From the September edition of pv magazine

When it comes to PV module assem- bly, the backsheet is a crucial com- ponent, and one which must bear the brunt of protecting the inner workings of a module from moisture, high temper- atures, acid corrosion, and other harsh conditions. The market for backsheets is concen- trated in China, where the bulk of sili- con modules is currently manufactured. “There is a favorable long-term outlook for growth in the PV backsheet market in China, backed by increasing capacity of module production in the region and other Asian countries including India,” says Karl Melkonyan, Senior Analyst Solar Technology at IHS Markit.

While long-term growth in backsheet demand will be somewhat slowed by an increase in glass-glass modules, the Inter- national Technology Roadmap for Photo- voltaic (ITRPV) 2018 still expects around 60% of module production to be based on glass-backsheet technology by 2028. “The need for more backsheets is offset by the slow increase in the use of glass-glass module technologies, in particular with increasing demand of bifacial modules,” continues Melkonyan. “Glass-glass tech- nologies are predicted to be a larger factor in the decrease of backsheet demand. IHS Markit forecasts that they will increase steadily (mid and long-term), reaching around 15% of total module production in 2020.”

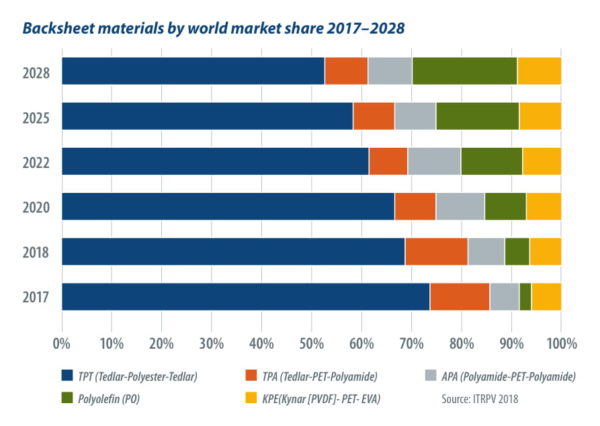

Figures from ITRPV 2018 (see chart above) estimate that Tedlar-polyes- ter-Tedlar (TPT), represented the larg- est share of the world market in 2017; although this figure is disputed by DuPont and several other backsheet manufactur- ers. While ITRPV expects TPT to remain a mainstream backsheet technology for the foreseeable future, industry voices are in broad agreement that new approaches are needed to keep up with expected cost reductions in PV. To this end, new pro- cesses and material combinations are being rolled out by several players, and can expect to gain some traction in this highly competitive marketplace. “IHS Markit forecasts that market share of Tedlar-based backsheets will decrease marginally with penetration of new mate- rials, such as new fluoro and non-fluoro backsheet products,” says Melkonyan. “Tedlar’s overall loss of market share posi- tion means that other backsheets are gain- ing more acceptance in the market.”

Indeed, backsheet manufacturers that pv magazine spoke with for this article point out that, outside of China, mod- ule manufacturers are already showing preference for materials other than TPT: “Tedlar only has market share in China,” says Eric Yang, International Sales Man- ager at Suzhou, China-based Cybrid Tech- nologies, which manufactures backsheets using a range of different material combi- nations. “Cybrid is making KPf the new backsheet standard, and succeeding in India, Turkey, Japan, and also China.”

Material innovations

Creating plenty of interest among these new materials is polyolefin (PO), which ITRPV expects to account for more than 20% of the market in 2028, from less than 3% last year. Dutch materials special- ist DSM developed its Endurance back- sheet using PO materials, and expects to see positive response from manufacturers as the material gains further acceptance. “We combined polyolefin materials with a polyamide PA12 layer, both of which are extremely durable,” says Jan Grimberg, Business Director Advanced Surfaces at DSM. “That’s basically what the market is looking for from a technology point of view, and you can provide it at a very effi- cient cost.” Isovoltaic Solinex has also rolled out a PO-based backsheet, the Icosolar CPO 3G. “We started with the production in June 2017, and we now have a broad range of module makers who are customers, says CEO Thomas Rosegger. “I am convinced that the future cell packaging concept will be based on polyolefin.”

With its potential for strong performance as a moisture barrier and high lev- els of acetic acid permeability, polyolefin appears to be generating plenty of inter- est among module manufacturers. The market for backsheet materials, however, remains diverse, with manufacturers con- tinuing to innovate on plenty of other materials, some of which have the advan- tage of having been used for many years,with data to back their performance – a key issue in an industry as risk averse as PV manufacturing.

Companies are sticking with better known materials, even where they may not have the strongest reputation based on older installations. DSM, for one, uses a polyamide layer in its Endurance back- sheet – a material known to have caused problems in older iterations: “There were backsheets that basically contained three layers of polyamides, which were not tested enough and caused all kinds of issues, and this meant that polyamide was then treated with suspicion,” explains Grimberg. “But the polyamide we are using is completely different in design than those products – we are combining it with different materials, and it has proven its performance in other industries with high durability requirements”.

Polyethylene terephthalate (PET) is another material known to have exhibited yellowing and cracking in the field. Agfa, however continues to innovate with this material, and is confident that its Uniqoat backsheet will not exhibit such problems. “Standard, electrical grade PET films can become yellow and brittle, but the PET films used in Uniqoat are high grade, and hydrolysis and UV resistant,” says Wer- ner Vandevelde, Marketing Manager Functional Foils at Agfa. “The mechani- cal properties of Uniqoat after exposure are very well retained, which is essential for the module durability.”

Cybrid meanwhile, says that it is look- ing to move away from PET layers in its Cynagard range of backsheets, and search- ing for new materials with the required properties. “Ninety percent of Cybrid’s products use polyvinylidene difluoride (PVDF). We do not suggest that customers use PET for installations which require a guarantee for 25 years,” says Yang. “Cybrid is trying to find a new material to replace the core PET. We need to find cheap solu- tions to reduce water vapor transmission rate (WVTR) with thinner backsheets, then try to find a way to change the core PET material to another reliable material.”

Beyond lamination

The majority of today’s backsheets consist of multiple material layers glued together in a lamination process. This has been identified as an area for improvement by several backsheet specialists, as the sep- aration, or delamination, of these layers has been observed in the field, and can adversely affect module performance. “Any laminated multi-layer backsheet is the weakest link in a solar module because it has an interlayer adhesion strength of merely 5 N/cm on average whereas the adhesion with glass and EVA reaches 70 N/cm or more on average,” explains Werner Vandevelde.

Agfa has launched its Uniqoat back- sheet, which does away with lamination entirely, replacing it with a single-layer extrusion process. “We believe that the single-layer backsheet in itself represents a major innovation compared to laminated multi-layer backsheet, continues Vande- velde. “Any innovation track that builds on the lamination-based concept is a dead end, because incremental improvements cannot remedy inherent issues like delam- ination or environmental unfriendliness.” DSM, which has also adopted a co- extrusion process rather than lamina- tion for its multilayer Endurance back- sheet, agrees this will be a needed step for backsheet suppliers to keep up with falling costs. “You need to look at different con- cepts. If you don’t do that you hit the wall with how thin you can go,” says Grimberg. “In 2018, you see more players stepping away from the lamination process and saying that this is not effective anymore.”

New modules, new requirements

As it has done with many other system components, bifacial module technology has placed a whole new set of require- ments on the backsheet. While bifacial modules are typically associated with glass-glass, backsheet manufacturers state that they have plenty to offer this technol- ogy. “There are two technical pathways for bifacial module backsheets,” says Cybrid’s Eric Yang. “Some want to use bifacial cells combined with high reflectivity backsheet to gain more power. Also, as the installa- tion of glass-glass modules still has a num- ber of issues, module makers are looking to transparent backsheet as an alternative.”

Earlier this year, DuPont launched its clear Tedlar film for transparent back- sheets, and points to multiple advantages over glass-glass modules: “Compared to a glass-glass module structure, a breath- able transparent backsheet, enabled by clear Tedlar film, can help to reduce cor- rosion in the module by releasing moisture and acetic acid from EVA degra- dation,” explains Stephan Padlewski, Regional Marketing Leader, EMEA, DuPont Photovoltaic Solutions. “Trans- parent backsheets significantly reduce module weight, and the glass-transpar- ent backsheet module with frame is eas- ier and faster, and requires less extensive mounting to install, thus lowering instal- lation costs. The frame also provides for stronger resistance to static and dynamic mechanical load stresses in the field.”

Currently, DSM has not produced a transparent backsheet, though Grimberg acknowledges that this will be an impor- tant area to consider in the future: “Bifa- cial is not a question, it’s coming, and I think glass will find its segment in the market, as well as backsheets,” he explains. “So we’ll have to consider that part of the development road map – to also develop transparent backsheets.”

Market approach

Convincing manufacturers and investors to trust in an unproven material is no easy task, particularly given the trend towards ever longer PPAs and lifetime guaran- tees. Backsheet makers are now focused on testing standards, looking to provide customers with a convincing set of data on their product’s performance. Even so, rolling out a new material can be a lengthy process. “It is understandable that mod- ule manufacturers want to avoid risk, and some caution before adopting innovations is probably not even a bad thing for the solar industry’s reputation,” says Agfa’s Vandevelde. “Our approach has been based on patience and repetition. Patience because some manufacturers have exten- sive testing programs before adopting a new component. Repetition because that is what it takes to explain what a single- layer backsheet is and how it better serves the needs of the industry.”

DuPont advocates improved testing standards, which focus on predicting life- time performance. “The current standards provide minimal UV testing which is one of the more important and under-tested stresses on materials in modules,” says Padlewski. “DuPont recommends more rigorous Module Accelerated Sequential Testing (MAST) that simulates real-world conditions, combining and repeating mul- tiple aging stresses such as UV, heat, mois- ture, and thermal cycling to match the aging observed in the field, in all types of climatic conditions or applications.”

Manufacturers are in broad agreement with DuPont’s recommendation and that clear information about long-term aging and environmental performance is what is needed by the industry. “It is always a combination, not only of UV, of humidity and temperature,” says Isovoltaic’s Thomas Rosegger. “The combination of sequen- tial testing, damp heat testing, and ther- mal cycle testing, and then measuring and comparing the degradation rates in both directions, is needed.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.