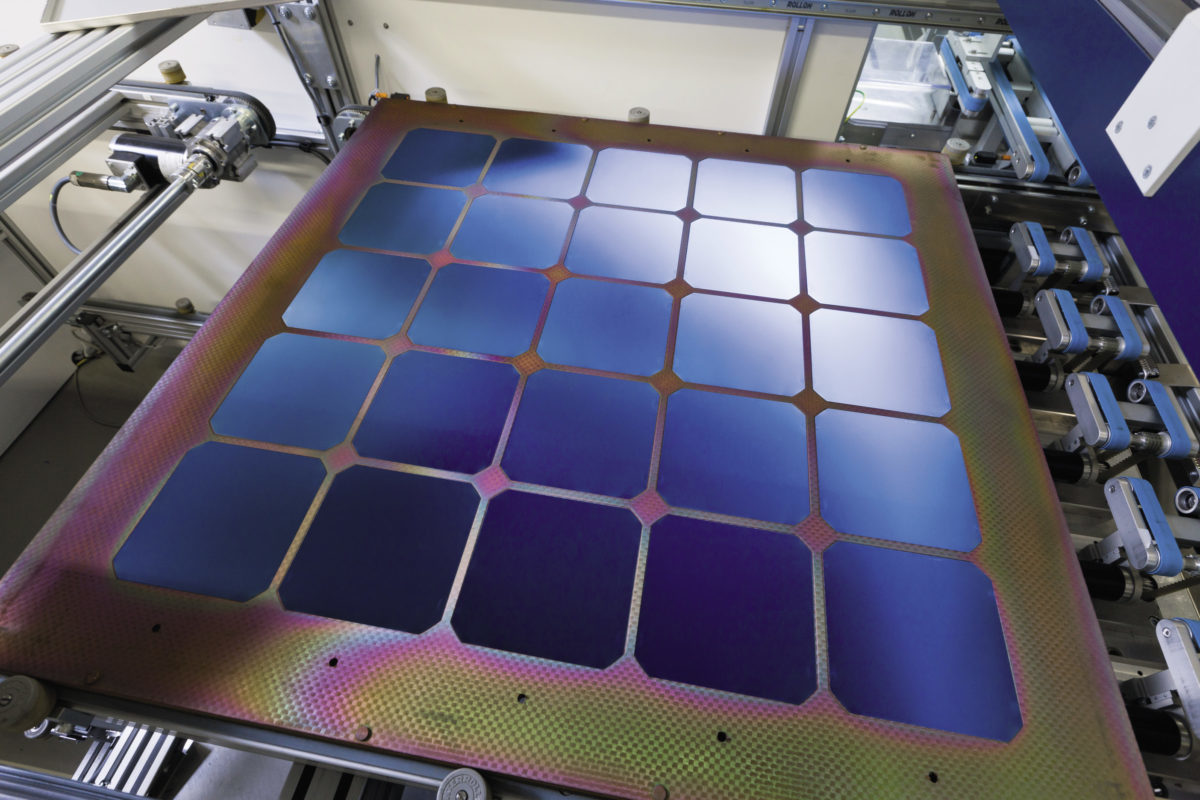

On this front, ALD has historically faced challenges. All PERC manufacturers require PECVD for at least some of their cells’ process steps. They invariably deposit an aluminum oxide passivation layer on the rear surface of a crystalline silicon wafer and then cap the cell on both sides, typically with a layer of silicon nitride. To date, ALD can only deposit the layers of aluminum oxide. Cells are then typically transferred to PECVD tools where a capping layer can be deposited over them.

Duttagupta warns of operational expenses involved in interrupting the fabrication process. His data from the factory floor suggests that the average yield of manufacturing lines (the percentage of top-class cells compared to lower quality batches) decreased the more handling steps were involved. As a result, disaggregated equipment sometimes brought down the initial capital and operational expenditure of depositing the aluminum oxide passivation layer, while inflating investment in complementary tools and automation machinery to deposit the rest of the cell.

This is not the only advantage of inline manufacturing equipment. Duttagupta also found that assembly line interruptions can squeeze overall profits, given production delays and product degradation when transferring cells between process steps.

“You are not making a presentation slide,” he said, explaining that delays can result for instance from human error, busy equipment or maintenance. “Real life gets messy and there will always be hiccups on the production line.” He says that once aluminum oxide passivation layers are exposed to air, they absorb hydroxyl radicals, gradually degrading the properties of the PERC cell. The delay between process steps figured as a key limit to cell performance in several factory lines studied.

2-in-1 deals

Josef Haase, director of process and technology photovoltaics at centrotherm, a German supplier of tube systems to deposit aluminum oxide and capping layers by PECVD, says that ALD has so far required one more handling step, as the aluminum oxide and capping layer have traditionally been deposited in separate tools. He recognizes that the operational expenditure of ALD furnaces is lower than that of PECVD tools performing the same task. But once additional costs are included, he says that the overall costs of running a manufacturing line work out to be significantly higher.

“PECVD is remarkable in that the process does not expose aluminum oxide layers to air at all,” said Haase. “The passivation and capping layers of the cell can both be deposited in situ.”

This advantage may no longer be exclusive to PECVD technology. At the SNEC 2019 solar exhibition in Shanghai, Leadmicro launched its first plasma-enhanced ALD (PEALD) system, which is capable of depositing both aluminum oxide and silicon nitride layers.

“No one says that ALD cannot be two-in-one,” said Leadmicro’s Li, adding that the ZR4000X3 is even capable of three-in-one process integration for stacks, including silicon oxide/polysilicon for TOPCon cells and in/ip passivation layers for heterojunction cells. “Our latest innovation focuses on future high-efficiency solar cells and can be back-integrated into existing PERC lines,” he said.

In spite of mounting opportunities offered by ALD, some PERC cell manufacturers remain unconvinced. Schwabedissen acknowledges that new products may tip the scales, but says that Hanwha Q Cells still has no plans to acquire ALD tools for production. He adds that other PERC manufacturers, including REC Group and efficiency record-holder JinkoSolar, are also expanding operations with passivation layers deposited by PECVD.

International skepticism of ALD deposition contrasts starkly with the enthusiasm that has been gripping manufacturers across Asia. “ALD is primarily being adopted in China,” said Meyer Burger’s Erfurt. “Cell manufacturers outside China don’t really use it.”

According to Corinne Lin, chief analyst at Taiwan-based market intelligence provider PV InfoLink, the reason for the split may owe more to taste than technology. “Using ALD or full-PECVD will not have much impact on cell manufacturing costs,” Lin explained. “There is currently no appreciative difference between the two processes.”

Kessels, meanwhile, is not so sure. “If you had asked me three years ago whether ALD would grow mainstream, I would have answered no,” he said. “But now it is hard to predict what market share it will take. People initially thought that ALD would never reach the PV industry, then that it would never prove competitive, now that it will never bring down the overall cost of the manufacturing line. What I have seen of Leadmicro suggests that they are starting to turn this situation around.”

He points out that as PV efficiencies continue to rise and specifications grow tighter on each layer of the cell, the quality of aluminum oxide deposited by ALD may grow decisive in PERC performance. “In the end, the market will not lie,” said Kessels. “If a technology can achieve better results at a comparable cost, manufacturers will adopt it.”

By Benedict O’Donnell

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.